New York officials this week heard conflicting stakeholder comments on energy storage proposals by two utilities, both of which want to sell their battery power into NYISO’s wholesale electricity market — Consolidated Edison from a 100-MW project in New York City, and National Grid from a 2-MW unit on the shores of Lake Ontario (Case Nos. 18-E-0130, 16-M-0411).

In 2018, the Public Service Commission directed New York’s electric investor-owned utilities to procure dispatch rights for bulk-level energy storage systems to be operational by the end of 2022. The PSC directed 300 MW to be procured by Con Edison and 10 MW by each of the five other IOUs: Central Hudson Gas and Electric, New York State Electric and Gas, National Grid’s Niagara Mohawk Power, Orange and Rockland Utilities, and Rochester Gas and Electric.

The utilities last fall petitioned for an extension of the in-service deadline and contract lengths. The PSC granted the request in an April 16 order, but reaffirmed “that competitive ownership of energy storage assets, and of DERs in general, is a core principle and the existing limitations on utility ownership of energy storage should be maintained if possible.”

New York Supports Con Ed Project

The major stakeholder in the Con Edison case (21-E-0122), the City of New York, supports the transformation of a defunct gas-powered peaker plant on the East River into an energy storage system (ESS) to be built this year and next to provide peak capacity, energy and ancillary services, and enhanced grid reliability. In contrast, generators and storage advocates oppose National Grid’s petition to sell its storage power into the wholesale market.

Susanne DesRoches, deputy director for infrastructure and energy at New York City’s Office of Resiliency and Office of Sustainability, said the city needs storage in its supply portfolio as it retires aging, dirty fossil generation. “Today, New York City’s generation fleet contains facilities that are almost 70 years old, with the median age of the fleet at about 50 years old,” she wrote in comments supporting the Con Ed project. “The existing units are inefficient and heavily polluting, and the city has concerns regarding their reliability given their advanced age.”

A public hearing on the Con Edison project, at the site of the former Charles Poletti Power Plant, Tuesday drew no commenters.

Irvine, Calif.-based solar developer 174 Power Global proposed to build the East River ESS on land owned by the New York Power Authority in Astoria, Queens, and to operate it on behalf of Con Edison under a seven-year contract, after which the developer would own the facility.

IPPNY Opposes National Grid Proposal

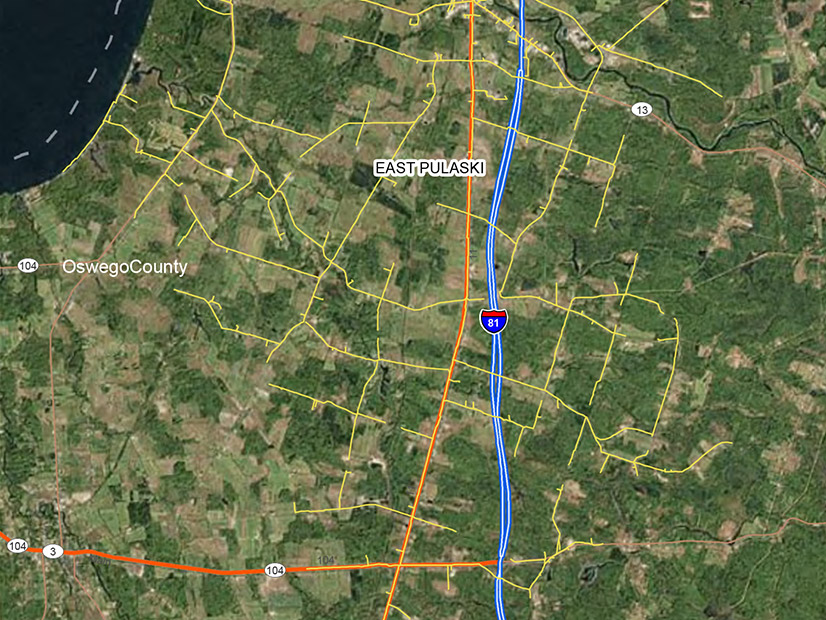

April 26 marked the comment deadline on the smaller proposal regarding the ESS located at National Grid’s East Pulaski Substation. The company says it wants to sell wholesale power “in order to aid understanding of such transactions in advance of the deployment of two larger-scale, bulk ESS projects,” one of 20 MW and one of 10 MW.

Although the PSC’s 2018 order said net revenues from bulk storage assets should be allocated 30% to utility shareholders and 70% to customers, National Grid proposed allocating 100% to customers.

The Independent Power Producers of New York (IPPNY) opposed National Grid’s petition, arguing that “private developers are best positioned to develop power generation resources at lowest cost to consumers … and instances of utility-owned generation participation in the wholesale markets operated by the NYISO should be limited to only the most narrow of circumstances.”

The New York Battery and Energy Storage Technology Consortium (NY-BEST) on April 21 urged the PSC to reject National Grid’s petition as violating commission precedent with respect to utility-ownership of distributed energy resources and energy storage.

The petition goes beyond the commission’s narrow definition for permissible utility ownership of energy storage and, if approved, has the potential of creating a “camel’s nose under the tent” scenario which could lead to additional cases of utility-owned storage seeking to participate in non-distribution level services, NY-BEST said.

“This would seriously undermine the playing field for third-party energy storage providers and would have a chilling effect on the budding energy storage industry in New York state,” the consortium said.

Should the PSC choose to approve the National Grid petition, NY-BEST said the commission should allow no more than five years until the project should be divested. It also should require the utility to publicly share its learnings from the project, and should reaffirm that utility ownership of storage should be restricted to allow third-party providers into the market, NY-BEST said.

At the end of 2020, about 79% of the 2025 target of 1,500 MW and 40% of the 2030 target of 3,000 MW had been awarded or contracted, and over 8,000 MW of energy storage projects are presently in IOU and NYISO interconnection queues, the commission said in its recent modification order.