Imagine, sometime in the not-too-distant future, telling Alexa to run your washing machine, and the virtual assistant device, interfacing with an energy management platform, answers back that you will lower your electric bill if you run it in four hours rather than right now.

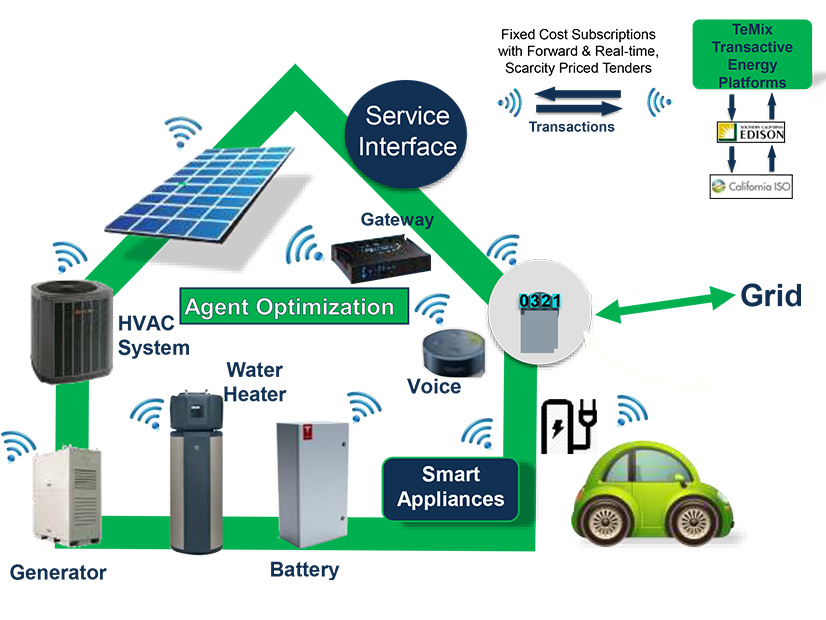

That scenario, in a nutshell, is what proactive demand-side management (DSM) via a transactive energy market with dynamic, time-varying rates is all about, said Stephen MacDonald, managing director of business development at TeMix Inc. The California company has developed such a platform and tested it in a pilot project with Southern California Edison.

Running for 36 months from 2016 to 2019, the Retail Automated Transactive Energy System (RATES) pilot was designed to demonstrate the technical feasibility for facilitating transactive energy at the retail customer level, MacDonald said during a recent webinar on proactive DSM hosted by the Smart Electric Power Alliance.

“The transactive market allows end customers to become active participants in the market, as opposed to passive participation,” he said. That active engagement means customers automatically shift “away from consuming energy when prices are high, which equates to reducing the need for grid services from the utilities. It reduces spinning reserves; it reduces the need for resource adequacy and [provides] more beneficial things for both the grid operator as well as the consumer, meeting clean energy goals and reduction in greenhouse gases.”

The webinar looked at both the critical role of dynamic pricing for unlocking transactive markets and their benefits, and the regulatory challenges of getting dynamic and other time-of-use (TOU) rates approved and widely adopted.

The evidence that TOU rates save customers money is “overwhelming,” said Ahmad Faruqui, principal at The Brattle Group. But only about 10% of U.S. utility customers are on them, he said in his opening remarks during the webinar.

“The rates that are being offered today come across to new customers as unfriendly,” Faruqui said. “Sometimes a peak period is 12 hours long; sometimes the messaging is incomplete. Sometimes the price is so weak — the differential between peak and off-peak — that you can’t save much even if you shift all your load from A to B.”

Another problem, he said, is the possibility of cross subsidies. “Some utilities and commissions are fearful that those people [who] take these rates will instantly save money, so there will be revenue loss, and the question will be how to recover the revenue loss. Then, they say, ‘we have to recover it from other customers,’ and then create a class subsidy.”

While California is in the process of rolling out residential TOU rates, most regulators and utilities have not been willing to make TOU or other dynamic rates the default option for utility customers, Faruqui said. Getting 100% participation for such rates may not be realistic or cost effective, he said, citing what he calls the 80-20 rule.

“If you can get 20 to 30% of your customers on these rates, you’re going to get 80% of the benefits” he said. “Trying to get 90 or 100% of the benefits will be extremely costly, and a lot of inconvenience and political capital will have to be consumed in the process.”

Talking to the House

The RATES pilot was the brainchild of TeMix founder and CEO Ed Cazalet, a former governor and interim CEO of CAISO. He was awarded about $3.2 million in funding for the project from the California Energy Commission in 2016. SCE was not directly involved in the development of the project but provided a letter of support and helped TeMix identify the area north of Los Angeles where utility customers were recruited to participate.

