By Rory D. Sweeney

The closure of four nuclear plants in Pennsylvania and Ohio would result in substantial increases in electricity bills and carbon dioxide emissions, among other air pollutants, while cutting jobs and economic productivity, according to a Brattle Group report released on Monday.

The report, commissioned by Nuclear Matters, a bipartisan pro-nuclear advocacy group, focuses on the Three Mile Island unit Exelon said last year it will close and the three plants FirstEnergy Solutions announced on March 28 it was closing: Davis-Besse and Perry in Ohio and Beaver Valley in Pennsylvania. (See FES Seeks Bankruptcy, DOE Emergency Order.)

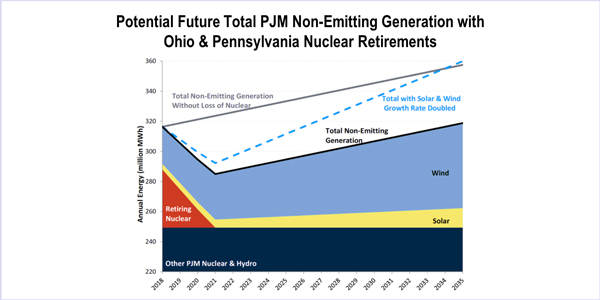

The closures would trigger price increases of up to $2.43/MWh for Ohioans and $1.77/MWh for Pennsylvanians and eliminate the environmental benefit of all the zero-emissions generation installed in PJM over the past 25 years, according to the report. The four plants’ 4,745 MW generated 38.7 MWh of electricity in 2017, surpassing the 35 million MWh generated by wind, solar, and hydro resources in PJM, the report concluded. It would take 14 years for zero-emissions generation to recover to its 2017 level, Brattle said.

“This means that the retirement of these four nuclear generators would more than undo the entire emissions benefits of all renewable generation investments made to date throughout the PJM region,” the report concluded.

Matching the emissions-free output expected in PJM at the current pace would require another two years and doubling the current growth of generation from renewables to 4.8 million MWh annually. Attempting to replace the environmental benefits of the four nuclear plants with renewables could cost around $2 billion annually, based on the Energy Information Administration’s (EIA) national average renewable cost estimates and would not stop the lost capacity from the nuclear closures being replaced by fossil-fuel generation. “We estimate that about 72% of the replacement would come from gas-fired generation and 28% from coal,” the report said.

“Following [nuclear plant] Vermont Yankee’s shuttering in New England, we saw devastating effects. The loss of tax revenues forced local officials to make major budget concessions to the detriment of their residents, including cutting their municipal budget by 20%, drastically reducing police services, and raising their property taxes by 20%,” said Judd Gregg, a Nuclear Matters Advocacy Council member and former Republican senator from New Hampshire. “In the year following the closure, carbon emissions increased by 2.5% due to nuclear energy being replaced by emission-producing sources.”

Annual CO2 emissions would increase by more than 20 million metric tons if the plants closed and could create potential social costs of more than $900 million per year. It also would increase annual emissions of air pollutants such as sulfur dioxide, nitrous oxide, and criteria particulate pollutants by tens of thousands of tons, with potential social costs of $170 million per year.

Electricity bills would increase by $400 million for Ohio residents, $285 million for Pennsylvanians, and $1.5 billion across PJM annually, according to the report, due to increased clearing prices in the capacity and energy markets. At least 3,000 jobs would be “at risk” without including indirect jobs at the plants, and the closures would eliminate tens of millions of dollars in local tax revenues.

Other Voices

David Lochbaum, a nuclear safety engineer with the Union of Concerned Scientists, questioned the study’s economic conclusions, telling the Cleveland Plain Dealer that other plant closures have not led to economic disasters. “The unemployment in the other states is not rampant, despite the permanently shut down reactors. The price of electricity in the other states is not exorbitant, despite the permanently shut down reactors,” he said.

“So, why does Nuclear Matters believe the folks in Ohio and Pennsylvania cannot figure out what folks in other states have figured out?” Lochbaum asked.

Meanwhile, the American Petroleum Institute (API) sent President Trump a letter Friday, urging him to reject FirstEnergy’s request for an emergency order to save the nuclear plants. (See Perry Hints DOE Won’t Grant FES ‘Emergency’ Request.)

“The natural gas industry and the shale revolution are poster children for letting the markets work,” API President Jack Gerard said. “The energy abundance wrought by the shale gas revolution is a prime example of competition at work.”

Gerard said government intervention would jeopardize the “economic benefits delivered to consumers” by natural gas.

[EDITOR’s NOTE: Due to an editing error, an earlier version of this article mischaracterized API position on the FirstEnergy request.]