A group of former campaign staffers for Washington Gov. Jay Inslee wants the federal government to pay utilities to accelerate their transition to clean energy and penalize them if they lag on mandated targets. Fifty clean energy advocacy groups and private businesses want a new investment tax credit (ITC) to help shovel-ready transmission projects get built. And the Department of Energy would settle for an extension of the existing solar ITC to help cut the levelized cost of utility-solar to 2 cents/kWh by 2030.

Congress may officially be on summer break, but Democratic lawmakers continue to work on getting the $1.2 trillion bipartisan infrastructure package and their own $3.5 trillion budget reconciliation bill ready for passage when they return. The Senate passed both bills earlier this month, which means the focus for many clean energy advocacy groups and agencies has now shifted to the House of Representatives, where progressives have been pushing for more aggressive climate and clean energy policies and spending. (See Senate Democrats OK $3.5T Spending Package After Bipartisan Accord on Infrastructure.)

While advocating for specific policies — and billions in added spending — the challenge for these groups is to avoid even the appearance of “double dipping”: using the reconciliation bill to increase funding for programs already in the bipartisan package. In a series a recent reports, briefs and letters, advocates and their allies attempt to navigate that landscape via various alternatives and new initiatives.

Clean Energy Payment Program

The Clean Energy Payment Program (CEPP), in which the U.S. government would pay utilities to decarbonize, is one of the more aggressive of the provisions in the budget reconciliation package. A report from Evergreen Action — the group of Inslee’s former campaign staffers — argues that, as a budget item, the program can be passed as part of the reconciliation bill and is needed to push U.S. emission reductions beyond the uneven progress of state and corporate commitments to clean power.

Federal incentives would also mean that utility customers would not be picking up the tab for new clean energy infrastructure or stranded fossil fuel assets, the report says.

While not mentioning specific dollar amounts, the report states a “well designed” CEPP would pay utilities “for building or procuring clean electricity at the pace and scale necessary for an 80% clean nationwide average by 2030” and 100% by 2035. Clean energy targets would vary from utility to utility, depending on size and current progress on decarbonization, with payments based on megawatt-hours of power produced with zero or low emissions, as a percentage of their overall demand.

The “clean” megawatt-hours could be produced by wind, solar and hydropower as well as geothermal, nuclear, carbon capture and other technologies, the report says. The utilities would also be required to use these “clean energy performance payments” for specific purposes, such as reducing customer bills, supporting clean energy, paying off debt on fossil assets, or investing in distribution, transmission or storage.

Utilities not meeting their megawatt-hour targets would pay penalties. Evergreen Action says the initial appropriation for the program should be $150 billion to $180 billion.

The 30C Tax Credit

Getting more money for electric vehicle charging stations into the reconciliation bill will be tricky because the bipartisan infrastructure package already includes $7.5 billion for “alternative vehicle fueling infrastructure,” $5 billion of which is specifically earmarked for EV charging.

A recent report from Third Way, a center-left think tank, calls that money a good first step that would get about 400,000 new chargers installed — not quite the 500,000 envisioned in President Biden’s American Jobs Plan and well below the 1 million chargers Third Way says are needed.

Third Way’s solution to the double-dipping dilemma is for Congress to “extend and expand the 30C Alternative Fuel Refueling Property Credit, which provides a 30% tax credit to help people install chargers in their homes and helps businesses install chargers at workplaces and in public charging locations.”

The estimated cost to the government would be $1.95 billion over 10 years, the report says.

Beyond extending the credit, which will otherwise expire at year-end, the report recommends raising the credit cap from $30,000 to $200,000 for businesses, making it per charger rather than per location and making it “refundable,” so that it could be monetized even if an individual or business does not have a tax liability.

Accelerating Solar

To meet Biden’s 2035 clean energy goals, “solar deployment would need to accelerate three to four times faster than its current rate by 2030,” which would move solar from 3% to 40% of U.S. power generation by 2035, according to a DOE brief issued Tuesday.

