By Michael Kuser

The rise was “driven primarily by higher wholesale power prices, offset by higher retail supply costs and mild weather,” NRG CEO Mauricio Gutierrez said in a call with analysts on Wednesday.

The company reported second-quarter earnings of $189 million ($0.75/share), compared to $27 million in the same period last year.

NRG’s generating arm earned $618 million for the quarter, up 145% from a year earlier, while losses from the retail division grew from $84 million to $280 million.

The company said that generation gains on hedge positions this year were partially offset by losses on retails hedges, “both driven by large movements in gas prices and ERCOT heat rates.”

During the quarter, NRG launched its “capital-light” strategy by signing approximately 1.3 GW of solar power purchase agreements at an average length of 10 years, complementing its generation portfolio. The company also highlighted that its 385-MW combined cycle Gregory plant in Corpus Christi returned to service in June.

Gutierrez noted NRG has spent $1.25 billion so far this year on a share buyback program and announced plans to spend $250 million more by year-end.

“We will address our plans for the remaining $259 million of 2019 excess cash, as we usually do, on the third-quarter earnings call,” Gutierrez said, noting that the company is reserving up to a $124 million in capital for the Petra Nova project. The coal-fired power plant captures carbon dioxide from one of the eight units at the 3.65-GW WA Parish Generating Station southwest of Houston, which is then injected into mature oilfields to release more oil.

In May, NRG agreed to spend $325 million for Stream Energy’s retail electricity and natural gas business, increasing its retail portfolio by approximately 450,000 customers. The acquisition closed on Aug. 1.

Markets Update

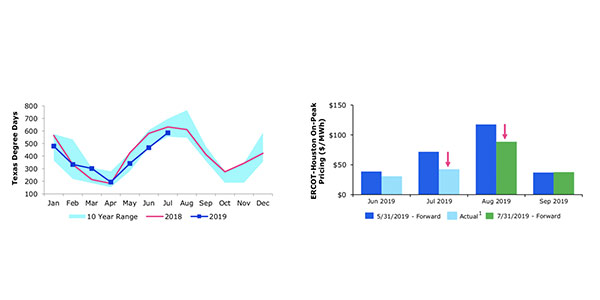

Gutierrez said NRG expects ERCOT’s supply-demand balance to remain tight, given strong load growth, previous generator retirements and a lack of new builds. He pointed out that ERCOT’s own projections for its future supply margins rely on its semi-annual Capacity, Demand and Reserves report, which has typically been a “poor indicator of what actually gets built in the current year.”

He noted the report includes 1.7 GW of natural gas-fired generation that has been delayed an average of five years “with no signs of moving forward” and 1.4 GW of thermal generation already set to retire, while little more than half the 7 GW of solar projects listed have posted the financial security needed to interconnect to the grid.

“ERCOT needs a lot of generation … needs a lot of investment,” Gutierrez said. “And even the numbers that we’re providing you are only sufficient to maintain the current load reserve margin that we have.

“Obviously, the implication of that is we expect the ERCOT market to continue to be robust over the foreseeable future but, more importantly, to be pretty volatile,” he said. “This price environment should prove difficult for pure retailers or generators that will be exposed to swings in the market.”

Gutierrez also referred to a recent FERC Halts PJM Capacity Auction.)

“While we’re hopeful a final order will be issued by the end of the year, the timeline for FERC action remains uncertain,” Gutierrez said. “We continue to view a strong [minimum offer price rule] as the simplest and most cost-effective way to reduce the harmful impact of subsidies on the capacity market.”

Call transcript courtesy of Seeking Alpha.