By Rich Heidorn Jr.

January’s cold weather resulted in a sharp increase in natural gas and power prices in the first quarter, PJM’s Independent Market Monitor reported last week.

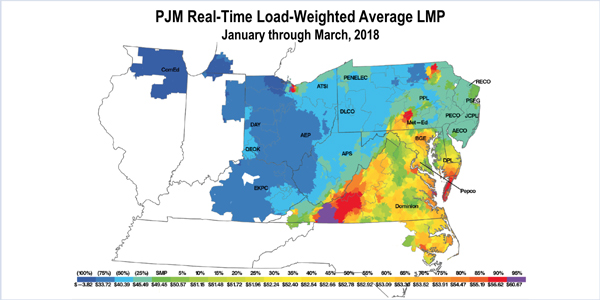

The load-weighted average real-time LMP rose to $49.45/MWh in the first three months of 2018, a 63% jump from the $30.28/MWh seen a year earlier, according to the Monitor’s quarterly State of the Market report. The increase reflected a nearly 136% jump in eastern natural gas prices versus the first quarter of 2017.

Other metrics saw even bigger jumps, including energy uplift charges (up $57.7 million, 227%) and congestion costs (up $503 million, 318%).

Revenues from auction revenue rights and financial transmission rights offset less than 62% of total congestion costs for the first 10 months of the 2017/18 planning period, the first in which new rules required the allocation of balancing congestion to load instead of FTR holders. ARR and FTR revenues had offset 98% of load’s congestion costs during the 2016/2017 planning period.

It was a good quarter for generators, as measured by net revenue. All types of generation saw higher margins, including combustion turbines (+324%); combined cycle (+61%); coal (+650%); nuclear (+70%); wind (+43%); and solar (+57%).

The Monitor made seven new recommendations in the first-quarter report:

Energy Market

- Change the Tariff to allow generators to have fuel-cost policies that do not include fuel procurement practices, including fuel contracts. “Fuel procurement practices, including fuel contracts, may be used as the basis for fuel-cost policies but should not be required,” the Monitor said. (Priority: Low.)

- PJM should change the fuel-cost policy requirement to apply only to units that will be offered with non-zero cost-based offers. The RTO should set to zero the cost-based offers of units without an approved fuel-cost policy. (Priority: Low.)

Energy Uplift

- Uplift should only be paid based on operating parameters that reflect the flexibility of the benchmark new entrant unit in the capacity market. (Priority: High.)

- PJM should eliminate the use of intraday segments to define eligibility for uplift payments and return to evaluating the need for uplift on a daily, 24-hour basis. (Priority: High.)

- PJM should pay uplift based on the offer at the lower of the actual unit output or the dispatch signal. (Priority: Medium.)

- PJM should implement a metric to define when a unit is following dispatch to determine eligibility to receive balancing operating reserve credits. (Priority: Medium.)

FTRs/ARRs

- All congestion revenue in excess of FTR target allocations should be distributed to ARR holders on a monthly basis. (Priority: High.)