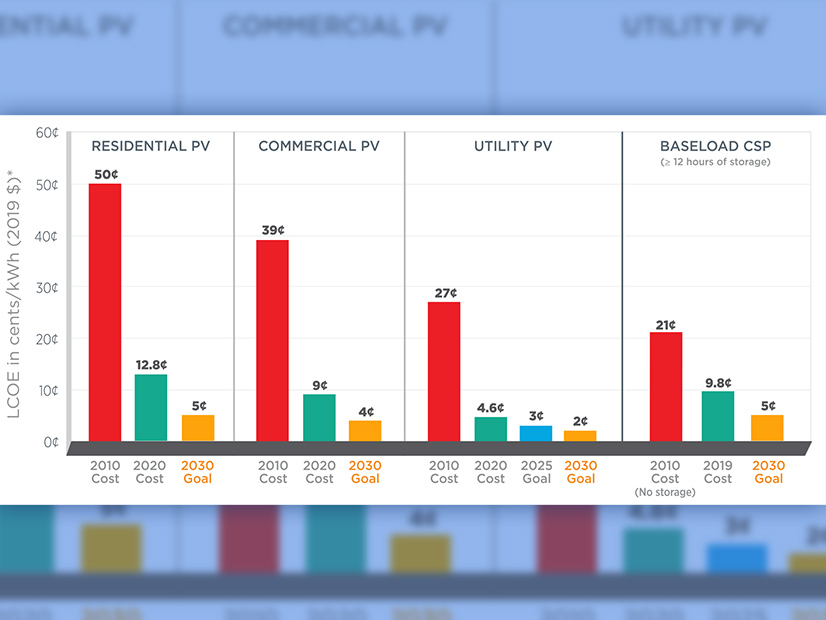

But getting there will require ever deeper cuts in solar costs. DOE is setting new targets for reductions in the levelized costs of energy for all solar, with residential going from just under 13 cents/kWh in 2020 to 5 cents/kWh by 2030. The goal for the LCOE of commercial solar is 4 cents/kWh by 2030, and 3 cents by 2025 and 2 cents by 2030 for utility-scale.

Outlined in the brief, the department’s wish list for the reconciliation bill focuses primarily on tax credits, extending existing incentives like the production tax credit (PTC) for wind and the ITC for solar, along with similar, new credits for standalone storage and transmission. The PTC is due to sunset at the end of this year, and the ITC will step down for residential solar in 2023 and for commercial and utility-scale solar in 2024.

Ongoing funding for research and development, especially for building domestic clean energy supply chains, is also mentioned, along with support for low-income and community solar programs.

Electrons Need Wires

Whatever incentives offered, higher penetrations of clean energy, EVs and EV chargers cannot be achieved without more modern distribution and transmission. A recent report from Princeton University said Biden’s goal of a net-zero economy by 2050 will require a 60% expansion in high-voltage transmission by 2030. Another study from the American Council on Renewable Energy identified 22 high-voltage transmission projects that are “ready to go” with a little help from a transmission ITC. (See Transmission ITC Could Add 20 GW of New Capacity to Grid.)

Sent to key members of the House Ways and Means Committee on Aug. 11, a letter from 50 clean energy advocacy groups, utilities, businesses and labor called for a transmission ITC to help such “interregional, interstate, highway-type lines” that, it says, were cut out of the bipartisan infrastructure package. Further, it argues that the $73 billion for transmission in the package only earmarks $2.5 billion in borrowing authority for new transmission.

A transmission ITC would also offset the cost allocation issues that, the letter says, are not well addressed in the current U.S. regulatory structure.

“Even if the Federal Energy Regulatory Commission decides to act on its own authority in this area, that process has historically been time-consuming, characterized by significant uncertainty and subject to lengthy judicial review. A federal transmission ITC would give private capital the certainty it needs now to invest in the national, high-priority lines that will serve as the backbone for America’s clean energy grid,” the letter says.

Making the Transition Faster

The coming debates over the bipartisan infrastructure package and budget reconciliation bill will likely take place under multiple pressures, with the urgency called for in the recent climate report from the U.N. Intergovernmental Panel on Climate Change offset by hearings on the U.S. withdrawal from Afghanistan.

Committees across the Senate and House will be working out the details on different parts of the reconciliation package, with intensive negotiations and tradeoffs likely before both the bipartisan infrastructure and reconciliation bills get to Biden’s desk. For example, Leah Stokes, senior policy adviser to Evergreen Action, acknowledges that many details remain to be worked out about how to implement the CEPP, such as how much utilities would be paid or penalized and how the program would be administered, but she remains confident it could remain in the final bill.

DOE as program administrator would be able to draw on the experience and best practices of state agencies that have administered their own renewable standards, she said. In addition, some utilities are voicing support for a national clean energy standard, Stokes said, pointing to an April letter from 13 utilities to Biden. The utilities, including investor-owned, municipal and cooperative organizations, called for “a broad suite of regulatory and legislative policies to enable deep decarbonization of the power sector, including a clean electricity standard that ensures the power sector, as a whole, reduces its carbon emissions by 80% below 2005 levels by 2030.”

That support could be shifted toward the CEPP, Stokes said. “Many other utilities also are sort of coming around to: ‘Maybe we do want to make this transition faster, and maybe it does make sense to have support from the federal government so that we cannot push the costs onto our electricity customers,’” she said. “That support from the industry is going to be really important.”