Shortage pricing played a crucial role in Texas wholesale market competitiveness last year, ERCOT’s Independent Market Monitor said in its annual market report.

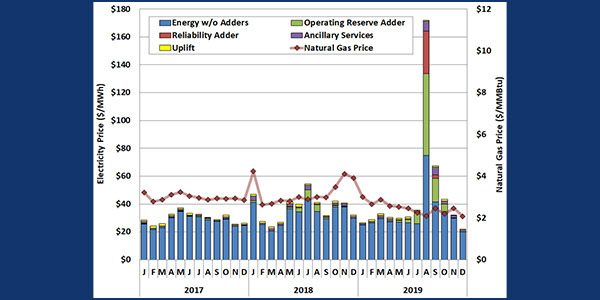

The report from Potomac Economics showed average real-time energy prices rose by 32% in 2019, despite a 23% reduction in natural gas prices. The Monitor attributed the increase to shortage pricing in August and September, when prices reached the offer cap of $9,000/MWh for more than two hours.

“Shortage pricing is key in ERCOT’s energy-only market because it plays a pivotal role in facilitating long-term investment and retirement decisions,” the Monitor said, the idea being that high prices during energy shortages will incent new generation.

ERCOT entered last summer with a reserve margin of 8.6%, which is up to 12.6% this summer. The Monitor said only 4.5% of the grid’s generation was unavailable during summer peak conditions, similar to 2018 but lower than the 6% during 2016 and 2017.

“We attribute this increased availability to the effectiveness of the shortage price signals in motivating participants to increase maintenance and minimize outages during the summer peak,” the Monitor said.

The Texas Public Utility Commission in January modified ERCOT’s shortage pricing mechanism by altering the market’s operating reserve demand curve. The changes accounted for a nearly $7/MWh increase in average energy prices and a $1.9 to $2.1 billion increase in energy revenue.

The PUC has also approved the real-time co-optimization of energy and ancillary services, scheduled to be added to the market in 2024.

“This will significantly improve the real-time coordination of ERCOT’s resources, lower overall production costs and improve shortage pricing,” the Monitor said. “These improvements will be increasingly valuable as additional intermittent wind and solar resources enter the ERCOT market.”

In its report, the Monitor recommends key improvements to ERCOT’s pricing and dispatch processes:

- Remove the “opt-out” option for resources receiving reliability unit commitment instructions.

- Eliminate the 2% shift factor rule, and price all congestion regardless of its generation effect.

- Modify the allocation of transmission costs by transitioning away from the four coincident peak (4CP) method.

- Price ancillary services based on the shadow price of procuring each service.

- Modify the reliability deployment adder and operating reserve adder to improve pricing during emergency response service deployments.

- Implement a locational reliability deployment price adder.

- Improve the mitigated offers for generating resources.

- Implement transmission demand curves.

The Monitor retired six other recommendations no longer needed, including the inclusion of marginal losses in ERCOT’s LMPs. The PUC has concluded the incremental benefit of applying marginal losses was not worth the implementation cost and market disruption.

The market report was the first delivered under the guidance of Monitor Director Carrie Bivens, who promised a “timely and comprehensive” report when she was hired in April. (See Bivens Steps in as New Director of ERCOT Monitor.)