Proposed rule changes in a New Jersey Board of Public Utilities (BPU) program that awards incentives of up to $5,000 for an electric vehicle purchase triggered stakeholder questions at a public hearing May 27 about the goals of the program, who will benefit and whether it is big enough to meet the state’s ambitious fleet goals.

The board’s suggestion that the full $5,000 incentive be awarded to vehicles only with a manufacturer’s suggested retail price (MSRP) of below $45,000 prompted speakers at the hearing, which focused on proposed rule changes for the program, to question what the BPU is trying to achieve. The proposal would cap the incentive for EVs priced $45,000 or more at $2,000.

The straw proposal, released on May 18, outlines the rules for the award of grants totaling $30 million in the second year of the Charge Up New Jersey Program as the state tries to reach the legislature’s goal of putting 330,000 EVs on the road by 2025. The program aims to close the gap between the cost of a gas vehicle and the higher priced EV by offering an incentive to the vehicle purchaser equal to $25 for each mile the EV can travel powered solely by electricity.

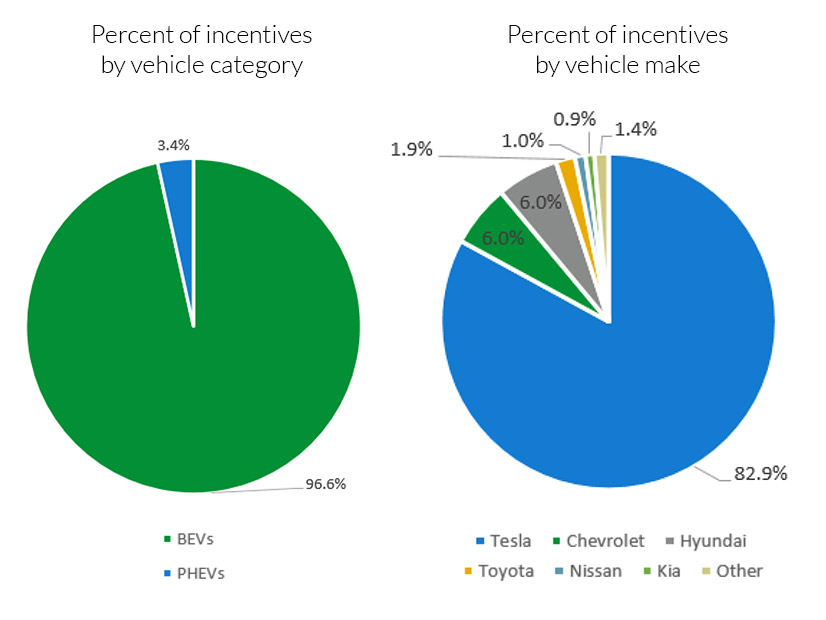

The first year of the program, which ended in December, provided incentives for the purchase of about 7,000 vehicles, about 83% of which were Teslas. About 93% of the awards were for the maximum $5,000 grant.

But in an effort to award incentives to “incentive essential” customers — those who will buy only if there is an incentive, rather than those who would buy anyway — the BPU has suggested that the second year include the $2,000 “soft cap.” The change, the proposal said, would “keep the funding available longer and prevent vehicles with a higher MSRP from garnering a larger-than-necessary incentive.”

Several speakers said there were hardly any vehicles in that lower price band, and the number is declining as vehicle prices have risen in recent months, in part because of the shortage of computer chips. Only one of Tesla’s four models, the Model 3, is priced below $45,000.

“We have to ask ourselves about this program: What does New Jersey want?” said one speaker, whose lease on his EV just expired and who said he is looking to the incentive program to help buy another. He suggested the BPU raise the soft-cap threshold to $60,000.

“Does New Jersey want low-income families to have access? Or have everyone have access to these funds?” he said in the hearing. “Are we deciding that we want to give the ability for people to get into a Nissan Leaf that’s been out forever and hasn’t had many technological advances? Or are we wanting people to just get into an electric vehicle of some sort, because that is what’s better for the environment?”

Incentive Distribution in NJ

Outlining the rule proposals, Cathleen Lewis, the BPU’s e-Mobility program manager, said that the three counties in the state in which consumers received the most incentives — Bergen, Middlesex and Monmouth — were not only the largest but had “higher income levels.”

“By creating a soft cap, we are continuing to incentivize the same suite of EV vehicles but are focusing funding on vehicles more accessible to middle-income families,” she said.

