Global electric vehicle sales are expected to hit a record 14 million this year, up from 10 million in 2022, the International Energy Agency said Wednesday in its Global Electric Vehicle Outlook.

The EV share of the global market has grown from 4% in 2020 to 14% last year and is expected to hit 18% this year.

“Electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging, and they are bringing about a historic transformation of the car manufacturing industry worldwide,” IEA Executive Director Fatih Birol said in a statement.

The growth in EVs has significant implications for oil demand, as IEA expects they will avoid the need for 5 million barrels of oil per day by 2030. IEA reported earlier in the month that global oil demand is expected to average a record 101.9 million barrels per day this year.

China, Europe and the U.S. are the three leading markets for electric vehicles, with China being the clear front-runner, making up 60% of global sales. Europe is the second-largest market, but the U.S. grew faster last year at 55% compared to 15% in Europe.

China is home to more than half the EVs on the road, with a total of 13.8 million; the IEA credits its manufacturing dominance to more than a decade of strong policy support for early adopters. Electric cars made up 29% of China’s domestic market, beating its 2025 goal of 20% of sales. Sales spiked in China last year because incentives were winding down, but they were still 20% higher in the first quarter of this year compared to a year earlier.

Both the EU and U.S. enacted major policies expected to ramp up their industries, with IEA saying all three markets should see total sales rise to 60% of their domestic markets by 2030.

The U.S. saw EV sales increase nearly 55% to 800,000 last year despite an 8% decrease in overall new car sales. Tesla has dominated the EV market historically, but competition is coming from other manufacturers such as General Motors and Ford.

The U.S. market is expected to continue to grow thanks to the Inflation Reduction Act, which has prompted $52 billion in domestic supply chains. About half those investments are for battery manufacturing, and 20% each covers battery components and EV manufacturing.

“While these investments can be expected to lead to high growth in the years to come, the impact may only fully be seen from 2024 onwards as plants come online,” said IEA.

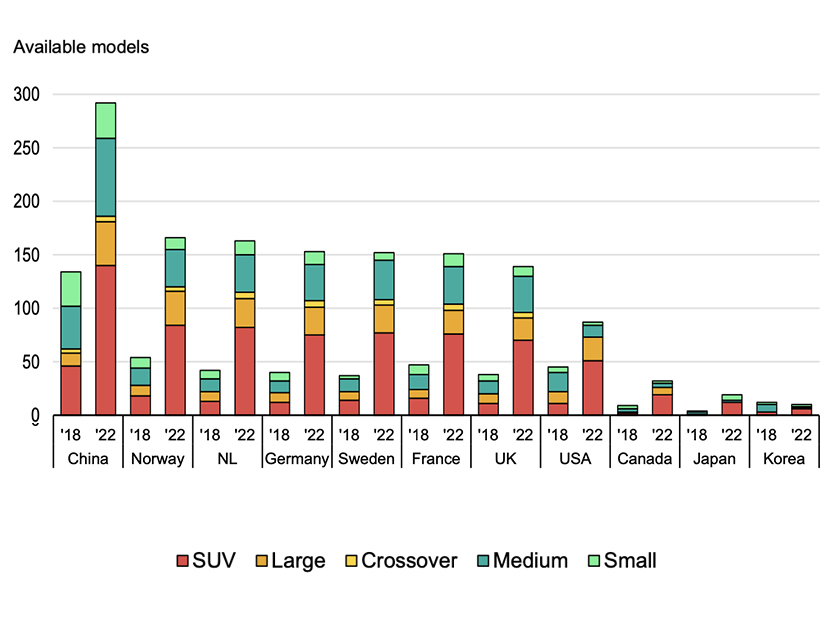

Policy requirements were an important driver for electrification in the early years, but IEA said it has become increasingly important for major automakers to start rolling EV models to capture market share and maintain a competitive edge.

The report said that battery manufacturing projects around the world are more than enough to meet the ramped-up production of electric vehicles by the end of the decade. Battery manufacturing remains concentrated in China, which dominates production of batteries and other components.

Lithium demand exceeded supply, despite the 180% increase in production since 2017. Battery manufacturing last year took up 60% of global lithium supply, 30% of cobalt and 10% of nickel, when just five years earlier those shares were 15%, 10% and 2%, respectively.

“As has already been seen for lithium, mining and processing of these critical minerals will need to increase rapidly to support the energy transition, not only for EVs but more broadly to keep up with the pace of demand for clean energy technologies,” the report said. “Reducing the need for critical materials will also be important for supply chain sustainability, resilience and security.”

Demand can be cut by using new battery technologies, recycling, and setting policies that optimize vehicle battery sizes, the report said.