By Hudson Sangree

Concern about the ripple effects of Pacific Gas and Electric’s financial meltdown had already spread last week as CAISO addressed worries about the utility’s potential to default on its payments to the ISO, and a solar farm owned by Warren Buffett’s Berkshire Hathaway saw its credit rating cut to junk status because of its dependence on PG&E.

Those worries will grow after PG&E announced Monday it would file for Chapter 11 bankruptcy protection by Jan. 29 because it faces $30 billion in liability for the catastrophic wildfires of 2017 and 2018. (See related story, PG&E Says It Will File Bankruptcy, as CEO Steps Down.)

On Friday, CAISO issued a market notice aimed at easing concerns about how PG&E’s problems could affect the ISO and its participants.

“The California ISO has received inquiries relating to the financial status of Pacific Gas & Electric Co. in light of recent media reports,” the notice said. “The ISO wants to assure market participants that PG&E has posted collateral with the ISO to cover its outstanding and upcoming obligations.”

Should PG&E default, however, the ISO’s other members would have to pick up the tab. CAISO rules require each market participant to cover default losses “in proportion to the benefits it receives from its activity” in the market. When GreenHat Energy spectacularly defaulted in June in PJM’s financial transmission rights market, other members were angry that they had to cover tens of millions of dollars in payments. (See Greenhat FTR Default a ‘Pig’s Ear’ for PJM Members.)

GreenHat was a relatively small player in PJM, whereas PG&E, California’s largest utility, is a huge part of CAISO. The total volume of energy delivered in CAISO in 2017 was 228,191 GWh, according to the ISO’s annual Market Issues and Performance Report. PG&E’s total deliveries that year were 82,226 GWh, the utility said in its Annual Report to Shareholders.

Bankruptcy Imminent

The question of PG&E’s default isn’t academic. The company’s circumstances have been quickly worsening, raising questions about its ability to continue making ISO payments.

Hours before Monday’s bankruptcy announcement, PG&E said CEO Geisha Williams was stepping down amid the growing turmoil.

Both Moody’s Investors Service and S&P Global Ratings cut PG&E’s credit rating to “junk status” last week, citing the utility’s financial exposure for two years of massive, deadly wildfires along with the waning will of politicians to bail out the state’s largest utility. (See PG&E Stock Plunges, Credit Downgraded to ‘Junk’ Status.)

“The downgrade reflected our assessment of a weakening of the company’s governance, the souring political environment that we expect will lead to a weakening of the regulatory construct, what we see as the company’s limited capital market access, and the possibility of a voluntary bankruptcy filing given the immense pressures and uncertainties still facing the company,” S&P said in an update posted on its website Friday.

As of Monday afternoon, PG&E had lost about $32 billion, or nearly 78% of its market value, over 15 months starting in October 2017, when 21 major fires swept Northern California’s famed wine country. Those fires killed 44 people and destroyed thousands of homes, including a substantial part of the city of Santa Rosa.

State fire investigators blamed PG&E for at least 17 of those blazes, and its stock price sunk from more than $70/share to about $38/share. For months, the utility’s stock price hovered in the range of $40 to $50/share, then the Camp Fire struck Nov. 8. The deadliest fire in state history killed 86 people and wiped out the town of Paradise in the Sierra Nevada foothills of Butte County.

PG&E’s equipment quickly fell under suspicion after the company reported to the Public Utilities Commission that it had experienced a problem with a transmission line, and that employees saw flames near the Camp Fire’s point of origin on the morning it started.

The company saw its stock price drop to less than $18/share last week as S&P downgraded its credit rating from investment grade to junk status.

News reports, quoting unnamed sources, suggested the utility might be getting ready to file for bankruptcy — or to put its downtown San Francisco headquarters on the market or sell off its gas division.

By Monday afternoon, PG&E shares were selling for about $8 on the New York Stock Exchange.

‘Negative Implications’

The uneasiness about PG&E’s future has started to spread to companies with which it does business

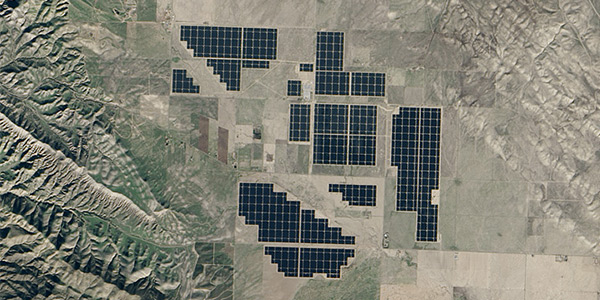

On Friday, S&P slashed the credit rating of the 550-MW Topaz Solar Farms in San Luis Obispo County to junk, citing its reliance on PG&E, with which it has a 25-year sales contract. Topaz is owned by BHE Renewables, a subsidiary of Buffet’s Berkshire Hathaway Energy. The solar farm was completed at a cost of $2.4 billion in 2015.

“Topaz Solar Farms receives all of its revenue from PG&E under a long-term power purchase and sale agreement,” S&P said. “Our rating on the solar project is currently capped by our view of the credit quality of PG&E, its utility offtaker.”

S&P put Topaz on its credit watchlist with “negative implications.”

“The CreditWatch negative listing reflects the increasing risk that we will downgrade PG&E by one or more notches over the next few months. If we lower our ratings on PG&E again, it could lead us to take an equivalent action on our ratings on Topaz Solar Farms.

“If PG&E files for Chapter 11, this could, subject to it being a material adverse effect, trigger a cross default under Topaz Solar’s financing documents unless the power contract is replaced within 90 days of the bankruptcy event,” S&P added.

In a separate post on its website Friday, S&P explained why it had downgraded PG&E’s credit rating from BBB- to B Jan. 7.

“A number of events, over several weeks, contributed to our … multinotch downgrade,” it said.

Immediately after the Camp Fire, it appeared that state lawmakers and regulators would try to keep PG&E afloat to protect ratepayers and to achieve the state’s ambitious renewable portfolio standards, S&P said. A new law, SB 100, requires the state to obtain 60% of its energy from renewable sources by 2030.

But public anger intensified, with protests at PUC hearings and PG&E headquarters. That anger has undermined the will of state regulators and politicians to protect PG&E, S&P said.

An allegation by the PUC in December that PG&E had falsified natural gas safety records made things worse. Politicians who had supported the utility expressed distrust.

On Jan. 4, PG&E issued a press release saying it was planning to shuffle its board of directors and reviewing “structural options,” including in its operations, finances and management. Speculation quickly followed that PG&E might file for bankruptcy.

“It was the totality of these events that led to S&P Global Ratings’ downgrade of PG&E into speculative grade,” the credit rating firm said.