ISO-NE’s energy transactions rang in at $159 million in April, the lowest monthly total since 2003, as the COVID-19 pandemic and ensuing shutdown of most economic activity continued to weigh on New England’s energy market.

“I wouldn’t be surprised if May breaks April’s record in terms of the lowest energy market value over the last 17 years,” COO Vamsi Chadalavada reported to the New England Power Pool Participants Committee on Thursday. His report covered data through May 27, which showed a month-to-date energy market value of about $120 million.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

May 2020 natural gas prices over the period were 16% lower than April average values and down 41% from a year ago. Average real-time hub LMPs ($16.39/MWh) were 9.4% lower than April averages and down 28% from May 2019 averages.

The RTO still has approximately 95% of its workforce working remotely and will continue that “remote deployment posture” until June 15, when it expects to start its re-entry plan, Chadalavada said.

“We are comfortable that we are compliant with the guidelines issued by [the Centers for Disease Control and Prevention], the states of Massachusetts and Connecticut, and also the local authorities,” he said.

Boston RFP and System Disturbances

ISO-NE’s competitive transmission solicitation for Boston garnered 36 proposals from eight qualified parties by the March 4 deadline, Chadalavada said, adding that the RTO would present a draft list of qualifying Phase One proposals at the June 17 Planning Advisory Committee meeting. (See “Faster Boston RFP,” National Grid, Eversource Finalist for Boston Tx Plan.)

A markedly quiet month in terms of operations turned less so in the last week of May with system disturbances on May 27 and 29, Chadalavada said.

On May 27 at 2:48 p.m., the system experienced the loss of the Phase II transmission line to a lightning strike, resulting in the loss of 1,980 MW, “a fairly severe source loss, given the size of New England,” he said.

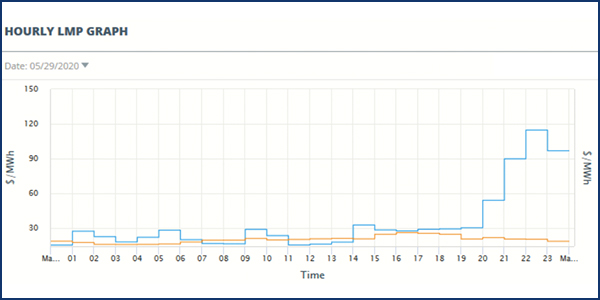

May 29 brought two events, Chadalavada said: “We lost a major generation facility at [2:04 p.m.], which was about 1,250 MW, and later that evening, we lost the first pole at Phase II at 8:23 p.m. and the second one at 8:34 that night, again due to equipment failure.”

According to a report from New Hampshire Public Radio, the evening event stemmed from a control rod malfunction at the Seabrook nuclear plant, with the subsequent scram taking 1,340 MW off the grid.

The total loss was about 2,600 MW, “so on a 14,000- to 15,000-MW load, that translates to north of 20% of energy loss that had to be replenished,” Chadalavada said.

All transmission and disturbance control standard criteria were met and maintained during and after the events, he said.

Virus Reduces RTO Spending

The financial impact of the COVID-19 pandemic will likely translate into net savings in ISO-NE’s 2020 budget, said Chief Financial and Compliance Officer Robert Ludlow in presenting the preliminary 2021 and 2022 operating and capital budgets.

Committed COVID-19 spending totals $730,000, with current projected possible risks of an additional $300,000, but offsetting those increased costs are $800,000 in planned costs that will not be incurred in 2020. Those savings are primarily derived from suspended travel and training and the limited hiring of interns this year.

ISO-NE Tariff collections for January through April were lower by 5.7% (or $3.6 million), reflecting decreased load, which is estimated to be 3 to 5% lower because of the pandemic.

The 2021 and 2022 budgets’ year-over-year increases before depreciation are projected to be $4.8 million (2.7%) and $6.3 million (3.5%), respectively.

The proposed budgets will be presented in August with a detailed review of project budgets and estimated go-live dates.

