High natural gas costs drove wholesale electricity prices sharply higher in CAISO and its Western Energy Imbalance Market (WEIM), the ISO said in its fourth-quarter 2021 Report on Market Issues and Performance, released this week.

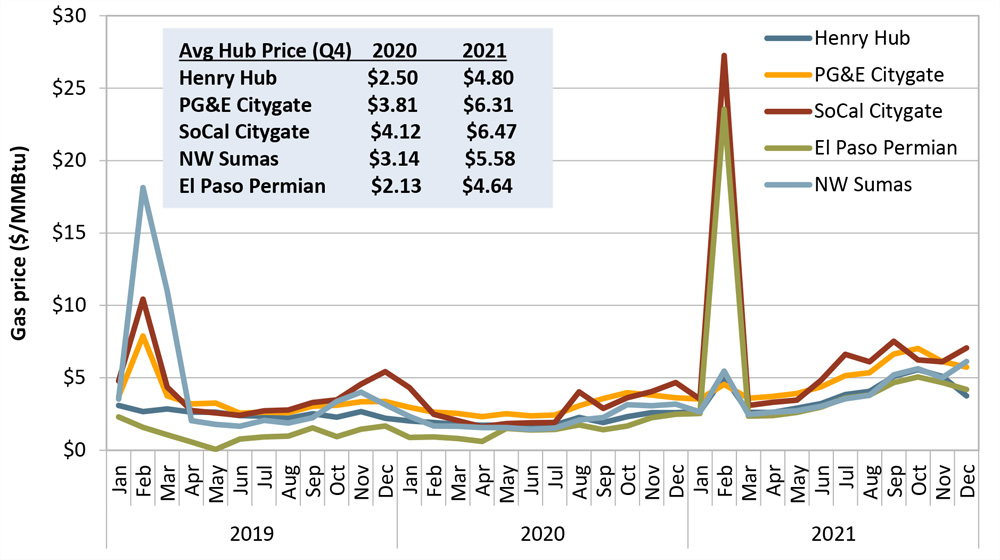

Day-ahead electricity prices in CAISO rose by about 50% compared with the same quarter in 2020, reflecting a similar rise in natural gas prices at key trading hubs, according to the Q4 report. Gas prices increased by more than $2/MMBtu at the Henry Hub in Louisiana, SoCal Citygate near Los Angeles, PG&E Citygate near Sacramento, NW Sumas in Washington State and El Paso Permian in Texas, it said.

PG&E Citygate saw a 65% price jump and SoCal Citygate experienced a 57% increase over the same quarter one year earlier, it said.

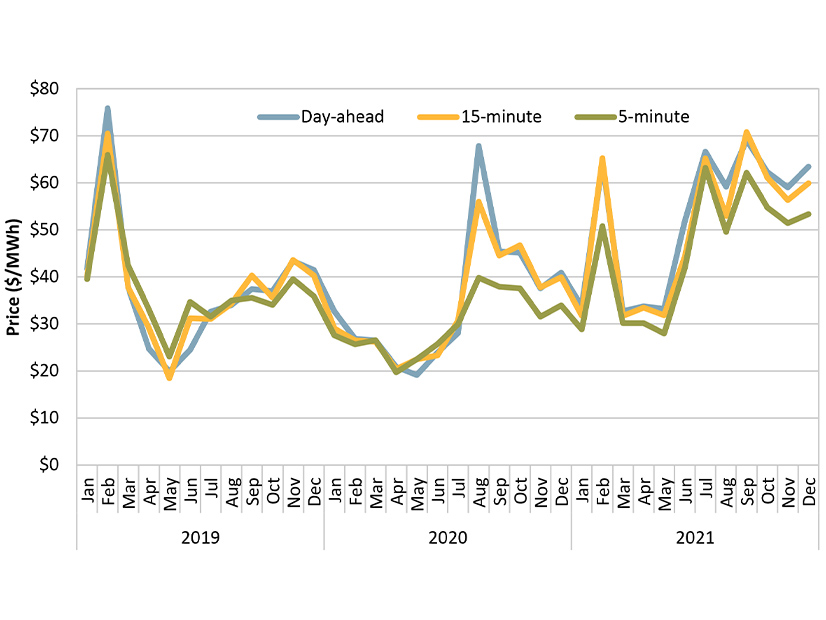

The price spike led to higher marginal energy prices across CAISO and the WEIM, which covers much of the Western Interconnection. Prices averaged $62/MWh in the day-ahead market, $59/MWh in the 15-minute market and $53/MWh in the real-time market.

“Electricity prices in western states typically follow natural gas price trends because gas-fired units are often the marginal source of generation in the [CAISO] balancing area and other regional markets,” the report said.

In the WEIM, energy prices in California were 18% higher than in the rest of the interstate trading market.

“Prices tend to be higher in California than the rest of the system due to both transfer constraint congestion and greenhouse gas compliance costs for energy that is delivered to California,” CAISO said.

Congestion on three lines — the Los Banos-Quinto 230-kV line in Central California, the Miguel 500/230-kV transformer nomogram and the Imperial Valley-El Centro 230-kV nomogram, both in Southern California — affected CAISO prices the most, it said.

On major interties, “the frequency and import congestion rent on Palo Verde [feeding power from Arizona to Southern California] remained notably high relative to the same quarter in 2020,” but congestion decreased on the Pacific AC and DC interties linking the Pacific Northwest to California and the Southwest.

Prices in the WEIM’s Northwest region — which includes PacifiCorp West, Puget Sound Energy, Portland General Electric, Seattle City Light and Powerex — trended lower than in other balancing areas “due to limited transfer capability out of this region during peak system load hours,” the report said.

CAISO was a net importer during most hours except the middle of the day when California’s ample supply of inexpensive solar power makes it a net exporter.

“Compared to the fourth quarter of 2020, imports into the California ISO from Arizona Public Service and Salt River Project were partially replaced by imports from Los Angeles Department of Water and Power,” the ISO said.

CAISO’s addition of a net-load uncertainty requirement to the WEIM’s bid-range capacity test in June 2021 caused the most resource sufficiency failures in Q4 2021, but CAISO removed the controversial requirement from the test in February.

While gas prices were rising, renewable production increased by about 600MW, or 9% compared to Q4 2020, CAISO said. Hydroelectric, wind and solar generation increased 12%, but geothermal and biogas-biomass generation were down 4%, it said.

The prolonged Western drought eased from October to December, helping to increase hydropower slightly from last year’s fourth-quarter low point, but California then saw its driest January to March on record.