OGE Energy (NYSE:OGE) saw earnings per diluted share drop slightly from 2021 as it did not benefit as much from the sale of its midstream natural gas business, the company said during its fourth-quarter earnings call Thursday.

The firm brought in $3.32/diluted share in 2022 compared to $3.68/diluted share in 2021, but its regulated electric company, Oklahoma Gas & Electric, brought in more money, contributing $2.19/diluted share, up from $1.80 in 2021.

OGE still had some earnings from its natural gas business in 2022 despite its sale closing in December 2021, but going forward it is going to be a pure-play electric company, CEO Sean Trauschke said.

“My message to you is this, we’ve certainly got this, and our sustainable business model provides numerous opportunities from driving load growth, to grid investments and generation for many years to come,” Trauschke said on his firm’s earnings call. “We are mindful of ensuring a smooth customer impact and delivering consistent growth.”

The winter storm at the end of last year led to a lot of “discussion” in the utility industry, but OG&E made it through “Elliott” without issue because of the firm’s weather hardening, he said.

“I’m very proud of our team’s work every day, particularly during the weather extremes we experience here in Oklahoma and Arkansas,” Trauschke said. “We continue our grid weather-hardening investments that deliver great results for customers.”

The firm built seven new substations, upgraded another nine and added 65 miles of transmission lines last year to better serve its customers and keep up with demand growth, he added.

“Our communities maintain strong unemployment rates and continue to attract expanding and new businesses that our low rates help secure,” Trauschke said. “Our load forecast for 2023 continues to keep pace with the outstanding growth we’ve experienced over the last two years, and our long-term load forecast remains strong as our service area continues to grow.”

The firm saw weather-normalized load growth of 3.1% in 2022, which comes on top of 2.4% growth in 2021, CFO Bryan Buckler said.

“This back-to-back expansion of load is remarkable and indicative of economic strength in Oklahoma and Arkansas,” Buckler said. “The biggest driver of load growth is coming from the business sector with a variety of companies contributing, including those in data mining, agriculture and manufacturing.”

Commercial load shot up by 12.2% in 2022 compared to a year earlier, and it is now about 15% above 2019, pre-pandemic levels, he added.

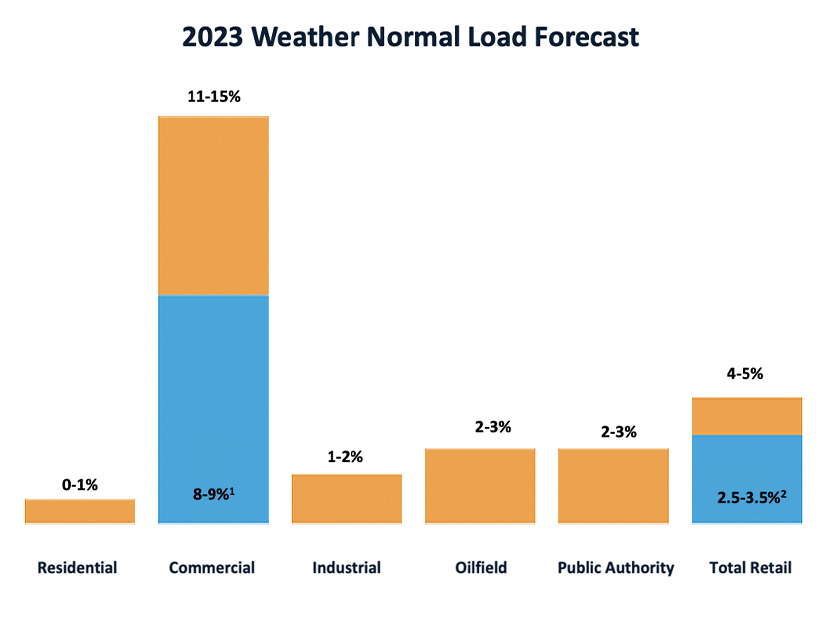

The load growth for 2023 varies depending on how much data mining for cryptocurrencies expands in OG&E’s footprint. Without any growth from that industry, load growth would be just about 2.5 to 3.5%, but with it, growth could be 4 to 5%. Focusing in on commercial load for 2022, OG&E is forecasting growth without data mining expansion of 8 to 9%, but it could hit as high as 15% with expanded data mining.

The firm is also participating in the HALO Hydrogen Hub — a joint effort between Arkansas, Louisiana and Oklahoma, in which OGE is a stakeholder — which is seeking federal funds under the Infrastructure Investment and Jobs Act to produce hydrogen.

“Additionally, OG&E is competing for two [Department of Energy] grants as part of the IIJA for grid resilience and smart grid,” Trauschke said. “After assessing our initial submission, DOE encouraged us to submit full applications.”