With CAISO’s Extended Day-Ahead Market to launch May 1, some parties are urging Nevada regulators to wait until initial results are in before deciding whether to grant NV Energy’s request to join EDAM.

“Given that EDAM is scheduled to ‘go live’ in May 2026, we will have a much clearer picture of these risks [of EDAM participation] in one year’s time,” Michael Roberson, utility analyst with the Nevada Bureau of Consumer Protection, said in written testimony. “Both the governance structure and the identities/volume of participants should become much clearer. Most importantly, we will see real cost/benefit data instead of projections.”

NV Energy filed its request to join EDAM in October 2025. The Public Utilities Commission of Nevada (PUCN) set a Feb. 10 deadline for parties to file testimony in the case. A hearing is scheduled for March 10.

NV Energy’s target date for EDAM entry is fall 2028. (See NV Energy Files Request to Join EDAM.) PUCN is expected to issue an order within 135 days of the initial filing.

As part of its request, NV Energy asked the commission to approve its participation in EDAM as prudent.

Roberson said PUCN should deny that request. A prudency determination now, while it’s not known if projected benefits of EDAM participation will materialize, would shift risk to ratepayers, he said.

Positive WEIM Experience

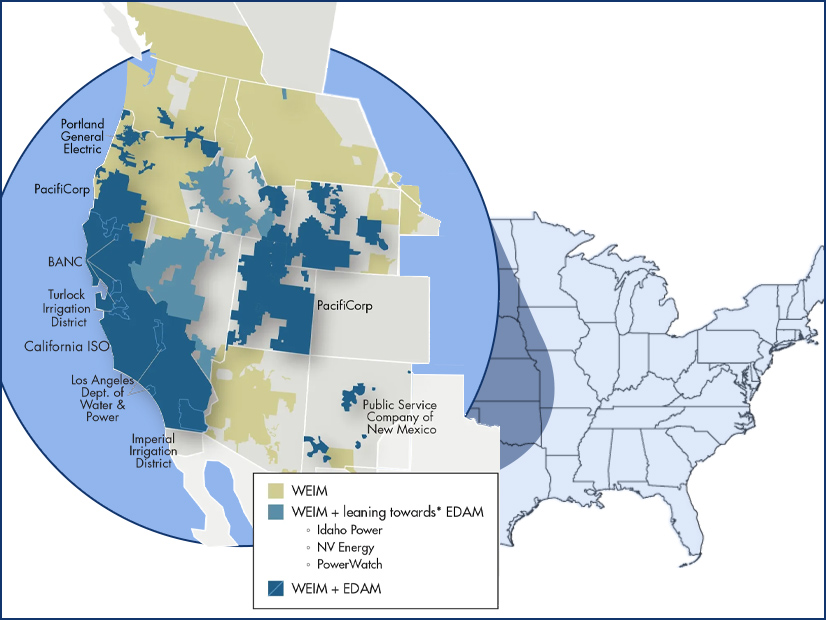

Factors in NV Energy’s choice of EDAM — rather than SPP’s competing day-ahead market, Markets+ — include its positive experience with CAISO’s Western Energy Imbalance Market (WEIM), the company said in its filing. NV Energy accrued $931 million in benefits from the time it joined WEIM in 2015 through the third quarter of 2025.

NV Energy also pointed to better transmission connectivity within the anticipated EDAM market footprint compared to that of Markets+.

A Brattle Group study, updated in October, projected that NV Energy would save $93.1 million a year by joining EDAM, compared to participating in WEIM alone. In contrast, joining Markets+ would increase annual costs by an estimated $7.3 million.

David Chairez of DSC Utility Consulting recommended that the PUCN wait to see whether benefits modeled for the electric utilities joining EDAM in 2026 and 2027 materialize before making a prudency finding for NV Energy to join EDAM. Chairez filed testimony on behalf of Boyd Gaming Corp., Caesars Enterprise Services, MGM Resorts International, Nevada Gold Mines, Southern Nevada Water Authority, Station Casinos and Venetian Las Vegas Gaming.

The PUCN should also wait to see what changes are made to NV Energy’s open access transmission tariff (OATT), Chairez said.

“The commission cannot decide on prudence without reviewing those proposed changes to understand the effects they will have on Nevada customers,” he said.

Another unknown is how much participants might end up paying in resource sufficiency evaluation (RSE) penalties, Chairez said. The RSE is intended to make sure each balancing authority can meet its own obligations before making transfers with other EDAM participants.

Participation Timeline

EDAM is expected to launch on May 1 with participation from PacifiCorp. Initially, the day-ahead market will identify efficient resource commitments and energy transfers among the PacifiCorp West, PacifiCorp East and CAISO balancing areas, a CAISO spokesperson said. Portland General Electric plans to join EDAM in fall 2026.

The Los Angeles Department of Water and Power, Public Service Company of New Mexico, Turlock Irrigation District and Balancing Authority of Northern California are planning their entry in 2027, followed by Imperial Irrigation District in 2028.

Carolyn Berry, a partner with Bates White Economic Consulting, filed testimony on behalf of Google, recommending that the PUCN approve NV Energy’s request to join EDAM. (See Western Market Seams Complicate Data Center, Clean Energy Investments, Panelists Say.)

Berry said EDAM would give NV Energy access to a highly diverse — and complementary — resource mix, including low-cost solar from California and wind resources from the Pacific Northwest. And NV Energy can leverage its experience with WEIM to reduce implementation risk and uncertainty “compared to joining an entirely new market construct,” she said.

Regulatory operations staff at the PUCN recommended several conditions for commission approval of NV Energy’s EDAM request.

Those include ordering the company to develop a commission-approved method for quantifying annual production cost savings from EDAM participation; and filing progress reports on revisions to the OATT. Another recommendation is that NV Energy’s shareholders should bear the cost of any RSE surcharges.