CAISO staff showed how the grid operator plans to implement certain parts of its Extended Day-Ahead Market, with stakeholders asking for more time to comment on what they said crossed into potential policy revisions.

CAISO staff on Aug. 21 showed how the grid operator plans to implement certain parts of its Extended Day-Ahead Market (EDAM) next year, with stakeholders asking for more time to comment on what they said crossed into potential policy revisions.

CAISO began the workshop by discussing changes to intertie scheduling processes. In the ISO’s current day-ahead market, intertie schedules occur at an intertie scheduling point, George Angelidis, CAISO executive principal of power systems and market technology, said at the workshop.

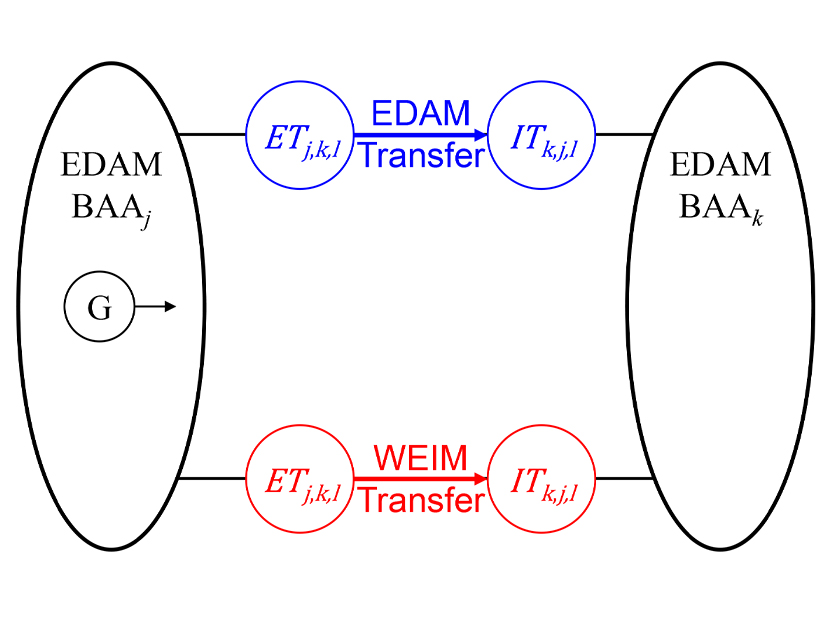

But under EDAM, intertie schedules will be taken at a Generation Aggregation Point (GAP) in the corresponding source or sink balancing authority area (BAA), Angelidis said. This change will increase the accuracy of power flow on the grid and improve power flow congestion, and more closely aligns with actual flow by reducing phantom congestion, Angelidis said.

CAISO broke down the GAPs into three types: a Default Generation Aggregation Point (DGAP), a Custom Generation Aggregation Point (CGAP) and a Generic Generation Aggregation Point (GGAP). Each type is used to determine intertie participation categories.

Under EDAM, there will be “specific GAPs for balancing authority areas that are the source or the sink of the energy for the import or the export,” Angelidis said.

“We want to have more accuracy in the power flow calculations and market solutions,” Angelidis said. “In the current market, at the intertie scheduling point … there is no resource actually at that location, so modeling energy of the import or the export at that location is inaccurate.”

CAISO is therefore moving the intertie scheduling location under EDAM to “somewhere where it is more reasonably representative of the energy being generated or consumed,” Angelidis said.

“Of course, accurate market solutions for power flow translate to accurate congestion management and also accurate locational marginal prices,” Angelidis said.

Some stakeholders at the workshop said they were concerned that some of the implementation processes presented by CAISO were in fact policy-related issues, which should be discussed further in other workshops with comment periods.

“We need some form of formal comment period,” said Dan Williams, principal adviser with The Energy Authority. “Being someone who has been involved with this initiative since 2018, I was under the understanding from the EDAM design and discussions during that time that EDAM implementation was primarily about the CAISO BA and its interaction with the EDAM BAs.”

Williams said he thought CAISO’s interties, other bilateral intermarket activity in the West and the EIM were “not going to be fundamentally impacted in the way that it is to me being described here.”

“There is, for me, a large impact here to the market in general and contracting that is a lot for folks to absorb in one workshop,” Williams added.

CAISO also discussed how it plans to implement congestion revenue rights and settlements under EDAM. CAISO is looking to phase in its implementation of its CRR model, which could improve the accuracy of the model, said James Lynn, CAISO principal.

When EDAM begins, CRRs will not be paid based on constraints where the CAISO BAA does not receive congestion revenue from integrated forward market flow on that constraint, Lynn said.