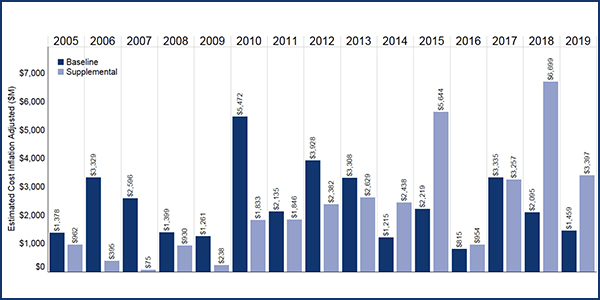

Transmission owners’ supplemental projects totaled almost $3.4 billion in PJM in 2019, more than double the less than $1.5 billion in regionally planned baseline projects, PJM told the Transmission Expansion Advisory Committee Tuesday. It marked the fifth year out of the last six in which supplemental projects exceeded baseline projects.

“Supplemental projects undermine the strength of PJM as a regional planner,” LS Power’s Sharon Segner responded after a presentation by PJM’s Aaron Berner. “The question in our mind is: Is the right transmission being built?”

She was repeating a position that she and load-side stakeholders have made repeatedly in prior meetings — and that LS Power and dozens of other stakeholders made in a letter Tuesday to the PJM Board of Managers.

“Will the Grid of the Future be regionally or locally planned?” they asked. “We believe that the best way to reliably, cost effectively and holistically plan the Grid of the Future is through PJM’s independent regional planning process.”

Signing the letter, in addition to LS Power, were American Municipal Power, Old Dominion Electric Cooperative, the PJM Industrial Customer Coalition and numerous municipal utilities and state public advocates.

The stakeholders noted that the largest component of the spending on supplemental projects in 2018 was that identified by TOs as necessary due to end-of-life (EOL) conditions. “The statistics for 2019 also show that the vast majority of projects were based on claims of EOL conditions and were not subject to regional planning,” they said.

They called for Operating Agreement changes to make clear that PJM plans replacements for facilities identified by TOs as end-of-life, quoting from the PJM Board Reliability Committee’s Oct. 4, 2019 letter that said “PJM may be in the best position to determine the more cost-effective regional solution to replace a retired facility.”

“The transmission system in PJM needs to be developed with an eye toward the future, rather than simply rebuilding the grid of the past,” the stakeholders said. “We envision a future where PJM is able to combine drivers of transmission projects, namely public policy projects, with aging infrastructure replacement projects, to plan the Grid of the Future through a robust and transparent regional planning process.”

The stakeholders sent the letter to help the board understand their proposals scheduled for a vote at the May 28 Market and Reliability Committee meeting to change the OA to authorize PJM to direct the most cost-effective solution after the TO provides an EOL notification.

Three EOL proposals were given first reads at the April 30 MRC. The proposals — which would require TOs to share how they make EOL determinations and potentially open at least some replacement projects to competition under the Regional Transmission Expansion Plan (RTEP) — are the result of deliberations over six special MRC meetings since December. (See PJM End-of-life Tx Proposals Near Vote.)

In their letter, the stakeholders insisted their proposal “is consistent with” the Consolidated Transmission Owners Agreement — just one of the many points on which the TOs disagree with the stakeholders. The stakeholders also repeated their assertion that two FERC orders cited by TOs relating to “asset management” are irrelevant to their proposal.

“Our collective hope is that PJM follows the direction set forth by [CEO Manu] Asthana and refrain from advocating particular policies and instead listens to all stakeholders and perspectives and brings expertise to bear to help achieve the three priorities of reliability, planning and market function for the most efficient delivery of power to [PJM’s] 65 million customers,” they said, inviting “constructive feedback” from the board.

The TOs are likely to make their own case to the board. But at the TEAC meeting, it was left to Alex Stern of Public Service Electric and Gas to get in the last word on their behalf.

“They’re excellent sound bites, but they don’t mesh with the project statistics [PJM] just showed,” Stern said of Segner’s comments.

During his presentation, Berner introduced new graphs showing that post contingency local load relief warnings (PCLLRW), wind curtailments and system congestion costs all have trended down in recent years.

“The data PJM presented in its Project Statistics review today demonstrates that PJM has been a strong regional planner,” Stern added after the meeting. “Particularly in the midst of the current pandemic, the region is worried about a lot of things but, thus far, fortunately, cost effective, reliable power has not been one of them.”