A graphic displayed by Lewis showed that Tesla’s Model Y, which starts at $60,990, accounted for 44% of the incentives awarded, and the Tesla Model 3, which starts at $39,990, accounted for 39%. Third placed was the Chevrolet Bolt, with 6% of the incentives and a starting price of $36,500.

One reason for the shortfall in non-Tesla vehicles was the limited number of models on offer in the state, the BPU’s proposal says. The program rules don’t allow New Jersey residents to receive the incentive if they buy the vehicle outside the state.

Kathy Harris, clean vehicles and fuels advocate for the Natural Resources Defense Council, told the BPU that it should consider allowing consumers to buy EVs outside the state with the incentive.

“The goal of the rebate program is to reduce greenhouse gas emissions from New Jersey’s air,” she said. “Electric vehicles on the road will improve air quality and mitigate the effects of climate change. Therefore, so long as the electric vehicle is registered and driven in New Jersey, it shouldn’t matter where or how the vehicle was purchased.”

She added that the organization would like to see the BPU adjust the program to enable more members of the low- and moderate-income sectors to participate. That could include allowing buyers of used vehicles to get the rebate and providing an additional rebate for low- and moderate-income buyers.

Proposed Changes

The BPU’s suggested rule changes for the program’s second year also include switching the incentive structure for plug-in hybrid electric vehicles (PHEVs) from $25/mile to a flat incentive. PHEVs, which are seen by the BPU as bridge vehicles to help consumers move from gas-powered vehicles to EVs, made up only 4% of the incentive awards in year 1. The average incentive was just $625 in the first year, according to the proposal, which did not suggest a figure for the flat incentive.

In addition, the approval process for incentives would be streamlined to provide rebates at the point of sale instead of the EV buyer applying for the incentive as a rebate after the purchase of the car, as is currently the case.

A third phase of the program, to run concurrently with the second, would add an incentive for EV owners to install a “smart charger” that can collect and transmit operating data to be used to analyze consumer behavior. The incentive would pay half the cost of the charger, to a maximum of $250.

The first phase of the program ran from January to December 2020, and the second year will begin over the summer, although the BPU has yet to announce the exact date.

The Best Way to Incentivize

The reduced incentives drew the most attention in the public hearing. One speaker said he could find only nine EVs priced below $45,000, and they are all basic entry-level models. In addition, he said, dealers would likely stock cars with options, rather than the basic models, and the extras would likely push the cost of the EV above the threshold to receive the full incentive, he said.

“My point is that the rebate levels I think are going to drive people to potentially be in cars that they don’t necessarily want to get, but [they] want to capitalize on the rebate,” he said. “I think the incentive cap should be raised,” suggesting $60,000.

Stanislav Jaracz, president of the Central Jersey Electric Auto Association, said that EV sales in 2020, which likely were affected by the COVID-19 pandemic, were only a little above those of 2018. He noted that the state has a long way to go from the estimated 41,096 EVs in 2020 to the goal of 330,000 in 2025.

“So my suggestion is to scatter the rebate in a different way,” he said, advocating a cut in the incentive to $4,000 for vehicles priced up to $40,000 and $2,000 for those $40,000 to $50,000. That way, he said, “we can purchase as many vehicles as possible, without running out of the budget.”

Zachary Kahn, senior policy adviser for Tesla in the Northeast, said the company has “concerns” about the addition of the soft cap, in part because it complicates the incentive program. He said that research has shown that range — how far a vehicle can go on a single charge — is the most important factor to buyers, with at least 300 miles being generally desired.

“There are currently no 300-mile range cars on the market under the $45,000 MSRP cap,” he said. “So none of the cars that most people are interested in, in giving them the confidence that they can move to EVs, would actually be available.”

The Nissan Leaf, priced at $31,670, has a range of 226 miles. The Tesla Model 3, with a $39,990 price tag, does 263 miles.

Jim Appleton, president of the New Jersey Coalition of Automotive Retailers, a trade association that represents about 500 car and truck dealers, said the BPU has not released enough data for it to assess the merits of the soft cap.

“[We] certainly support the goal there, which is to ensure that more money goes to people who really are going to use that money and need that money to make the decision,” he said.

He added that the incentives would have more impact if they were frontloaded, with most of them awarded in the first five years of the program, rather than spreading them evenly over 10 years.