TeMix recruited about 100 SCE customers in the area, with a pitch that avoided talking about transactive energy or dynamic rates. Rather, said Mark Martinez, the utility’s senior portfolio manager for emerging markets and technologies, potential participants were told, “We want to demonstrate how we could be saving money in the future using new technology.”

A transactive tariff with time-varying rates was a critical part of the pilot, based not only on TOU, but on individual customers’ location and the load on the local distribution system, MacDonald said.

“The concept here was … to take the volatility of the wholesale market and develop a tariff that wouldn’t expose customers to that volatility but would actually provide a way for them to take advantage of cost reductions and use automated systems,” Martinez said.

Another unique feature, rather than use an app or log into a computer, customers could interact with the platform using a virtual assistant like Amazon’s Alexa. Once registered, customers interact with the platform, changing settings for the level of savings for different smart devices in their households, “simply by just talking to the house,” MacDonald said. For the pilot, the platform specifically managed and optimized customers’ HVAC and heat pump systems, pool pumps, storage batteries and electric vehicle chargers, according to a final report by the CEC.

While the customers in the pilot were not actually on the transactive tariff — they paid their regular SCE rates — TeMix used it to calculate demand shifting and potential savings. The CEC report shows that in a small sampling of customers, four out of five would have saved money on the RATES tariff, with savings especially strong for those with rooftop solar or other technology, such as a battery or EV charger, allowing demand flexibility. One customer in the sampling without solar or other technologies would have seen bill increases, according to the report.

“What was really kind of neat is that Alexa actually developed a vocabulary for time of use,” MacDonald said. “It understood how different terms are being used, load management and things like that. We were very pleased to see this being developed and look forward to getting more of this type of information out there.”

For SCE, the pilot served as a catalyst, Martinez said. SCE recently issued a request for qualifications for its Distributed Energy Resources Partnership Pilot program, which is aimed at finding out “how we can get distributed energy resources to dispatch in accordance with our grid needs,” he said.

The five-year assessment the utility is planning will examine technologies both in front of and behind the meter, Martinez said. He characterized SCE’s approach as neither running nor crawling, but walking to “be observant, take a situational awareness of what the opportunities and technologies are out there.”

Better Grid Partners

MacDonald and TeMix, on the other hand, are working with “prime movers” — regulators, utilities and original equipment manufacturers — to move toward creating a real transactive market.

California has been rolling out time-of-use rates since 2019, and all three of the state’s investor-owned utilities — Pacific Gas and Electric, San Diego Gas & Electric and SCE — now offer two or more TOU plans to their residential customers, along with traditional volumetric rates based on the amount of electricity used.

In addition, the California Public Utilities Commission in May held a workshop on advanced DER and demand flexibility, during which commission staff presented a future vision for a “unified, universal, dynamic and economic (UNIDE)” system. A roadmap forward included rate reform and optimization of customer energy devices and use, with the goal of widespread demand flexibility.

On the rate side, customers would have universal access to dynamic, real-time electricity prices through home energy management systems that would enable many of the same transactive features as the TeMix platform. A presentation from CAISO at the workshop offered strong support for “greater demand flexibility and new ‘grid informed’ rate options,” as well as “dynamic pricing policies that shift load.”

But MacDonald says it is a chicken-and-egg situation convincing OEMs to integrate transactive platforms, such as TeMix’s, into the front-end controls of their devices, while also pushing utilities to move ahead with dynamic rates. The utilities want to know how many devices will be able to process transactive transactions, while the OEMs want to know how many transactive markets will be out there for their products, he said.

SCE’s incremental approach notwithstanding, Martinez knows the markets are coming. “Customers now are generating their own electricity; they’re storing it; they’re driving it around,” he said. “So, all these technologies really will help not only customers be able to manage their lifestyles, but they can be better partners for the grid. The future is really a linkage. It’s a reliability partnership where we can have customers, with the proper signals and the proper information, able to manage the load on the grid, if there is an issue that needed to be managed.”

MacDonald likens transactive energy markets to other aspects of the shared, digital economy. It is, he said in a phone interview with NetZero Insider, all about incentivizing market participation through monetization. “We have devices that are smart, and we want to monetize them for the owners’ benefit, as opposed to being passive participants,” he said. “Why am I incentivized to get a battery behind the meter unless I’m able to use it optimally to make money? It’s only half the story if I am only doing arbitrage. Monetizing our assets digitally incentivizes and capitalizes on that kind of momentum.”