By Chris O’Malley

Nearly two years after joining MISO — and despite a seams spat between the RTO and SPP — Entergy said it is realizing expected cost savings from the integration.

Entergy and MISO’s Independent Market Monitor told the Entergy Regional State Committee in Little Rock on Aug. 11 that the December 2013 integration has produced substantial benefits and that the transition was well-managed.

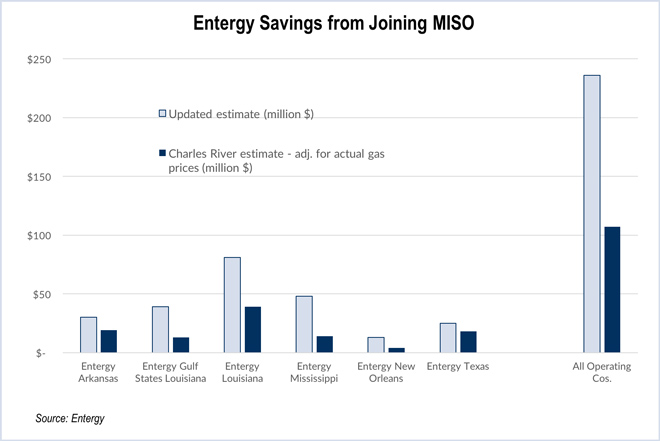

Entergy cautioned that its recent review amounts only to an initial snapshot. But, so far, at least, it has identified $236 million in annualized energy related savings since integration in 2013.

MISO had estimated at the time of integration that Entergy customers could see savings of $1.4 billion over a decade.

Six Entergy operating companies operate in four MISO states: Arkansas, Louisiana, Mississippi and Texas.

Entergy vice president Matt Brown said the company would have had to acquire 1,402 MW of additional capacity resources had Entergy not joined MISO.

That’s slightly lower than 1,413 MW of avoided capacity estimated during a May 2011 study Entergy commissioned to look at potential cost savings of joining the RTO.

“The benefits that our customers are realizing from actual participation in the MISO RTO are meaningful and that they are at a level that is on par or better than what we projected in the change of control filings,” Brown told stakeholders.

The study focused on non-baseload resources and did not take into account transmission related benefits.

Broadly, the study looked at changes in costs resulting from the move to Day 2 RTO commitment and dispatch. That includes benefits in generation costs, purchased power costs, net wheeling costs and additional Day 2 production cost savings such as deferred generation investment.

On the other side of the equation were additional costs such as RTO administration and cost allocations for its share of MISO’s regional transmission projects.

“The takeaway here is that the capacity-related savings, the planning reserves, additional production cost [savings], if you will, associated with being in MISO have been in line with what we projected,” Brown said.

Among them was a 9% reduction in the portion of energy provided by Entergy’s legacy generation. “The legacy generation that we are using is being used more efficiently,” Brown said.

He cautioned that the approximately one-year post-integration period studied wasn’t enough time to draw broader conclusions. “But the information that we’re seeing is encouraging. Our customers are realizing meaningful benefits from being in MISO.”

Constraints Mar Integration’s Potential

The results also received some affirmation from MISO’s Market Monitor, Potomac Economics.

“Overall, we found that the market performance in MISO South has been well-managed and has produced substantial benefits,” said Robert Sinclair, a principal at Potomac. “The integration has been efficient.”

But Sinclair said the Operations Reliability Coordination Agreement (ORCA) and the South Region Power Balance Constraint (SRPBC) remain obstacles to transfers between MISO Midwest and MISO South.

The latter was created in response to the need to make transmission payments to neighbors for transfers more than 1,000 MW. MISO began limiting flows last year after SPP complained that MISO breached their joint operating agreement by moving power over its transmission footprint in excess of a 1,000-MW contractual limit.

Currently there’s a hurdle rate of nearly $10/MWh for transfers more than 1,000 MW, causing price separations between the regions. That raises efficiency concerns by limiting transfers more than 1,000 MW and price effects in both regions that don’t reflect physical realities of the network, Sinclair noted.

The best mechanism would be one allowing MISO to eliminate the SRPBC, Sinclair said. Reducing the hurdle rate to zero would support efficient interregional transfers and improved pricing.

Sinclair also reiterated the Monitor’s call to develop a reserve product that will reflect operating reserve needs in MISO South, in particular.

“We believe that if that constraint was released, we would have more instances where the power flows were above 1,000 MW and that would be more efficient because we would be experiencing more production cost savings,” Sinclair added.

$844M in Tx Projects for MISO South

Meanwhile, stakeholders received an update from MISO about its 2015 Transmission Expansion Plan, which proposes 352 projects totaling $2.4 billion.

Of those, 79 projects totaling $844 million are proposed for MISO South:

- Arkansas: 15 projects totaling $159 million;

- Louisiana: 34 projects ($473 million);

- Mississippi: Seven projects ($30 million); and

- Texas: 23 projects ($182 million).

However, the list is expected to be whittled down prior to board consideration in December.