By Rich Heidorn Jr.

The Trump administration’s replacement for the Clean Power Plan is likely to mean limited and localized relief for the coal industry while increasing nuclear retirements and premature deaths, according to EPA and outside analysts.

The Affordable Clean Energy (ACE) rule announced by EPA last week will seek heat-rate efficiency improvements at individual plants, in contrast with the CPP, which set state emissions limits and encouraged switching to natural gas and renewables. (See related story, EPA:CPP Replacement Could Boost Coal-Fired Power by 6%.)

The new plan, which will cover about 600 coal-fired generating units at 300 facilities, also proposes for the coal industry long-sought relief from New Source Review (NSR).

President Trump celebrated the new rule at a campaign rally in Charleston, W.Va., last week, extolling “clean, beautiful West Virginia coal.”

Observers agree the changes will keep some coal plants running longer than they would have under existing law or the CPP.

But few, if any, analysts believe the administration’s proposal will be enough to overcome economic trends and state and local policies favoring natural gas and renewables. Some say EPA is exaggerating the coal plant efficiency improvements likely to result.

“Killing the Clean Power Plan will not bring coal back, because the Clean Power Plan did not kill coal. It’s still economics,” West Virginia University law professor James Van Nostrand told the Charleston Gazette-Mail.

“It’s unfortunate, because I think peoples’ hopes were raised in a cruel way by Trump,” Van Nostrand said. “But I don’t think our politicians have done a service to our citizens either by continuing to blame the EPA, because they know it’s broader forces at issue. They know we need to transition away from coal to other sources.”

EPA’s Regulatory Impact Analysis (RIA) predicted that, assuming a 4.5% average heat rate improvement at $50/kW, coal production for power sector use will be 5.8% higher than under CPP by 2025, rising to 9.5% by 2035. A scenario assuming the same heat rate improvement at a cost of $100/kW would see coal’s use increase 4.5% in 2025, rising to 7.4% in 2035.

But a Brattle Group analysis last week said that EPA’s assumption that coal plants in all states would see heat rate improvements (HRI) of 2 to 4.5% is unlikely.

“Some states will likely adopt lower HRI requirements for many plants and none at all for some plants, since the states have the discretion to set unit-specific emissions standards. In addition, the potential HRIs may be overstated, since they appear to be based to some extent on potential improvements at inefficient plants that have already retired,” Brattle said. “If so, the surviving fleet may have already employed some or most of the BSER [best system of emission reductions] measures and therefore don’t have as much room for improvement.”

An analysis by Resources for the Future released earlier this month said that while EPA’s “at-the-source” enforcement plan would reduce coal units’ emissions per megawatt-hour by 4%, it would result in only a 2.6% cut in national power sector CO2 in 2030 compared to the no-policy scenario. “This modest change is due in part to the emissions rebound effect, with coal generation estimated to be 1.1% higher in 2030 relative to the no-policy reference case … with potential increases in CO2 emissions in eight states.”

New Source Review

EPA proposes to change the NSR rules under the Clean Air Act so that only projects that increase a plant’s hourly rate of pollutant emissions would face a full NSR analysis that could trigger additional pollution controls.

Miles Keogh, executive director of the National Association of Clean Air Agencies, said the NSR change is likely to be most significant in vertically integrated states.

By exempting any projects improving efficiency from NSR, plant operators could extend their units’ lives by five to 10 years rather than being replaced by cleaner generation, Keogh said. “In restructured states, you take your chances in the market earning a return on an upgrade. But where you can rate-base an improvement, you earn a return on the investment,” Keogh tweeted, adding that many state regulators may favor saving coal plants and their jobs.

“Ten years is a big deal. Ten years ago, we had hundreds of coal plants in the pipe, gas was $15/MMBtu, there was one-fifth as much installed wind and no [electric vehicles] on the market.”

Utility Plans

There is no indication that utilities that have announced targets for decarbonizing will change their plans based on the new rule.

In February, American Electric Power, the largestCO2 emitter in the power sector, announced plans to reduce carbon emissions by 60% below 2000 levels by 2030 and 80% by 2050. AEP’s projected CO2 emissions for 2018 are about 90 million metric tons, 46% below 2000. In its 10-K, AEP said its strategy is based on “economics, customer demand, regulations, and grid reliability and resiliency.” Coal currently represents almost half of its generating capacity.

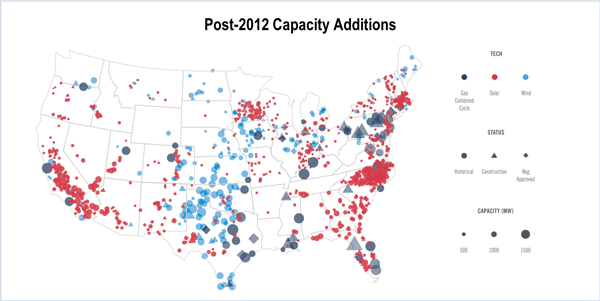

Less than 2 GW of new coal plants were built between 2013 and 2017. In contrast, 60 GW of new combined cycle gas generation was completed, under construction or had cleared regulatory approvals since 2012. Wind added 29 GW and solar added 23 GW over the same period with a combined 12 GW under construction or in post-permitting development. | Bipartisan Policy Center

Duke Energy, the No. 2 carbon emitter among generators, has said it hopes to cut its coal- and oil-fired power generation to 16% by 2030, from 33% in 2017. Coal and oil accounted for 61% in 2005.

