FERC ordered PJM to begin billing up-to-congestion (UTC) transactions for uplift, calling the RTO’s current rules unjust and unreasonable.

In its ruling Thursday, the commission found that UTC transactions are “similarly situated” to increment offers (INCs) and decrement bids (DECs) that accrue uplift under existing rules (EL14-37).

The commission said that even though it may be just and reasonable to treat UTCs differently than INCs/DECs regarding the bidding locations, as it did in 2018, that is not relevant to whether UTCs should be allocated uplift. (See FERC OKs Slash in Virtual Bidding Nodes for PJM.)

“Although the commission has recognized that UTCs have certain characteristics that distinguish them from INCs and DECs, we find that those characteristics do not justify failing to allocate uplift to UTC transactions,” the commission wrote. “Though UTCs and INCs/DECs are different financial products, each are deviations from day-ahead positions that can impact uplift.”

FERC directed PJM to submit a replacement rate within 45 days that treats UTCs as if they were a DEC at their sink points and allocate them both real-time and day-ahead uplift.

Backstory

Thursday’s ruling followed seven years of debate among PJM and its stakeholders over whether uplift can be accurately pinpointed to a specific UTC, given the day-to-day variability of the energy markets. Some members have argued that there’s no proof that UTCs even cause uplift, let alone that they should be charged for it.

FERC instituted an investigation under Federal Power Act Section 206 on PJM’s allocation of uplift to virtual transactions in 2014. In January 2017, the commission extended PJM’s financial transmission rights forfeiture rule to cover UTCs, but it denied the RTO’s proposal to extend uplift charges to the trades as well.

By April 2018, FERC issued Order 844, which incorporated additional uplift transparency rules for all RTOs and ISOs, but it withdrew a requirement that grid operators categorize real-time uplift costs based on their causes and allocate them only to market participants “whose transactions are reasonably expected to have caused” the uplift. (See FERC Orders RTOs to Shine Light on Uplift Data.)

Then, last October, FERC issued an order requiring additional briefing to update whether PJM still wanted to charge uplift on all virtual trades. (See FERC Queries PJM on Virtual Transaction Rules.)

PJM’s brief said it still supports allocating uplift to UTCs. Because UTCs, like all virtual transactions in the day-ahead market, directly affect “the commitment and dispatch of resources, flows on transmission lines, LMP levels and the revenues that resources collect from the market,” UTCs contribute to uplift the same way as INCs and DECs and should be treated similarly, PJM said.

FERC’s ruling cited PJM’s Report on the Impact of Virtual Transactions from 2014 that found UTCs can impact unit commitment by affecting the dispatch of supply resources in the day-ahead market. The report said that when UTCs were removed from the day-ahead market, several generating units were decommitted while other units were committed — an indication that UTCs can impact unit commitment decisions.

While PJM’s report only considered the day-ahead market, “the changes in commitment decisions that were shown by removing UTCs represent the types of commitment and redispatch decisions that could be needed to adjust for the removal of UTC megawatts on certain nodes in the real-time market,” FERC said. “The change in commitment decisions can impact uplift.”

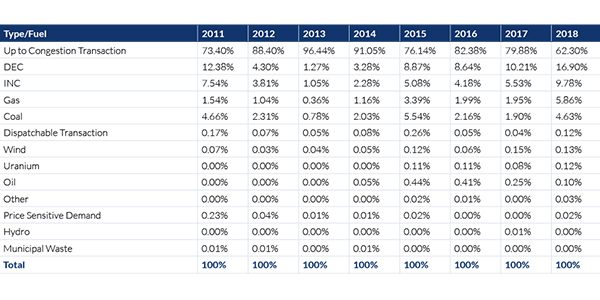

Besides PJM’s filings, the commission also cited analysis provided by the Independent Market Monitor showing that most real-time congestion charges are allocated to UTCs. FERC said the Monitor provided an example of how UTCs can collect “negative balancing congestion on the sink side of the transaction” and that they cause negative balancing congestion charges by contributing to “physically infeasible market flows” in the day-ahead market.

“We find that the Market Monitor’s analysis and supporting examples provide further support for our finding that UTCs can cause uplift in both the day-ahead and real-time markets,” the commission said.