FERC’s directive to open wholesale markets to aggregations of distributed energy resources is forcing states to consider new communication channels and more holistic system planning, and how they respond will be crucial, industry officials say.

“FERC left a lot of power in the state regulators’ hands, and this is really leaving the states in a place to make or break Order 2222,” Marcus Hawkins, executive director of the Organization of MISO States (OMS) said during a panel discussion at the National Association of Regulatory Utility Commissioners (NARUC) Winter Policy Summit on Feb. 9. Illinois Commerce Commission Chair Carrie Zalewski moderated.

FERC Order 2222, issued last September, ordered RTOs and ISOs to open their markets to DER aggregations now largely limited to providing demand response (Order 2222, RM18-9). Although the commission declined to allow local or state regulators to prohibit DERs from participating in the wholesale markets through an opt-out, it said regulators can prevent resources from participating in both retail and wholesale programs. (See FERC Opens RTO Markets to DER Aggregation.)

“What a retail regulator does to shape their programs will have a huge influence over the economics of where DER aggregation can flourish or not,” said Hawkins, who predicted retail programs are likely to provide more revenue to DERs than wholesale markets in the near term. “Also, the ability to condition participation in a retail program is huge. So, if a retail program prohibits wholesale activities … then you really have the final say in where the DER is going to go.”

State regulators will also control spending on distribution system investments, which will determine metering technology and the sort of information that will be available on DERs, Hawkins said.

FERC defines DERs as any resource located on the distribution system, a distribution subsystem or behind a customer meter, including energy and thermal storage, intermittent and distributed generation, energy efficiency and electric vehicles. The order requires RTOs to allow DER aggregators to register as market participants under models that accommodate their physical and operational characteristics.

FERC’s initiative would be threatened, Hawkins said, by “a system where distribution utilities are constantly fighting battles, being accused of being a barrier to participation in wholesale markets, or a place where inefficient planning is being done because not enough data is being shared between the DERs and the wholesale market.”

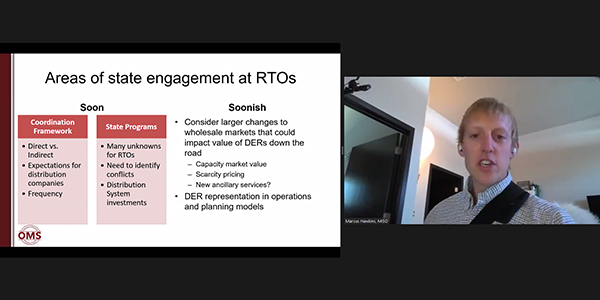

Hawkins noted that RTOs, which are facing a July 19 deadline for compliance filings, must determine the coordination framework among them, state regulators, distribution utilities and aggregators. “It’s important for [state] commissions to consider whether they want that coordination to be direct — where the aggregator or the RTO has some sort of direct communication with the commission — or indirect through a regulated utility,” he said.

RTOs must also determine how often to review the coordination. “It’s not just set it and forget it,” Hawkins said. “Aggregations might change. So, there might need to be some flexibility in the process.”

Hawkins said OMS has found it challenging to get utility distribution officials involved with MISO. “There’s a lot of what I refer to as MISO watchers, which are the wholesale and transmission planning people at the utilities, but not necessarily the distribution folks,” he said. “Getting those experts — both people who work on DER programs from commissions and also distribution utility experts into the conversation at the RTO is important. … Bringing those voices is the only way we’re going to understand where conflicts exist between retail and wholesale tariffs. … You need to have a lot of eyes on the language to understand what will make those retail programs either work or fail within the larger wholesale context.”

New Lines of Communication

Paul Suskie, SPP’s executive vice president of regulatory policy and general counsel, said the RTO’s territory, which has no capacity market and where all utilities are vertically integrated, is starting to see a bit more interest in DER, “but it’s still very, very small in the aggregate.”

“We’re looking at operational communication challenges [under Order 2222],” he continued. “This will require us to communicate with entities that we don’t historically communicate with. … Because we’re at the wholesale [level] we do not have a lot of communications with even some of our member companies at the retail level. … So, we have some new communication and operational challenges with existing members, let alone new entities that may participate under Order 2222.”

Ted Thomas, chairman of the Arkansas Public Service Commission said the FERC directive “is very challenging. But if we can meet those challenges, I think there’s a great upside.”

Thomas said FERC “left many of the most difficult challenges to be dealt with by the RTOs in their stakeholder processes,” adding that he hopes the commission will grant RTOs an extension on the compliance deadline. (See MISO to Seek Extension on Order 2222 Plan.)

System Planning

Former NYISO official Kelli Joseph, now an adviser to mobile storage company Power Edison, said it was “unfortunate” that FERC did not spell out its system planning requirements “other than saying a coordinated framework could be good.”

Although RTOs conduct separate transmission planning processes for reliability, economic and public policy projects, Joseph said it’s important to ensure “that there’s at least a process within one or more of those transmission planning models that can actually do a comparison between a transmission solution, a generation solution and potentially a DER solution.”

Joseph served on a joint task force of NARUC and the National Association of State Energy Officials that explored how aligned planning could guide the development of the grid in the future. The task force will hold a press conference at 11 a.m. EST on Feb. 11 to discuss the results of its efforts. “Thinking about how to use that … system planning framework could potentially inform some of this market coordination hopefully going forward as well,” Joseph added.

Oregon Public Utility Commissioner Megan Decker said although Order 2222 doesn’t apply in her state because it is not part of an RTO, it nonetheless demonstrated “leadership.”

“I have been really impressed with the level of dialogue on DER integration that I’ve seen as a result of the FERC order,” she said. “Unlocking the distribution system is something we will need. It’s going to be a pretty long-term transition. Wholesale market access by itself doesn’t necessarily mean the kind of DER explosion in states that aren’t ready for it. State programs right now largely drive DER uptake because of the economics.”

Even in California, which has done much of what is required by the FERC order, Decker said, “the money [to encourage DERs] is not there in the wholesale market.”