MISO last week said it has concluded that a short-term capacity reserve product would be cost-effective and beneficial to reliability.

An evaluation paper released last month said the product would “strengthen MISO’s vision for reliable and economically efficient markets.”

MISO Market Design Advisor Bill Peters told an April 12 Market Subcommittee meeting that the RTO plans to design a market product that can provide capacity within 30 minutes on the recommendation of the Independent Market Monitor, who last year said a local reserve product could provide voltage support, local reliability and subregional capacity. (See MISO Board Hears State of the Market Recommendations.)

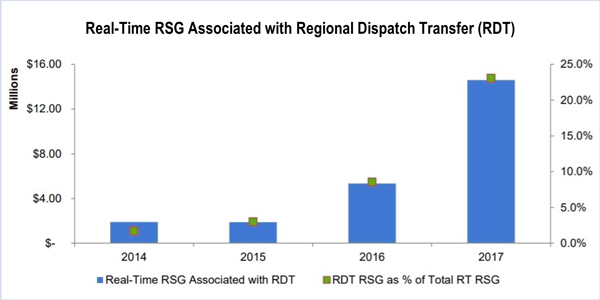

Last year the RTO incurred about $35 million in revenue sufficiency guarantee payments to cover load pocket needs and regional dispatch transfers over its contract path on SPP transmission from MISO Midwest to MISO South. The annual amount was “much more in some previous years,” MISO said.

The RTO currently makes “inefficient, out-of-market commitments to address operational needs” in both load pockets and regional areas, Peters said.

Staff have said that a short-term capacity reserve would be especially helpful in South, which has less than 500 MW of offline capacity available within 30 minutes. West of the Atchafalaya Basin (WOTAB) has 100 MW of 30-minute reserves, while Amite South has none. (See MISO Researching 30-Minute Reserves, Multiday Commitments.)

Peters said MISO envisions the short-term capacity reserves as an ancillary service to be deployed in late 2019. The RTO will now move into a conceptual design phase.

Minnesota Public Utilities Commission staff member Hwikwon Ham asked how MISO arrived at the requirement that the reserve product must be delivered within 30 minutes rather than another length of time.

“Some of the needs, particularly the [regional dispatch transfer] constraint, are 30 minutes,” Peters replied.

Northern Indiana Public Service Co.’s Bill SeDoris asked if the cost of maintaining a reserve product would be shared footprint-wide.

Peters said MISO is considering employing a “nesting” approach for the product in which load needs are determined by specific demands on load pockets.

“I’m just concerned that the entire footprint could be responsible for what are very localized problems,” SeDoris said.

Peters said MISO must still iron out numerous details of a new reserve product, including determining how the service would interact with other existing ancillary services, creating scarcity pricing and demand curves for the new reserves, and identifying how commitment would be justified in settlements.

MISO Manages Chilly February

MISO reported a 76-GW average load during February, down from the average 83 GW in January as winter wound down across the footprint.

Average prices likewise decreased month over month from $41.75/MWh to $25.05/MWh in the day-ahead market and $39.68/MWh to $25.36/MWh in the real-time. Systemwide energy prices in February were “kept flat” with the help of natural gas prices below $3/MMBtu. Average Henry Hub gas prices were $2.64/MMBtu.

Load peaked for the month at 94.6 GW on Feb. 8, 7.5 GW above the previous February’s peak load of 87.1 GW. MISO said average monthly temperatures were lower than the prior two years but higher than in February 2015.

— Amanda Durish Cook