Xcel Energy’s Public Service Company of Colorado is postponing its efforts to join CAISO‘s Western Energy Imbalance Market after one of its partner utilities in a joint dispatch agreement decided to join SPP’s Western Energy Imbalance Service instead.

“PSCo has decided to pause our project work related to joining the California Energy Imbalance Market in April of 2022 in order to afford more time to fully consider the impact of the Colorado Springs Utilities (CSU) decision to depart the PSCo balancing authority area and CSU’s intention to join the SPP Western Energy Imbalance Market,” the utility told stakeholders in an email June 3.

“PSCo remains committed to participating in a regional market that benefits customers and helps integrate wind and solar energy,” it said.

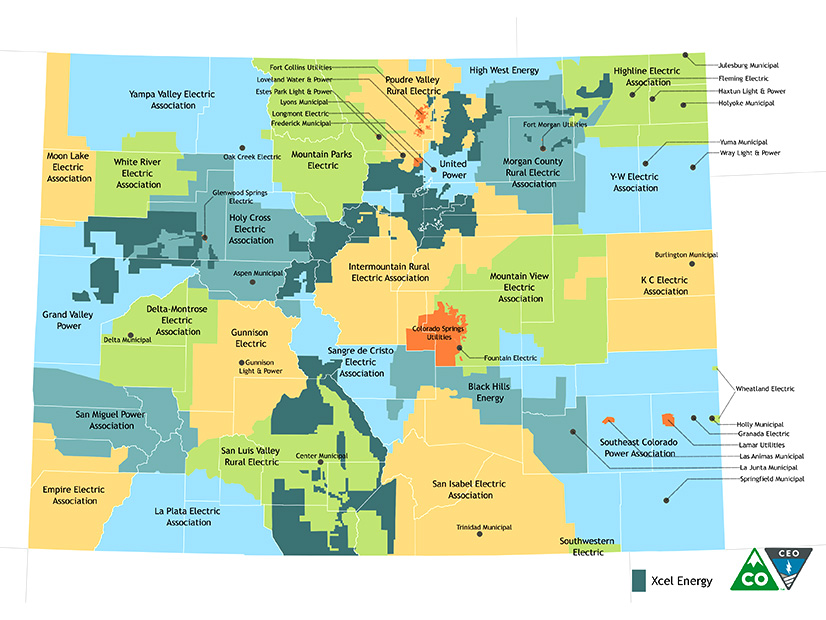

In December 2019, the EIM scored a major win when Xcel (NASDAQ:XEL), Black Hills Colorado Electric, CSU and Platte River Power Authority announced they planned to join the EIM under a joint dispatch agreement as soon as 2021. (See EIM Lands Xcel, 3 Other Colo. Utilities.)

The four utilities serve almost 2 million customers and reported $3.7 billion in sales in 2018.

It marked the first time the EIM had expanded into Colorado, the last state in the Western Interconnection without an EIM member. The decision disappointed SPP, which had hoped to lure the utilities to its nascent Western Energy Imbalance Service (WEIS). (See Why 4 Colo. Utilities Joined CAISO EIM, not SPP WEIS.)

Then, on May 12, CSU said it was pulling out of the plan to join the EIM and would align itself with SPP by joining the WEIS and seeking full membership in the RTO. CSU said it decided the SPP market would save its customers more money and better allow it to meet its carbon reduction targets.

“Our current portfolio of solar complements SPP well,” CSU CEO Aram Benyamin said in a news release, noting the WEIS market will help the utility better integrate new solar projects.

After CSU pulled out, Xcel chose to re-evaluate its options, the company said in an email to RTO Insider on Wednesday.

“During the next year, the company will continue to evaluate different market options that could reduce costs, increase reliability and help promote its carbon-free vision,” Xcel spokeswoman Julie Borgen wrote.

Xcel had been drawn to the EIM partly because of CAISO’s plans to expand the real-time interstate market to a day-ahead market, “but following the rolling blackouts last summer in California, that initiative is a lower priority for the market operators,” Borgen said.

CAISO responded Wednesday with a brief statement saying that “although PSCo has decided to pause work on joining the EIM for now, the ISO continues to engage with them, Platte River and Black Hills to answer questions and looks forward to their entry into EIM in the near future.”

SPP did not respond to a request for comment.

Western RTO

Another factor that may have played a role in Xcel’s decision was the passage by the Colorado legislature of Senate Bill 72, which would require Xcel, the state’s largest utility, and other transmission owners to join an organized regional market by 2030, said Doug Howe, a director of Western Grid Group and former chair of the EIM Governing Body.

Xcel announced its decision on the same day the bill passed. Gov. Jared Polis is expected to sign it.

Nevada lawmakers approved a similar bill a few days before on May 31, requiring TOs in the state to join an RTO. (See Far-reaching Energy Bill Sweeps Through Nev. Legislature.) Gov. Steve Sisolak signed the bill into law Thursday.

TOs in Colorado and Nevada could join CAISO or SPP or form one or more new RTOs, Howe said. Creating a Western RTO is a goal that CAISO and Pacific Northwest utilities have pursued without success in prior years.

In April 2018, Xcel had pulled out of a plan for the Mountain West Transmission Group to join SPP, saying it was not in its best interests. (See Xcel Leaving Mountain West; SPP Integration at Risk.)

To form a new RTO going forward, “it’s going to take a coalition of the willing,” Howe said.