By Christen Smith

PJM’s Independent Market Monitor said the RTO’s updated simulation results for energy price formation understimate the impact of its operating reserve demand curve (ORDC).

In its own analysis released Friday, the Monitor said PJM’s decision to rely on dispatch conditions that allow the software to decommit resources otherwise required for reliability “presents a significant departure from reality” and results in understated market impacts.

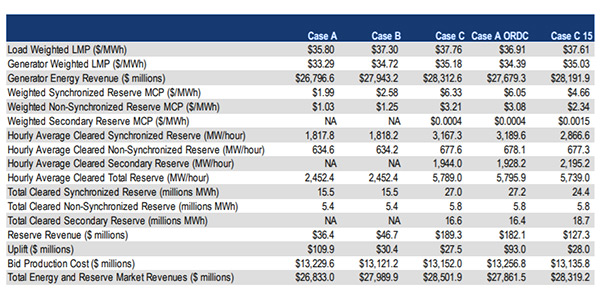

At an April 10 Market Implementation Committee meeting, PJM’s Adam Keech said changing unit commitment based on real-time instead of day-ahead market runs — otherwise known as “Case C” in simulations — increased LMPs, boosted energy revenues and cut uplift by more than 80% compared with the status quo, which staff referred to as “Case A” in simulations. (See “ORDCs Shrink in Updated Energy Price Formation Simulation,” PJM MIC Briefs: April 10, 2019.)

By applying PJM’s proposed ORDC and 30-minute reserve market to conditions set in “Case B,” the simulation increased LMPs by an average of 46 cents/MWh, assigned an additional 1,350 MWh of synchronized reserves and 3,337 MWh of secondary reserves, and generated $550 million more in total energy and reserve market revenues, Keech said.

“If it is the case, and PJM implies that it is, that the ORDC would replace manual operator commitments with market commitments, the relevant comparison is Case A to Case C, because Case A contains the steam unit commitments made by operators,” the Monitor said. “Case B removes all uneconomic operator commitments.”

The Monitor’s simulation compared Case C to Case A — defined as PJM’s optimal dispatch conditions — to get what it considers a better measure of real-life market impacts. The comparison shows less uplift, higher LMPs and revenues, with larger impacts than PJM’s Case B to Case C comparison.

The Monitor further cautioned that even Case A conditions do not represent the “actual status quo,” and using it as a benchmark still underestimates real-world costs of PJM’s proposed ORDC approach.

The Monitor’s simulation of an ORDC based on 15-minute forecast errors, compared to PJM’s 30 minutes, resulted in lower price and revenue differences.

“The Market Monitor disagrees with PJM’s conclusion that a 30-minute time horizon is appropriate for the 10-minute reserve products,” the Monitor said. “Case C 15-minute presents a case where the ORDC is shifted inward using a 15-minute forecast time horizon for the synchronized and primary reserve demand curves.”

On Monday, PJM spokesperson Jeff Shields said the RTO stands by its filing and disagrees with the Monitor’s opinion.

“PJM’s simulation analysis was intended to reflect and isolate the impacts of implementing the enhanced ORDCs,” he said. “While PJM acknowledges that there will also be benefits in the form of more optimal commitment and dispatch solutions, PJM does not agree that the entire difference between Cases A and C in the IMM report reflect the anticipated impact of the changes PJM filed on March 29.”

(Updated to reflect that the Monitor’s analysis compared Case A to Case C and found PJM’s simulation underestimates ORDC impact. A previous version of this story said the simulation results were overestimated.)

(Updated to include PJM’s statement.)