By Rich Heidorn Jr.

VALLEY FORGE, Pa. — PJM stakeholders last week launched another bid to change the $1,000/MWh energy offer cap, but consumer advocates said they were not optimistic about reaching consensus in time for next winter.

Marji Philips of Direct Energy proposed raising the cap to $2,700/MWh for cost-based day-ahead offers and price-based real-time offers — 50% more than the highest offers reported by PJM last winter.

“Everybody likes a piece of it and nobody likes the whole thing,” she said of those with whom she shared the proposal before the meeting. “So that means it must be pretty good.”

PJM’s Board of Managers asked stakeholders to make another attempt to reach consensus after efforts last year fell short. (See Members Deadlock on Change to $1,000 Offer Cap.) Philips and other PJM veterans said the $1,000 cap, which has been in effect for about 18 years, was set as a multiple of the highest prices seen at that time.

In January, PJM won FERC approval for a temporary waiver that allowed prices to rise as high as $1,800/MWh, but the RTO made it through last winter without having to invoke it. In the 75 days that the waiver was in effect, there were 54 cost-based offers between $1,000/MWh and $1,800/MWh, but none cleared.

PJM said the waiver was necessary to allow some gas-fired generators to cover marginal costs that hit $1,200/MWh in late January, as spot gas prices spiked as high as $140/mmBtu.

Higher Cap Better for LSEs

Philips said raising the cap is better for load-serving entities such as her company, because higher LMPs can be hedged while uplift cannot. She said it would also reduce capacity prices because increased energy market revenue would cause a drop in the net cost of new entry (CONE). “Here’s an opportunity to control our destiny,” she said. “We’d rather see [stakeholders] filing [a change] than PJM.”

Philips said she had been reluctant to back a change to the cap on day-ahead offers but was convinced by PJM that it was needed to enable price convergence with the real-time market.

The proposal also would require changes to scarcity pricing rules to ensure that generation dispatched for reserves receives lost opportunity costs — which could be higher than the existing $1,000 cap — she said.

Philips said her goal was “incenting the market to do the right thing. We’re trying to keep PJM as a market and not as a cost-based system.”

PJM Endorses Proposal

PJM officials — who proposed a $2,700 cap on price-based offers and removing the cap on cost-based offers in a FERC docket on price formation in March (AD14-14) — said they would accept the proposal. “It is something we would consider to be acceptable,” said Stu Bresler, senior vice president of market services.

Jim Benchek of FirstEnergy thanked Philips for the proposal, calling it “a good starting point.”

Consumer Reps Wary

But consumer representatives were not quick to embrace it.

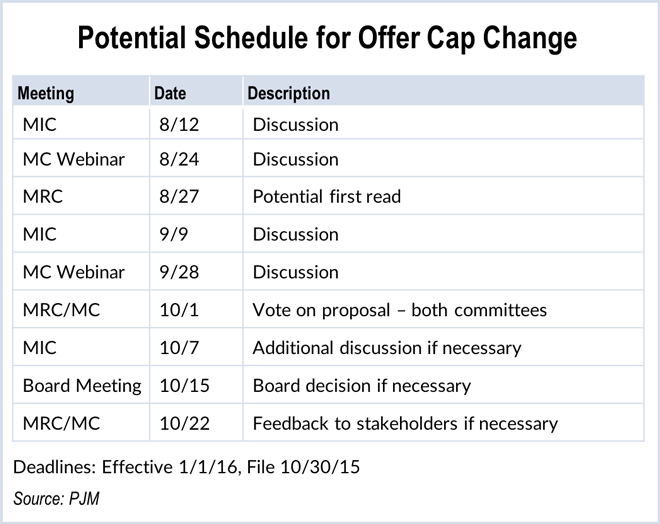

Carl Johnson, representing the PJM Public Power Coalition, said he did not think consensus could be reached in time for an Oct. 1 FERC filing — the deadline PJM officials have said is necessary to ensure new rules are in place for winter 2015/16.

Johnson noted that stakeholders were unable to reach agreement last year despite months of debate. “Even though the pope will be in [Philadelphia], I don’t think that’s going to be enough time to give us the miracle we need to come up with consensus,” he said.

“There’s a lot here that we will need to digest,” said Dan Griffiths, executive director of the Consumer Advocates of PJM States.

Griffiths said while consumer advocates are willing to consider lifting the offer cap for generators that can demonstrate costs above $1,000/MWh, they continue to have concerns about letting those offers set LMPs for the entire market.

Philips responded that while stakeholders can debate whether the cap should be lower than $2,700, not allowing high marginal prices to set LMPs is “antithetical to the entire market structure.”

Griffiths said later that his members are willing to consider market clearing prices above $1,000/MWh but that PJM had not demonstrated a spirit of compromise in last year’s efforts, saying the RTO’s unwillingness to consider a cap below $1,800 was “insulting.”

David Mabry, representing the PJM Industrial Customer Coalition, said any change in the cap should be accompanied by broader market power protections than current rules, which test only local market power. He cited the Independent Market Monitor’s charge in the 2014 State of the Market report that some generators appeared to engage in economic withholding during high demand hours in January 2014. (See Monitor: Winter Prices Boosted PJM Prices, Raise Withholding Concerns.) Mabry said cost-based offers should be limited to short-run marginal costs.

Consultant Roy Shanker called market power concerns a “red herring,” saying existing rules are sufficient. “If you misrepresent your costs, you’re in big trouble,” he said.