MISO has selected a 50/50 joint venture between Transource and Berkshire Hathaway Energy Transmission to build a $1.2 billion, 765-kV project from the RTO’s second long-range transmission portfolio.

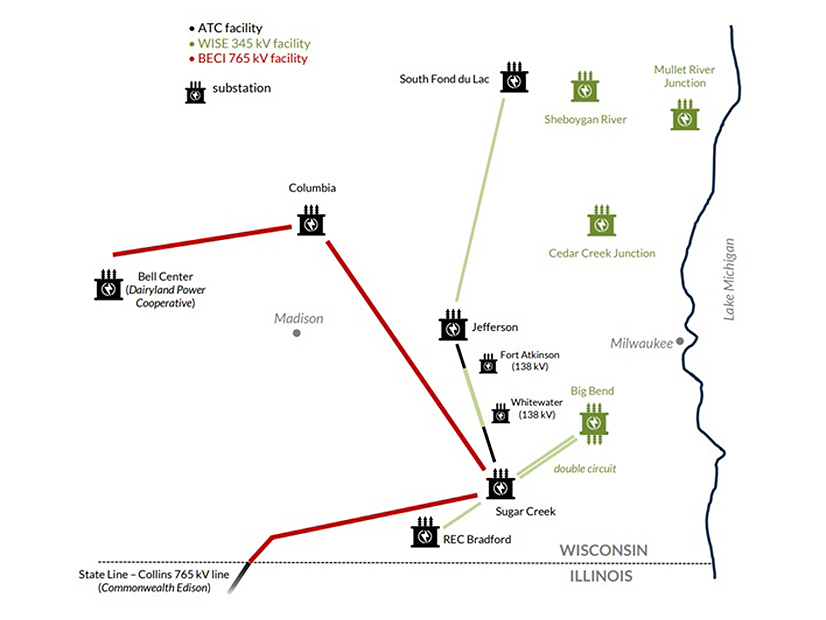

MISO opted for the jointly owned Midcontinent Grid Solutions to build the nearly 200-mile Bell Center-Columbia–Sugar Creek–IL/WI State Line (BECI) 765-kV competitive transmission project.

“Transource demonstrated the most 765-kV capabilities of all developers, and it will partner with a strong contractor to operate and maintain the project after it is complete,” MISO said in its Jan. 6 selection report. The companies’ joint enterprise outperformed four other unnamed bidders, according to MISO.

It said Midcontinent Grid Solutions “demonstrated reasonable cost estimates and offered reasonable cost containment,” though it didn’t propose the lowest revenue requirement, which ranged from $533 million to a little more than $1 billion among bidders. Midcontinent Grid Solutions pinned its revenue requirement between $775 million and $790 million.

BECI is part of MISO’s second, $22 billion long-range transmission plan portfolio, approved by the MISO Board of Directors at the end of 2024. Most of the portfolio is composed of 765-kV projects.

Midcontinent Grid Solutions pledged to cap its annual revenues through the end of the 14th year of the project’s existence at its estimates. It said it would not recover any revenue beyond its caps unless it was necessary for the company to earn a minimum 8.5% return on equity.

Estimated capital costs among the bidders varied from $808 million to $1.29 billion. Midcontinent’s winning bid predicted it would need a little more than $1 billion. MISO estimated the project would cost $1.2 billion.

American Electric Power 86.5% of Transource; Evergy owns the remaining 13.5%. To date, AEP has constructed and operates more than 2,000 miles of 765-kV lines.

MISO’s selection focused on developers’ design integrity and plans for maintenance once the lines are in service, design flexibility, ability to coordinate with other interconnecting transmission owners, and capability to finance and manage a large project.

MISO said Midcontinent Grid Solutions’ guyed, y-shaped lattice designs were the lightest structures put forward for consideration. The grid operator noted that lighter structures make helicopter installation easier while still designed to withstand a 300-year mean recurrence interval weather event. MISO noted that the company plans to keep at least 22 of the 765-kV structures on hand to make major repairs if necessary.

However, MISO said a weak point in Midcontinent’s proposal may lie in is its plan for sourcing construction materials and its routing. The RTO said the company’s “planned procurement responsibilities are less clear than other developers,” and its plan “demonstrates less certainty than other developers regarding its planned vendors and suppliers by not providing any letters of support and instead discussing supplier relationships, forecasted demand and capacity reservations which show that there is sufficient production capacity for BECI.”

MISO similarly said the company’s routing lacked specificity and was silent on whether it would route in accordance with Wisconsin’s siting priorities. It also didn’t appear to fully flesh out the complexities of siting near wetlands, forested areas and an airport, MISO said.

Transource said it has yet to draw a final route for the project.

MISO expects the line to be in service by June 1, 2034, pending regulatory approval.

Relatedly, MISO announced it would rely on Chicago-based Viridon Midcontinent to build a 345-kV project, also stemming from the second long-range portfolio. The smaller, $350 million project will span about 105 miles in southeast Wisconsin. MISO expects the line to be energized by June 1, 2033.

Blackstone Energy Transition Partners, one of Blackstone’s private equity funds, owns Viridon.

MISO said it’s concerned Viridon may have underestimated the capital costs of the project in its bid. Three other bidders estimated the project would cost anywhere from $471 million to $481 million; MISO itself estimated the project would cost $662 million to complete.

However, MISO said its confidence in its selected developer was buoyed by the fact that Viridon already executed an agreement with an experienced general contractor and proposed “cost containment strong enough to likely ensure the lowest cost to the ratepayer even if its estimated costs rose significantly.”