Duke Energy executives touted the company’s clean energy plans during the company’s fourth-quarter earnings call Thursday, saying the North Carolina-based utility expects to meet its goal of cutting carbon emissions 50% by 2030 through initiatives that include coal plant retirements in Indiana and 750 MW of new solar in Florida.

The utility, which has facilities in seven states, said that having cut emissions by 40% over 2006 levels, it expects that several projects likely to unfold over 2022 will help the company toward its 2030 goal and reaching zero emissions by 2050.

The company’s fourth-quarter performance “capped off a strong finish to a very productive 2021,” CEO Lynn Good told analysts on the call.

“We continue to make progress and are strongly positioned to achieve our clean energy vision,” she said. “We delivered on our commitments while also strategically positioning the company for the future.”

The utility’s future plan includes cutting its share of energy from coal to 5% by 2030 and a complete exit from the sector by 2035, she said. The coal share at present is 22%, a company spokeswoman said. The utility, which at present owns 10 MW of solar and wind energy, expects to increase that figure to 16,000 MW by 2025 and to 24,000 MW by 2030, Good said.

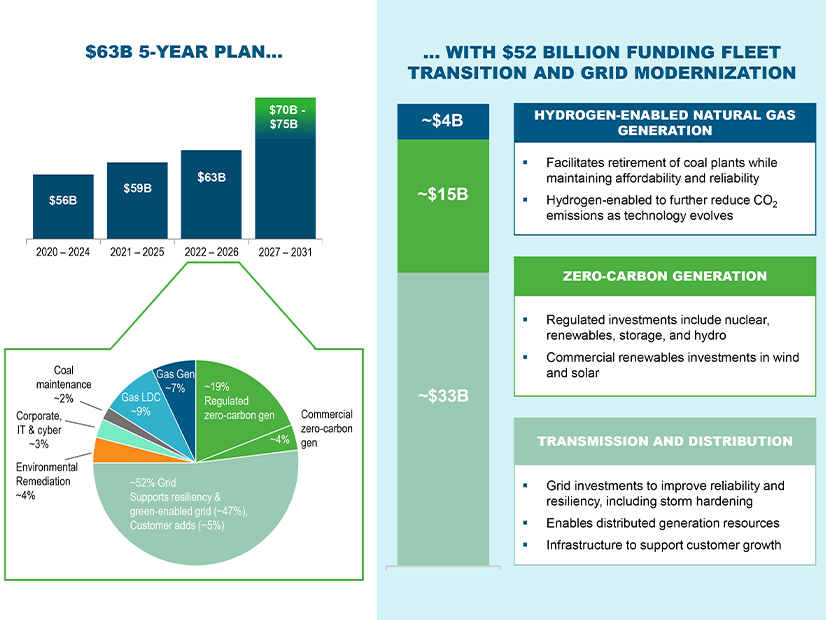

That growth would be driven in part by expenditures of $63 billion in capital expenditures over the next five years, of which 80% will be spent on clean energy investments, she said.

New Emissions Regulations

The company is awaiting the impact of a North Carolina law, H951, that is expected to reshape the state’s energy sector. It requires a 70% reduction in carbon emissions by 2030, a larger cut than Duke’s targeted 50%. The law authorizes the state Utilities Commission to establish performance-based regulation (PBR) that would link utility profits to specific, measurable performance goals, while also decoupling profits from power consumption by residential customers. (See NC Compromise Energy Bill Passes Senate, Heads Back to House.) The bill was signed into law Oct. 13.

Good said the utility is confident that the state “will adopt a balanced set of rules that provide flexibility to implement performance-based rates in a way that achieves policy goals and aligns with customer interests.” She said the company expects to file its carbon-reduction plan in May “after gathering stakeholder input over the next several months,” with a state ruling on the plan by the end of the year. The company in June said the bill would mean the closure of seven coal-fired plants in North Carolina by 2030 and replacing them with energy storage and a 900-MW simple cycle natural gas plant.

“The plan we submit will have multiple portfolios that weigh the costs and benefits, including reliability and affordability of various resource types,” she said. “We will also evaluate with stakeholders and our regulators the full range of potential risks and opportunities related to new clean energy technologies. We expect an order on the carbon plan by the end of this year.”

The coming year will see the start of a three-year program to add 750 MW of solar power in Florida after the state’s Public Service Commission approved a stipulated agreement to the Clean Energy Connection (CEC) program crafted by subsidiary Duke Energy Florida. The program allows customers to subscribe to blocks of solar power, each equal to 1 kW, from the CEC program and in return receive credits against their energy bill.

Yet the company’s solar sector also is facing challenges, in the form of modest supply chain disruptions that have forced it to consider using alternative suppliers of solar panels and other equipment.

“Certain suppliers have said, ‘We can’t meet the time frame,’” said Good. Faced with that scenario, which can extend the procurement time and make equipment more expensive, the utility opted to delay a few projects from starting in 2022 to beginning in 2023, totaling about 400 to 500 MW, the company said.

Coal Plant Closures

The solar sector growth comes as the company’s drive to cut coal plants is expected to continue unfolding in 2022, the company said. In December, the company submitted an integrated resource plan to the Indiana Utility Regulatory Commission that said the company would close its six coal generating plants in the state four years earlier than outlined in the previous IRP, in 2018. Duke has said it will reduce its Indiana carbon emissions by 63% from 2005 levels by 2030 and 88% by 2040, and triple renewable energy levels to about 7,200 MW. Good said the company expects to issue a request for proposals for companies interested in developing the renewable energy facilities this month.

The company’s slideshow presentation also noted that that in 2021 it submitted an IRP to Kentucky regulators that moved the date for closure of its East Bend plant to 2035, from the previous date of 2041. The IRP attributed the accelerated closure to expected operations and maintenance cost increases from increased regulation, an increased fuel supply risk and the declining costs of renewables.

The company reported full-year GAAP earnings of $4.94/share, compared to $1.72 in 2020. Adjusted earnings for the year were $5.24/share, compared to $5.12 a year ago. It reported fourth-quarter GAAP earnings of 93 cents/share, compared to a loss of 12 cents/share a year ago.

Adjusted earnings exclude the impact of certain items that are included in reported earnings, the company said in a press release. The main difference stemmed from an impairment charge related to the South Carolina Supreme Court decision on coal ash and insurance proceeds, as well as workplace and workforce realignment costs, the release said.