ERCOT on Monday released the results of planning studies under new reliability-must-run rules approved by the Board of Directors last week, confirming that Greens Bayou is still needed to support reliability in the Houston area until the new 1,100-MW, gas-fired combined cycle Colorado Bend Generating Station becomes operational in July.

The ISO also determined that removing Calpine’s 344-MW Clear Lake cogeneration facility from the system will not cause reliability concerns under the new rules, which went into effect the day after the board meeting.

The board approved three rule changes intended to improve ERCOT’s management of its RMR processes. Two of the nodal protocol revision requests (NPRRs 793 and 795) were included in the board’s consent agenda. The third, NPRR788, was unanimously approved in a separate vote after receiving four opposing votes from the investor-owned utility sector. (See “Stakeholders Send Three RMR Revisions to ERCOT Board,” ERCOT Technical Advisory Committee Briefs.)

NPRR788 requires ERCOT’s RMR planning studies to include forecasted peak loads and that a potential RMR unit must have “a meaningful impact on the expected transmission overload” to be considered for an agreement.

At last week’s board meeting, Jeff Billo, ERCOT’s senior transmission planning manager, quantified “meaningful impact” as the unloading effect a potential RMR unit would have on the transmission constraint. The unit would also need a shift factor of at least 2% and an unloading factor of at least 5% on the constraint.

“I recognize we need to make improvements in the contract analysis surrounding RMR agreements,” said American Electric Power’s Wade Smith, whose company opposed the Technical Advisory Committee’s endorsement of the NPRR. “We need to continue to work on our planning and … build transmission solutions quickly.”

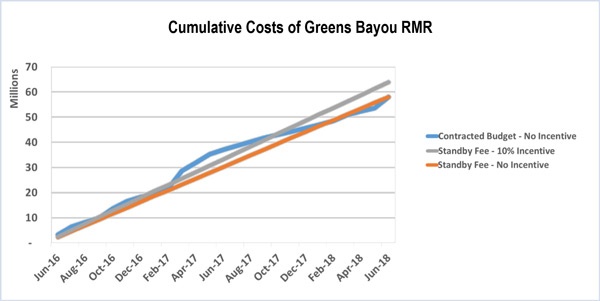

Beth Garza, director of ERCOT’s Independent Market Monitor, pegged Greens Bayou’s contract — projected to cost the market $63.9 million over the course of its 25 months — as equivalent to almost 18 hours of firm load shed in the Houston area, assuming a $9,000/MWh cost of load curtailment.

“If I drive a $10,000 car, it’s ridiculous for me to pay $10,000 in premiums for the full replacement of that car,” Garza said. “Frankly, I believe the decision we made on this RMR unit is to pay the full replacement cost — the full value of the potential risk of load shed — for this unit.”

Garza noted that the Public Utility Commission of Texas has opened an RMR-related rulemaking that offers guidelines mitigating involuntary load curtailment (45927). The PUC will hold a public hearing on the issue Nov. 30.

“So things are ripe for discussion at the commission and ERCOT,” she said.

Board Approves West Texas Tx Projects

The board approved a pair of transmission projects addressing reliability concerns in West Texas resulting from load growth in the Permian Basin oil fields. The Texas-New Mexico Power rebuild of 69-kV facilities to 138 kV is projected to cost $50.6 million, while the AEP-Oncor 54-mile, 138-kV line is estimated to cost $77 million. The latter project passed with one abstention.

Luminant, TXU Energy Provisions OK’d

The board also unanimously approved staff’s acceptance of Texas Competitive Electric Holdings’ (TCEH) request that its Luminant and TXU Energy companies not be recognized as affiliates of any ERCOT member companies. The vote clears the way for the subsidiaries to seek a corporate membership in the ISO’s independent generator segment and an associate membership in the independent retail electric provider segment, respectively, replacing their prior memberships.

TCEH recently emerged from bankruptcy as a tax-free spinoff. It is composed of Luminant and TXU Energy. (See Luminant, TXU Energy Emerge from Bankruptcy.)

Bermudez Resignation Leads to Revotes

Jorge Bermudez, who resigned as an unaffiliated member of the board two weeks ago, made his presence felt with his absence. (See “ERCOT’s Bermudez Resigns from Board Position,” ERCOT Briefs.)

