Bill Spence, in his final earnings call as CEO before he steps down on June 1, said PPL’s response to the pandemic has kept it in a “strong position in the face of this challenge.” He cited the company’s liquidity and steps taken during the first quarter to strengthen its financial position by accessing capital markets.

PPL has not changed its 2020 forecast of $2.40 to $2.60/share, Spence said, despite much of the company’s service areas being on lockdown for the past six weeks. Spence said the lockdowns have resulted in lower commercial and industrial load and higher residential loads in all its territories.

“At this point, it is too early to predict clearly what the pandemic impact will be on full-year results,” Spence said. “This will depend on how long the pandemic lasts, the pace and extent of the economic recovery and the degree companies continue to employ work-from-home protocols, which is what’s driving the higher residential loads.”

Q1 Earnings

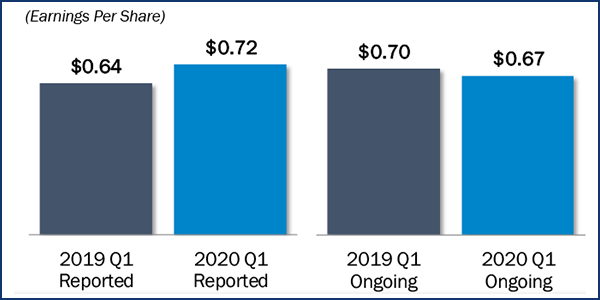

PPL’s first-quarter net income came in at $554 million ($0.72/share), a 19% jump over the $466 million ($0.64/share) during the same period last year. The company said its per-share earnings rose to 72 cents, compared with 64 cents in the first quarter of 2019.

Adjusted for nonrecurring gains, company officials said earnings were $514 million ($0.67/share), compared to $508 million ($0.70/share) last year. Operating revenue was $2.05 billion, down from almost $2.08 billion last year.

CFO Joe Bergstein said the adjusted earnings decrease was primarily because of a warmer-than-normal winter in the U.S. He said the warm winter drove a -3-cent variance compared to 2019 and about a 5-cent variance in the company’s forecast, as heating degree days were down by about 30% in Pennsylvania and 15% in Kentucky compared to normal weather conditions.

Based on observations in April, Bergstein said commercial and industrial load was down 15 to 25% depending on the region. He said those declines were partially offset by higher residential demand, with 1 to 3% increases in its U.K. operations and 5 to 8% increases domestically.

Bergstein also noted losses in the company’s U.K. business, with its regulated segment earning 39 cents/share, a 2-cent decrease compared to 2019. Bergstein said decreased U.K. earnings were attributable to lower pension income and higher operation and maintenance expenses.

Bergstein said PPL remains “very well situated” to survive the pandemic, with about $5 billion in total available liquidity. He said during March and April, the company was able to secure term loan facilities of $400 million for 12-and 24-month durations and also issued $1 billion of senior notes.

“We believe these positions have the company very well positioned from a liquidity perspective for the remainder of 2020,” Bergstein said. “While we have $700 million of additional debt maturities, at the operating companies in November, we believe we’ll have the ability to access the capital markets to refinance that debt.”

COVID-19 Response

The background of the pandemic flavored much of the earnings call.

PPL President Vince Sorgi, the person tapped to take over as CEO after Spence’s retirement, said the company has taken several measures to keep employees safe from the pandemic, including temperature testing, requiring masks and gloves, and enhancing its industrial cleaning. Sorgi said critical employees, which are primarily control room operators, have been split into multiple teams, and as much as 40% of its total workforce is working from home.

“While we are certainly managing the current crisis at hand and ensuring that our customers and employees are protected during these difficult times, I want to further emphasize that we remain focused on the long-term strategy of the company,” Sorgi said. “For PPL and many utilities, that includes the transition to cleaner energy, and we continue to position our utilities to fight climate change in a manner that balances the needs of our customers and the environment.”