By Michael Kuser

RENSSELAER, N.Y. — NYISO stakeholders learned Thursday that pricing carbon into the wholesale energy market would have little effect on corporate credit rules and that any necessary changes will only be discussed after a second-quarter vote on market design and Tariff revisions.

ISO Manager of Corporate Credit Sheri Prevratil told the Market Issues Working Group (MIWG) that, based on the current market design, the only potential change might be to adjust the projected true-up exposure timing of transaction settlements to reflect the true-up timing of emission charges.

“Currently, that particular [timing] requirement is triggered off only the four-month true-up as a percentage of the initial invoice,” Prevratil said. “Depending on the timing of when those carbon true-ups come in, it may impact [that] and we might have to make a change on the trigger to the final bill closeout as it relates to the initial or formal settlement.

“But that’s the only one that right now I see might have to change as a credit rule,” Prevratil said.

If necessary, such rule changes would likely have to go through the ISO’s Billing, Credit and Accounting Working Group, and potential credit rule changes would not delay implementation plans for carbon pricing, she said.

New York’s Implementing Public Policy Task Force (IPPTF) in December turned its carbon pricing proposal over to the ISO’s stakeholder process through the MIWG, which began its work in January. (See Imports/Exports Top Talk at NYISO Carbon Pricing Kick-off.)

Energy Credit Components

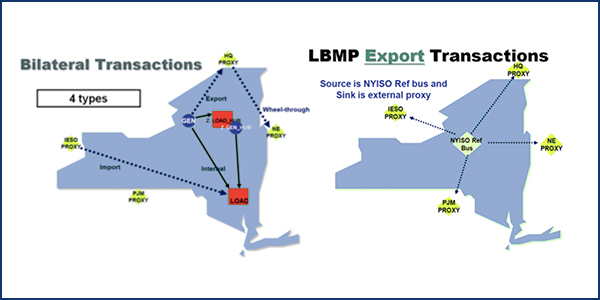

NYISO will also evaluate potential adjustments in the external transactions component to account for carbon charges on imports and carbon payments on exports.

“Currently, we do anticipate that that carbon charge or carbon payment will just be a part of the daily net gains and losses, part of those calculations, and just summed up daily as the daily bill finalizes,” Prevratil said. “Carbon pricing will net in the daily advisory bill and will therefore net against daily energy purchases or sales in the Energy and Ancillary Services credit calculation.”

At the previous MIWG meeting, market participants expressed concern about a gross carbon charge that would be netted against the residuals in net cost, and that the resulting net amount would be further netted with all the other energy and ancillary services numbers that go into that calculation, she said.

The intent of the second part of the calculation is to capture changes, Prevratil said. “For example, we’re in a polar vortex right now. … If that run rate on average exceeds what we’re already holding, then you’re going to get a collateral call and it will be due two business days later. That will continue, but that’s a rolling 10-day run rate, so once those charges go down, then it will fall back to the first part of the calculation.

“We don’t anticipate changing the methodology of this,” Prevratil said.

The energy and ancillary services credit requirement equals the higher of the following:

The highest month’s price adjusted energy purchases in the prior equivalent capability period divided by the number of days in that month, multiplied by 16 days; or

The total average daily energy purchases incurred over the last 10 days, multiplied by 16 days.

New Tariff Sections

Pricing carbon into the wholesale energy market would require new Tariff sections related to applying a carbon charge, defining the social cost of carbon (SCC) and allocating carbon residuals, Ethan D. Avallone, senior energy market design specialist, told the MIWG.

NYISO’s Market Administration and Control Area Services Tariff (MST) would also require revisions to other sections, and subsequent Tariff presentations, including redline Tariff sheets, will build on the one considered at Thursday’s meeting, Avallone said. (See NYISO Looks at Carbon Charge Tariff Impacts, Residuals.)

As an example, Avallone pointed out, MST sections 7.2 and 7.4 would need to address emissions data reporting; section 17 would address the carbon component of the locational-based marginal price (LBMPc); section 23.3 would cover emission rates and reference levels under a carbon charge; and section 26 would cover any potential credit rule changes. NYISO will address those details when credit discussions begin this fall after approval of the carbon pricing market design.

Stakeholders asked what would happen to the ISO’s carbon pricing scheme if New York were to implement a carbon tax.

“We will follow what’s in the budget bill, and we will evaluate how it impacts NYISO’s efforts,” said James Sweeney, a senior attorney at the ISO. “We will make efforts in the Tariff such that entities don’t pay twice for carbon. How exactly it would be done is yet to be determined.”

The ISO foresees no revisions to MST sections 4.2 and 4.5, which describe day-ahead and real-time energy settlements, respectively, nor to guarantee payments such as bid production cost guarantees (BPCG), day-ahead margin assurance payments (DAMAP) and import curtailment guarantee payments.

NYISO’s current guarantee payment practices will continue under carbon pricing, Avallone said.

He emphasized that the ISO will charge each supplier on carbon emissions resulting from actual energy flows.

For example, NYISO will charge each supplier scheduling imports or pay each supplier scheduling exports the LBMPc at the relevant proxy generator bus, but the supplier will not be subject to a carbon charge or payment if the transaction fails in the ISO’s checkout process or is curtailed at the ISO’s request.

The latest NYISO schedule on carbon pricing calls for discussing LBMPc calculation and identifying marginal units on Feb. 15; Tariff revisions on Feb. 28 and March 18; and carbon bid adjustment for opportunity cost resources on March 4.