Data centers bring new regional planning challenges for the Northwest Power and Conservation Council’s upcoming power plan, the organization said during a recent meeting.

The council discussed data centers during a meeting on Jan. 13.

For NWPCC, data centers will guide part of the resource recommendations in the council’s upcoming Ninth Power Plan. The council is required to develop a plan for the region and the Bonneville Power Administration under the Northwest Power Act of 1980 “to ensure an adequate, efficient, economical and reliable power supply for the region.”

NWPCC publishes a plan every five years, according to the organization’s website. (See NWPCC Considers Trump, Data Centers in Regional Power Plan.)

“Data centers are part of our regional load growth,” Jennifer Light, director of power planning at NWPCC, said during the meeting. “We have to grapple with it. It is part of the regional plan that we’re going to need to plan for. And so we will be needing to address this large load in our plan in some way, in terms of resource recommendations, as well as other supporting recommendations.”

A challenge in planning for data centers is how much projected load will materialize, Light noted.

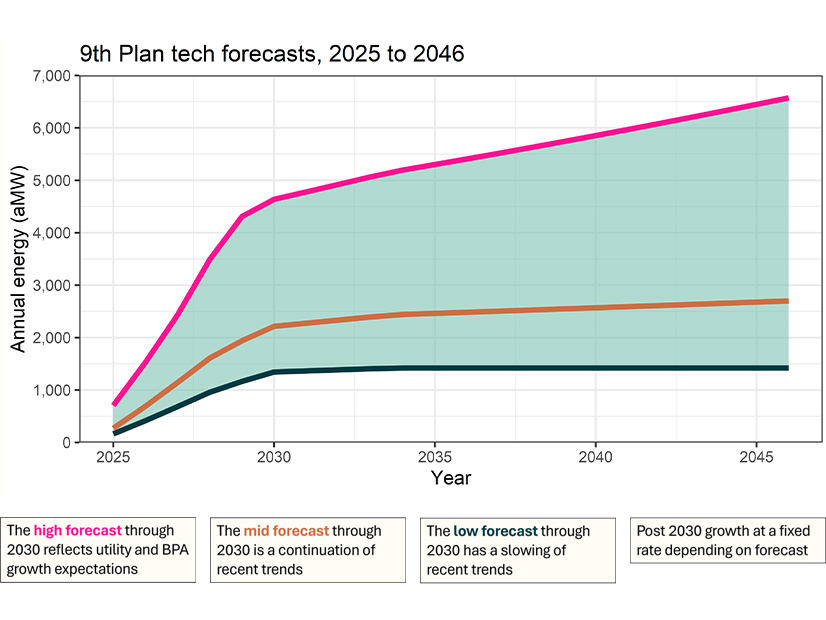

One way in which NWPCC plans for the forecasting uncertainty in the upcoming plan is by considering three different trajectories of data center load growth: low, mid and high.

The low forecast predicts a slowing down of current trends, the mid forecast is a continuation of trends, and the high forecast reflects utilities and BPA’s growth expectations, according to NWPCC’s presentation slides.

Under the high forecast, energy use is expected to reach more than 6,000 aMW by 2045, according to the slides.

“We want to make sure we have a robust strategy for the region and for Bonneville regardless of where this data center load comes,” Light said.

Under the Power Act, data centers are considered new large single loads and will receive different treatment by BPA. Data center loads are not eligible for BPA’s preference rates, such as Tier 1 or Tier 2 rates, according to NWPCC’s presentation slides.

Tier 1 “non-slice” contracts represent most of BPA’s power sales. “Non-slice” refers to a type of contract in which the customer is guaranteed a specified volume of energy regardless of conditions on the hydro system; in contrast, total volumes delivered to “slice” customers can vary based on availability. (See BPA Triggers $40M Surcharge Following Low Water Years.)

If requested by BPA’s utility customers, the agency can sell power to data centers under the New Resource Rate, but the timeline from request to delivery requires a study that can take multiple years to ensure BPA can find and transmit power to serve those large loads.

BPA’s current utility customers have long-term contracts that guarantee their access to BPA’s existing system. Any power BPA provides under the New Resource Rate would be based on the much higher cost of new acquisitions, costs that would also be available from other providers, likely with more flexible terms than BPA can provide based on the agency’s statutes.

“I do not expect much, if any, of this data center load growth to go onto the Bonneville’s obligation,” Light said.

“This doesn’t mean Bonneville might not have actions they can do in support of regional efforts,” Light said. “But for the obligation piece, the data center load is probably not going to Bonneville, at least the vast majority of it.”

Looming Shortfalls

However, NWPCC will need to address data centers in the broader regional strategy and focus on cost-effective resources to meet load growth and other additional recommendations, such as siting considerations, resource sharing and transmission constraints, Light noted.

The discussion follows a September 2025 study on Northwest resource adequacy by Environmental and Energy Economics that found “accelerated load growth and continued retirements create a resource gap beginning in 2026 and growing to 9 GW by 2030” and that “load growth and retirements mean the region faces a power supply shortfall in 2026.” (See 9-GW Power Gap Looms over Northwest, Co-op Warns.)

In an effort to address the costs associated with data centers, Oregon lawmakers passed House Bill 3546 to create a separate customer category for large energy users, such as data centers, and require those users to pay a proportionate share of their infrastructure and energy costs. Governor Tina Kotek signed the bill into law in June 2025. (See Oregon House Passes Bill to Shift Energy Costs onto Data Centers.)

The law defines a large energy use facility as one that uses more than 20 MW. It applies only to Oregon’s investor-owned utilities.

On Jan. 20, Kotek launched a statewide Data Center Advisory Committee, tasked with developing policy recommendations to address challenges associated with the growth of data centers across Oregon. (See Oregon Gov. Appoints Group to Address Data Center Growth.)