Because ERCOT’s legal staff determined Bermudez’s recent marriage made him ineligible to be on the board before its Aug. 9 meeting, the directors were forced to vote again on three items he moved in that meeting: the consent agenda and two proposals related to the ISO’s 401(k) plan.

Bermudez’s tenure will be celebrated during December’s annual meeting, when all directors leaving the board are honored for their service.

Board Approves 14 NPRRs, Other Changes

The board unanimously approved NPRR760, which received opposing votes from American Electric Power and Luminant last month and abstentions from CenterPoint Energy and Sharyland Utilities. The change ensures that operating days with no activity are captured in the calculation of credit variables.

The consent agenda included 13 additional NPRRs, three revisions to the Planning Guide (PGRRs) and a revision to the Retail Market Guide (RMGRR).

- NPRR755: Allows an entity to register as a data-agent-only qualified scheduling entity (QSE) to connect to ERCOT’s wide area network (WAN) as an agent for another QSE, without meeting applicable collateral and capitalization requirements.

- NPRR769: Clarifies the alternative-dispute resolution process to note the proceeding is the next level of appeal following ERCOT’s denial of verifiable costs. Also clarifies the confidentiality of data submitted in connection with a verifiable-cost appeal.

- NPRR775: Strengthens the limits on fast responding regulation service (FRRS) to address future operational issues. A previous revision request (NPRR581) added limits of 65 MW to FRRS up and 35 MW to FRRS down but lacked implementation details regarding self-arrangements in the day-ahead market and restrictions on providing the service in real time without a day-ahead award.

- NPRR778: Changes competitive retailer rules regarding move-in or move-out date changes to prevent inadvertent errors. The change should eliminate two-thirds of manual interventions currently required.

- NPRR779 and PGRR048: Clarifies references to the Texas Reliability Entity (Texas RE) and the Market Monitor. Current protocols refer to the Texas RE in both its capacity as the Regional Entity and the Public Utility Commission of Texas Reliability Monitor. The NPRR also removes the 24-hour deadline for ERCOT to notify the reliability monitor of a failure to provide ancillary services. The new language clarifies that the Market Monitor is an included party in several provisions related to the ERCOT stakeholder process.

- NPRR781: Addresses the market’s growing use of advanced metering systems (AMS) by updating protocol language to clarify purpose and definitions, update processes and methodologies and remove outdated ones.

- NPRR782: Removes inconsistencies in protocol language by changing the equations governing the settlement of ancillary services. The change affects resources unable to deliver on their ancillary service obligations because of transmission constraints.

- NPRR785: Allows ERCOT to automatically prepopulate current operating plans (COP) for wind and photovoltaic resources with the most recent forecast for the next 168 hours. QSEs representing these resources can either submit the prepopulated forecast as the COP by default or submit a lower number.

- NPRR786: Corrects the allocation of transmission losses, distribution losses and unaccounted-for energy (UFE) so that negative loads do not result in the loss of UFE allocations.

- NPRR787: Removes the requirement that the QSE receiving a verbal-dispatch instruction confirmation include the name of the individual that received the confirmation within the electronic acknowledgement.

- NPRR789: Requires ERCOT to publish all its midterm load forecasts for market participants and note which one is currently being used by operations. The ISO currently publishes several forecasts per weather zone but only makes one at a time available to the market.

- NPRR793: Adds several responsibilities for RMR unit owners, revises RMR formulas and makes other clarifications to ensure RMR units are not accidentally committed as a reliability unit before other resources.

- NPRR795: Creates a mechanism to refund capital expenditures funded by ERCOT under an RMR agreement.

- PGRR047: Requires energy developers seeking an interconnection agreement to include among their materials a signed affidavit that they have notified the Department of Defense of their proposed project and have requested a review.

- PGRR049: Removes the option to submit generation interconnection or change request (GINR) applications through standard mail or fax and updates the mailing address for GINR payments to ERCOT’s treasury department.

- RMGRR134: Gives non-modeled generators the option to use the AMS data-submittal process and clarifies processes for unregistered distributed generation versus registered non-modeled generators.

— Tom Kleckner