By Michael Kuser

New York stakeholders on Monday wrestled with the complex issue of how to evaluate the impact of a carbon charge on the dispatch of energy resources — especially in neighboring regions.

It was part of an ongoing effort by the Integrating Public Policy Task Force (IPPTF) to determine how to price carbon emissions into NYISO’s wholesale electricity market.

The group, a joint effort between NYISO and the state’s Department of Public Service, also discussed a method for calculating marginal emission rates, the allocation of carbon revenues and the effect of carbon pricing on customer bills — all part of “Track 5” of the carbon pricing initiative.

The group also touched on issues related to “Track 4,” which covers the interaction of carbon pricing with other state and regional programs, such as the renewable energy credit and zero-emissions credit programs, as well as the Regional Greenhouse Gas Initiative.

Assumptions and Metrics

“We are interested in looking at not just the financial impacts but also at what happens to emissions,” said task force co-chair Nicole Bouchez, NYISO market design specialist.

“How do we assume the cases?” Bouchez asked. “Do we assume there’s a change in RGGI or not? In realization that we’re not going to be able to run dozens of permutations, what are the key assumptions?”

If the group “ends up modeling emissions in neighboring regions, for example in Ontario, which trades with MISO, then you have to model all of MISO’s resources,” she said. “While Ontario may look like a low-carbon import … if all it’s doing is causing MISO coal use to go up, then not so much.”

Marc Montalvo, representing the DPS Utility Intervention Unit, said, “If we’re designing a policy and implementation, if success is highly dependent on having perfect or near-perfect information about our neighbors’ emissions rates and those kinds of things, then it’s probably not a good policy in the first instance.”

Bouchez said the group’s May 7 and 21 meetings would focus “on how to structure the analysis, what questions, what metrics we’ll be reporting, etc.”

Defining Impacts

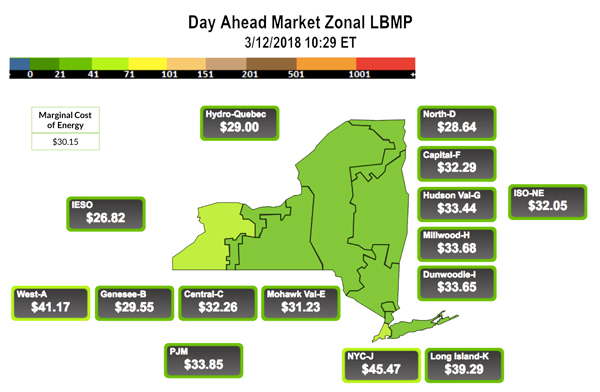

During a discussion of the impact of carbon pricing on consumer costs, Bouchez said the ISO’s locational-based marginal pricing (LBMP) represents “only the beginning of impacts on consumers because we’re also going to be looking at the return of these residuals associated with a carbon charge to consumers, so you can’t just look at the LBMP increase on its own.” The “residuals” refer to leftover money refunded to load under a carbon pricing scheme.

Representing a coalition of large industrial, commercial and institutional energy users, Couch White attorney Michael Mager said his clients were seeking “two big things” from the impact analyses. First, “a thorough, unbiased analysis” of the impacts on market prices and what consumers are paying.

“And the second piece is, what are the emission reductions, if any, that reasonably could be anticipated if this were to be done,” Mager said.

New York could see some really material carbon reductions if it starts retiring unused RGGI allowances, he said.

“On the other hand, if nothing is being done to RGGI whatsoever, and it’s just going to simply reduce the price of allowances that are going to be then used up by other states such that there’s little to no reduction in carbon throughout the RGGI region, then this whole effort strikes us as somewhat symbolic and not getting much for any price impacts,” he said.

Howard Fromer of PSEG Power New York asked, “Consumer impacts compared to what?

“And the what is not identified here,” Fromer said. “Obviously, the what, in my mind, has to include the fact that New York state right now is already spending and writing checks on a monthly basis and potentially, over the period that we’re talking about, could be spending billions of dollars.”

Fromer said that, aside from considering dispatch issues, the task force process also needs to consider the impact of a carbon charge on price signals, demand response and investment in the state’s 40,000-MW generation fleet.

No Pot of Money

Stakeholders asked how the trend of increasing electrification — in the transportation sector, for example — should affect pricing carbon into the wholesale market.

Bouchez said many experts have told her the price of electricity has very little to do with electrification.

Bob Wyman of Dandelion Energy countered that electricity prices definitely affect consumer choices in New York City, where Consolidated Edison learned that city residents who install heat pumps use them for air conditioning but simply turn them off in winter because of high electricity prices for heating.

“Whether this approach is complementary or designed to supplant the mandated programs [such as the state’s Clean Energy Standard] … to the extent that you are supplementing the existing programs, the issue is always about what are the incremental benefits, does it affect dispatch, new investment, how are the effects by zones, and you have to address those transition overlap and windfall revenue questions as part of the impact analysis,” said James Brew of Nucor Steel Auburn.

He said New York is relatively unique in trying to pursue both mandated and market programs, which means any analysis has to examine how the two programs interact.

David Clarke, director of wholesale market policy at the Long Island Power Authority, said carbon revenue collections within RGGI states would be a useful metric for examining the cost of abatement.

“I know we’re going to be looking at how much folks are paying for carbon allowances within New York as kind of the pot of money that we’re going to be splitting, but it would also be useful, depending on what scenario you are running, to find out what folks are collecting in terms of RGGI revenues within the other RGGI states,” Clarke said.

“There will be no pot of money,” Bouchez said. “I’ve been talking about them as residuals, which is how NYISO sees them, residuals being the difference between what we collect and what we pay out. How you allocate that within the wholesale settlements is a question. Do you give it back on a per-megawatt-hour basis? Do you give it back based on the impact of the increase in the LBMP?”

Warren Myers, DPS chief of regulatory economics, said that the joint staff are “nowhere near having an answer” on how to integrate multiple analyses into something useful but that “the work would get done by rolling up our sleeves” over the next few months.

The task force will next meet on March 19 to discuss Track 5 at NYISO headquarters.