Order 1000 Questions on Tx Planning

The PC approved changes to Planning Procedure 10 (PP10) to provide implementation details for the alignment of reliability reviews of delist bids with the competitive transmission solution process, as recommended by the Reliability Committee in May. (See “Changes to PP10 for Tx Solution,” NEPOOL Reliability Committee Briefs: May 19, 2020.)

The motion passed with 99.12% in favor.

Exelon argued in a presentation that ISO-NE is abandoning planning principles for expediency and thereby risking reliability.

“The proposed amendment to Planning Procedure 10 appears to be a result-driven attempt to preclude the potential retention of Mystic 8 and 9 for transmission security; the amendment and its attendant consequences, however, will live long after Mystic 8 and 9 have retired,” Exelon said in its presentation. (See Exelon Bid to Keep Mystic Units Running Provokes Outrage.)

“A significant amount of information is provided to the ISO early in the solicitation process, including information necessary for the ISO to determine whether the reliability need can be satisfied with the proposal,” said ISO-NE Director of Transmission Services and Resource Qualification Al McBride.

The changes are intended to prevent unnecessarily retaining a resource for reliability if transmission responses in the competitive solicitation process address the reliability need, McBride said.

Consent Agenda

The PC on its consent agenda approved a revision to Operating Procedure 12 (OP-12) related to voltage and reactive control, as recommended by the RC in May.

The changes:

- reflect the source of the data in OP-12B (voltage and reactive schedules);

- explain the different categories of voltage control for generators;

- clarify the use of “On Peak Period” and “Off Peak Period”;

- add that OP-12B would be updated “as needed”; and

- specify that ISO-NE may request technical status for certain units that have operational impact.

The committee also approved revisions to Market Rule 1 and Manual M-11 to modify the day-ahead energy market offer window, as well as clean-up changes to the offer cap, as recommended by the Markets Committee last month.

The submission deadline for day-ahead offers and bids moves from 10 to 10:30 a.m.; the offer cap filing revisions were approved by FERC (ER17-1565).

The PC also voted to approve a FERC filing to address rejected portions of ISO-NE’s Order 845 compliance filing (ER19-1951), as recommended by the Transmission Committee in May following the commission’s May 19 rejection of the RTO’s request for clarification on the issue. (See NEPOOL Transmission Committee Briefs: May 27, 2020.) The commission issued Order 845 in 2018 to set pro forma minimum standards for large generator interconnection procedures and agreements.

The PC deferred voting on major changes to the RTO’s billing policy until fall, with some related clean-up changes to the ISO-NE Financial Assurance Policy to be voted sooner at the virtual summer meeting June 23.

The committee also considered in executive session and unanimously approved — with some abstentions — ISO-NE Tariff revisions to carry out the settlement agreed to among New England Transmission Owners (NETOs), FERC staff and municipally owned power companies on pool transmission formula rates (EL16-19).

Litigation Report

The monthly litigation report mentioned that FERC will hold a technical conference July 8-9 to explore the potential longer-term impacts of the emergency conditions caused by COVID-19 on FERC-jurisdictional entities (AD20-17).

In addition, the commission issued a supplemental notice waiving through Sept. 1 its regulations that require filings with FERC be notarized or supported by sworn declarations (AD20-11).

Another item noted that FERC in May approved a procedure for “critical” New England generators and transmission operators to obtain compensation for compliance with NERC rules regarding interconnection-reliability operating limits (IROL) (ER20-739). (See FERC OKs Payment Rules for IROL Facilities.)

“Regarding the IROL, we were disappointed to see that,” said Brett Kruse of Calpine. “We do think ISO New England in this case acted in good faith, and we appreciate what they tried to do. This has ramifications. The next time the ISO comes to us and says, ‘We need you to start spending money on x, y or z because it’s a reliability issue,’ the first thing we’re going to have to think about, instead of going out and immediately doing it like we did this time, is go get it in front of FERC and get them to approve it. If that takes two and a half years, as it did in this case, well that’s what it takes.”

In addition, the litigation report noted that several market participants and state entities had filed comments and protests on the separate Energy Security Improvements filings submitted by ISO-NE and NEPOOL (ER20-1567). (See ISO-NE Sending 2 Energy Security Plans to FERC.)