No. 3 emitter Southern Co. has reduced coal’s share to 28% in 2017 from more than 70% in 2005.

The Edison Electric Institute was noncommittal on the plan, saying in a statement that it was still evaluating it.

Impact on Nuclear

The new plan could also undermine the Trump administration’s efforts to prolong the lives of at-risk nuclear plants because it doesn’t provide emission-reduction credits to low-CO2resources, Brattle said. “Unlike CPP, the ACE rule does not provide a mechanism (either through credits or higher energy prices) to benefit any low-CO2generation technologies, including nuclear, natural gas and renewables. This may result in greater risks for nuclear retirements and contradict the administration’s efforts to prevent retirements of ‘fuel secure’ baseload plants including nuclear.”

EPA’s RIA projects ACE will result in an additional 5,000 MW of nuclear retirements by 2030 compared with the CPP.

The Nuclear Energy Institute was noticeably silent on the proposal last week, issuing no statements. NEI declined RTO Insider’s request for comment on Monday.

Cost Claims and Trading

Brattle also questioned EPA’s claim that ACE could reduce compliance costs versus the CPP by up to $6.4 billion, saying it is based on inconsistent assumptions about the cost of heat rate improvements. “Under consistent assumptions for cost of HRIs ($100/kW), EPA’s analysis shows the compliance cost under ACE would be $1.7 billion to $3.0 billion higher than the costs under CPP. This somewhat counterintuitive result is likely due to the ability under CPP to trade emissions allowances through emission-reduction measures (such as dispatch switching) that are less expensive than implementing HRIs at $100/kW.”

ClearView Energy Partners analyst Christi Tezak told clients last week that the EPA proposal “appears to strongly disfavor compliance through trading beyond averaging emissions between units located at the same plant.”

At a press briefing last week, Assistant EPA Administrator Bill Wehrum acknowledged a “tension” between the Trump administration’s interpretation of its authority under the Clean Air Act and its desire to limit compliance costs. Wehrum acknowledged that trading programs, such as the acid rain program, can be more cost effective and “more effective over all.”

“We believe that BSER should be focused on emission controls and measures that can be implemented at the plant or applied to the plant. We … think certain aspects of the CPP, like consideration of how electricity grids are managed and how the various power plants are dispatched into the grid … goes beyond our authority and states’ authority.”

Wehrum said the agency is seeking comments on “how we could actually allow [trading] to be implemented in a way that’s consistent with what we think BSER needs to be. We’re really looking forward to getting public comment to help us think through that question.”

Health Impacts

EPA’s RIA predicts ACE will result in 400 to 1,400 additional premature deaths annually from fine particulate matter (PM) by 2030 compared with the CPP.

Wehrum was unapologetic about the impact, saying ACE is an effort to reduce greenhouse gases, not other pollutants.

“We care very much about the amount of pollution that’s emitted in the country and power plants are a significant source of certain types of air pollution. We’re the Environmental Protection Agency. This is what we do.

“We’re not dealing with SO2. We’re not dealing with NOX. We’re not dealing with particulate matter,” he said. “We have abundant legal authority to deal with those other pollutants directly, and we have very aggressive programs in place that directly target emissions of those pollutants. So our view is, if we want to regulate PM, we regulate PM straight up. If we want to regulate SO2, we regulate SO2straight up.”

Legal Challenges

ACE, like the CPP, will make only small reductions in carbon emissions over those expected based on current trends. But it is unlikely to be rejected by the courts, according to Tezak, who said EPA could finalize the rule in the first half of next year, setting up court reviews likely to continue into 2020.

“Critics of ACE may have difficulty proving, as a legal matter, that the rule guarantees [nationwide emissions increases],” Tezak said, noting that cheap natural gas and state policy preferences for renewables and nuclear energy “seem likely to deliver emissions reductions in line with ACE targets. It may be hard to argue that ACE is a failure if emissions continue declining.

“The D.C. Circuit [Court of Appeals] may agree with the new plan’s opponents that climate change is a problem that demands a response from policymakers, but we are not yet convinced that the courts will direct EPA to stretch interpretation of the existing statute when the agency declines to do so,” she said. “This matters. Even if voters elect a new president in 2020, should federal courts uphold ACE, it may take Congress (rather than a regulatory pendulum swing by a greener president) to replace or otherwise strengthen the rule.”

Tezak said EPA may revise ACE’s proposal to extend the implementation period, however. States will have three years from the date of the final rule to submit their plans for EPA approval, compared with nine months under the CPP. EPA will have 12 months to approve or reject state plans, up from four months under CPP. For states that fail to submit an approvable plan, EPA will have two years to develop its own plan, up from six months.

“Under this scenario, a state could be without an enforceable carbon limit program for coal-fired units as late as five years after ACE finalization,” Tezak said.