By Rich Heidorn Jr.

Moody’s Analytics said Friday it expects U.S. gross domestic product to drop by 2.3% for 2020 as a result of the “sudden stop” in the economy because of the COVID-19 coronavirus pandemic.

Mark Zandi, Moody’s Analytics | Moody’s Analytics

Moody’s expects a 2.2% drop in first-quarter GDP to be followed by an 18% drop in Q2 before rebounding with an 11% gain in Q3 and a 2.4% increase in Q4, Chief Economist Mark Zandi said during a webinar Friday.

The second-quarter GDP drop would be closer to 30% if Congress had not passed its more than $2 trillion in rescue packages, Zandi said.

He noted “about half the country is in some kind of lockdown,” with travel and restaurant sales down drastically and the equity market having lost $10 trillion in market capitalization. He predicted this week’s unemployment claims will be similar to the record 3.3 million filings reported Thursday. Moody’s expects the unemployment rate to peak at 8.7% in Q2 and to remain above 6% until 2022, not returning to full employment (4.5%) until late 2022 or the beginning of 2023.

PJM and ISO-NE use Moody’s Analytics’ projections as inputs in their load forecasts. The company has been criticized for overly optimistic predictions about the 2008 financial crisis. (See related story, PJM Staff Ponder Pandemic Effect on Load Forecast.)

Worldwide Recession

Moody’s expects worldwide GDP to drop 2.1%, with virtually every country in recession. “I’ve never seen anything like it,” Zandi said. “The entire global economy will be in recession,” he said. “The breadth of this is just incredible. … It’s going to be a very difficult couple of years.”

It estimated China, where the outbreak originated, will see a 29% GDP drop in Q1 but will have a 15% jump in Q2 and just a 0.1% drop for the year.

Europe will take much longer to get back to full employment because it has “fewer policy resources” than the U.S., Zandi said.

The good news in the U.S. is that the economy’s fundamentals are far better than they were in 2008, with financial institutions less leveraged and household debt also lower.

Moody’s expects the impact of the outbreak on business in the U.S. to diminish by the third quarter. “By July 4, the disruptions are largely played out,” Zandi said, adding that the country will likely need one or two additional economic stimulus packages as the impact of the initial spending recedes later in the year.

Projected annualized percentage change in real GDP growth, comparing January and March base cases with coronavirus update | Moody’s Analytics

Moody’s has developed three main epidemiological scenarios for the virus. The baseline assumes confirmed infections in the U.S. range between 3 million and 8 million, with new infections peaking in May. With 10% of those infected requiring hospitalization and 1.5% dying, Moody’s said the nation would have a 4% excess capacity of intensive care unit beds and 17% excess capacity of ventilators. Moody’s cautioned that some regions could face shortfalls of ICU beds, ventilators and trained medical staff even under this scenario.

Moody’s S3 scenario — rated as a 10% probability — is much grimmer, predicting infections peak in June with 9 million to 15 million total, a 20% hospitalization rate and a 4.5% fatality rate. With so many people infected, hospitals would have a 125% “capacity deficit” for ICU beds and a 56% deficit for ventilators.

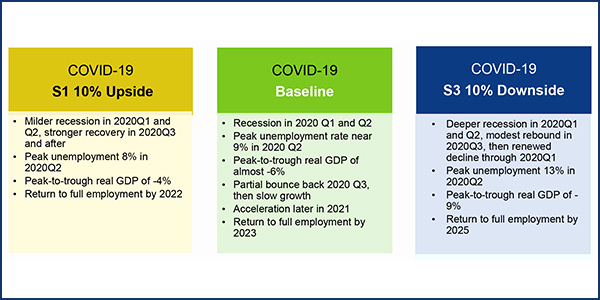

Moody’s three main economic scenarios for the COVID-19 outbreak include a base case with a 72% probability and a 10% upside and 10% downside case. Not displayed are extreme upside and downside cases with 4% probabilities each. | Moody’s Analytics

The company also produced varying scenarios on the impact of the $2.2 trillion rescue fund — with a downside risk that the distribution of funds is delayed by bureaucratic bottlenecks — and whether there is a fourth or fifth stimulus bill.

It also highlighted other policy risks. The government “could botch the crisis management,” Zandi said. “The discussion about opening up the economy quickly by Easter would qualify as a mistake in all likelihood, and that would lead to a more significant downside scenario.”

‘We have not bent the growth curve.’

Moody’s Senior Director Cris deRitis said the number of confirmed cases in the U.S. grew by 27.5% on Thursday with the addition of 18,000 cases — equal to the U.S. total a week before — as the number of tests reached 580,000.

Cris deRitis, Moody’s Analytics | Moody’s Analytics

“We have not bent the growth curve,” deRitis said. “As we look at the testing data, we still see that the positive rate is … growing, [which] indicates that the rise in the total number of confirmed cases is not just due to the increased number of tests that we’re running but that the virus truly is continuing to spread at a rapid pace.”

The baseline scenario assumes that the Federal Reserve will ensure liquidity and serve as a “firewall” to protect the financial system from the real economy, Zandi said.

But Moody’s Damien Moore highlighted the risk of the “already stressed” corporate debt market. He said high yield spreads have increased in recent weeks, “but it’s nothing like what we saw in the financial crisis.”

U.S. companies have about $10 trillion of nonfinancial corporate debt outstanding, including $2.5 trillion in speculative grade leveraged loans or high-yield bonds.

“In a well-functioning world — sales [and] cash flow are solid — [leveraged debt is] not a problem,” Zandi said. “But in a world like the one we’re in, where sales are potentially zero and cash flow highly disrupted, these companies will now have a Hobson’s choice — no choice at all really. Do I make my debt payments, or do I cut investment and hiring?”

Defaults would impact the Fed’s ability to serve as the firewall; cuts in investments and hiring would exacerbate the downturn and slow the recovery, he said.

Zandi said there will be a large number of bankruptcies by small businesses that lack the cash or credit to survive the disruption. “How widespread the failures are will have a lot to say about the severity of the downturn and also the nature of the recovery — whether we have a more V-shaped or U-shaped or L-shaped kind of recovery.”

‘We will all be changed by this.’

“We will all be changed by this. Normal will be different, just like the financial crisis changed us,” Zandi said. “I can’t imagine that anyone who lived through this won’t remember this and not be affected by this. Even the young people in their teens and 20s. They’re going to remember this. And I do think it’s going to have an impact just like the Great Depression did on that generation and World War II did. This event certainly will have [a] long-lasting imprint on people’s thinking and behavior.”

He said he is concerned it will “cement” anti-globalization sentiments and nationalism. He lamented the impact on low-income households and those who were just getting back into the labor force after the Great Recession.

“Wage growth among low-income groups was even higher than high-income groups because of the tight labor market among unskilled workers,” he said. “Now that’s all been derailed. I fear the income and wealth distribution … now will widen out again.”

Zandi said he was not worried that the extended unemployment benefits approved by Congress will prove a disincentive for people returning to work. “The effect of the stimulus is not just about dollars and cents but people’s psyches,” he said. “People are freaking out.”