By Michael Kuser

A draft version of NYISO’s annual load and capacity forecast shows electric vehicle usage driving a 66% increase in New York’s projected baseline peak demand growth rate over the next 20 years.

Much of that growth would occur in the second half of the study period, according to the preliminary 2019 Gold Book forecast released Thursday, which projects a cumulative electric load growth of 0.05% from 2019 to 2039, compared with the 0.03% growth from last year’s forecast. The baseline summer peak demand forecast growth rate was relatively unchanged between forecasts.

The new report presents load and capacity data for 2019-2029 and energy and peak forecasts through 2039 on a zonal basis and through 2049 on a system basis.

The baseline forecasts show the expected New York Control Area (NYCA) load, including the impacts of energy efficiency programs, building codes and standards, distributed energy resources, and behind-the-meter energy storage and solar PV.

The topline forecast, formerly referred to as econometric, shows what the expected NYCA load would be if not for these impacts, with the listed impacts added back into the baseline forecast. Both the baseline and the topline forecasts include the expected impacts of EV usage.

Load Reduction

Significant load-reducing impacts occur because of energy efficiency initiatives and the growth of distributed BTM resources. Much of the impact is attributed to the state’s energy policies and programs, including the Clean Energy Standard (CES), the Clean Energy Fund (CEF), the NY-SUN program, the energy storage initiative and other programs developed as part of the Reforming the Energy Vision (REV) proceedings.

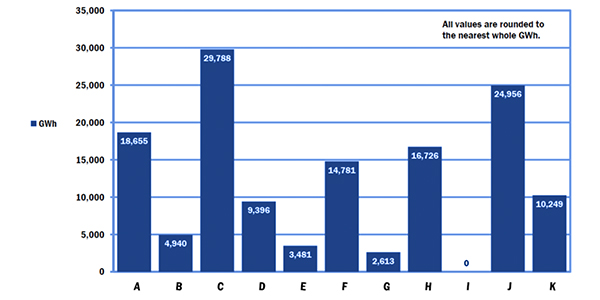

NYISO staff employ a multistage process to develop load forecasts for each of the 11 zones within the NYCA. In the first stage, baseline energy and peak models are based on projections of end-use intensities and economic variables. End-use intensities specific to New York are estimated from appliance saturation and efficiency levels in both the residential and commercial sectors.

Since last April, net summer capability has increased 228 MW to 39,294 MW, reflecting 744 MW of new additions, against 373 MW of deactivations and 143 MW in decreased ratings.

Total summer 2019 resource capability in the NYCA is 42,056 MW, a decrease of 201 MW compared to the same assessment last year. The ISO credits the decrease to changes in existing NYCA generating capability, special case resources (SCRs) for demand response and net purchases of capacity from other control areas.

Total resource capability for the year includes generating capability of 39,295 MW; SCRs at 1,309 MW, up from 1,219 MW last year; and net long-term purchases and sales with neighboring control areas at 1,452 MW, down from 1,625 MW last year.

The existing NYCA generating capability includes renewable resources totaling 6,351 MW, down from 6,373 MW last year; wind generation unchanged at 1,739 MW; hydropower virtually unchanged at 4,253 MW; large-scale PV unchanged at 32 MW; and other renewable resources down to 327 MW from 350 MW in 2018.

Beyond 2019, NYCA resource capability will be affected by additions of new generation, re-rates of currently operating units and the deactivation of existing generators, the ISO says.

Transmission Updates

The new report lists existing NYCA transmission facilities 115 kV and larger, including several new ones that came into service since the publication of the 2018 Gold Book. It also shows proposed transmission facilities, including merchant projects as well as firm and non-firm projects submitted by each transmission owner.

In 2017, NYISO’s Board of Directors selected the NextEra Energy Transmission New York’s Empire State Line proposal to satisfy the Western New York public policy transmission need, with an expected in-service date of June 2022.

The board last week selected two 345-kV transmission projects intended to address persistent transmission congestion in New York and foster delivery of renewable energy to the state’s population centers. (See NYISO Board Selects 2 AC Public Policy Tx Projects.)

The projects — part of the broader AC Public Policy Transmission Project — address transmission capacity at the Central East (Segment A) electrical interface and Upstate New York/Southeast New York (UPNY/SENY or Segment B) interface.

While both projects are expected to be in service in December 2023, neither are included in the draft Gold Book, which lists only projects confirmed by March 15. Future Gold Books will include the newly selected public policy transmission projects, the ISO says.

The ISO is taking stakeholder comments on the Gold Book at stakeholder_services@nyiso.com through April 17.