WILMINGTON, Del. — PJM likely will recommend reducing a proposed $30,000 fee for studying transmission projects of $20 million or more.

PJM has deferred filing the plan with FERC pending further review, Paul McGlynn, general manager of system planning, told the Markets and Reliability Committee on Thursday.

McGlynn said that as planners were preparing the filing, data indicated that the fee might be more than necessary to cover the costs of internal labor and external consulting associated with the competitive windows during the approximately two-year trial period.

The fee proposal was approved Feb. 26 by the MRC and Members Committee after the Federal Energy Regulatory Commission rejected as discriminatory a previous plan to apply the fee to all greenfield projects but not upgrades of less than $20 million. (See FERC Rejects Fee on Greenfield Transmission Projects.)

McGlynn said the decision was based on the increased number of projects being considered under this new approach along with the most recent data drawn from the limited 2014 proposal windows.

“We just wanted to give you a heads-up that we will delay filing it and will update the proposal to some amount other than $30,000,” he said.

PJM had planned to ask FERC for approval that would affect the window that ended in February. Now, McGlynn said, “It likely will not be in effect for any proposal windows this year.”

A revised proposal is expected to be presented at the Planning Committee next month.

PJM: Mistaken LOC Credits Total $7M to $15M

PJM this week expects to finalize the amount of money it will seek from generators that mistakenly received lost opportunity costs when they were on forced outages and ineligible, Chief Financial Officer Suzanne Daugherty told the MRC.

Daugherty said staff had narrowed the total overpayments over two years to between $7 million and $15 million. The next step is to break down the cost by generator.

“It’s taking time to do this,” she said. “We are having to look at reporting data systems that have not been designed to interact with each other.”

While Daugherty said it’s likely the erroneous payments extend before April 2013, the Tariff allows the RTO to recover only 24 months’ worth.

Affected generators will begin being contacted this week, she said. Following these conversations, billing adjustments will be appearing in the June month-end statements, she said, and might roll into July’s bills.

The compensation applies to combustion turbines that are scheduled in the day-ahead energy market but are not committed in real time. However, if they are not able to operate in real time, they are not eligible for the credit. (See PJM to Recoup up to $15 Million in Mistaken Lost Opportunity Costs.)

Members OK Gas-Electric Initiative

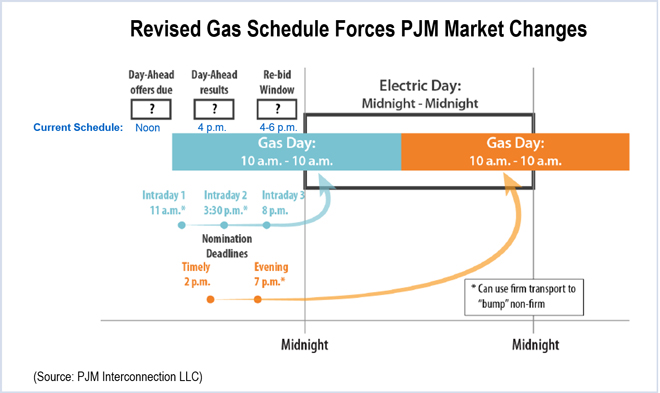

The committee approved a problem statement and issue charge to review options for moving the day-ahead energy market and reliability unit commitment timelines in response to FERC’s final rule on coordinating gas and electric schedules.

PJM must make a compliance filing in response to the order by July 23. Discussions will take place at the MRC. (See PJM, IMM Considering Changes to Virtual Trades, Day-Ahead Market.)

The initial proposed solution involves shrinking the amount of time, from four hours to three and a half, that PJM has to resolve offers.

In a related discussion later in the meeting, stakeholders expressed concern that the earlier the offer deadline is moved, the less accurate a load forecast will be due to lack of good information about impending weather and gas trades.

Joe Wadsworth, who made a presentation on behalf of Vitol, raised several concerns, including that robust natural gas trading does not occur before 9:30 a.m. and often is later, especially in the winter. And, he said, trading is unlikely to shift earlier regardless of whether PJM moves up its day-ahead bidding. In addition, he said in his presentation, “Sequencing of NYISO’s DA market clearing well in advance of PJM’s DA bidding deadline is critical.”

The next educational session on the issue will be held following the June 10 Market Implementation Committee meeting.

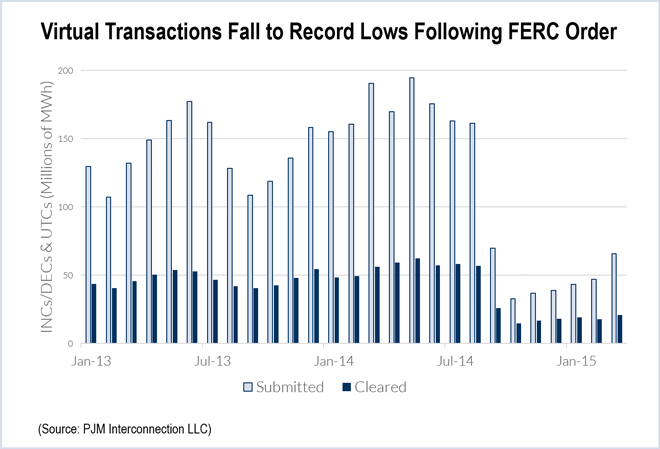

Interim Fee for Virtual Transactions Fails

Two proposals from Inertia Power to impose a temporary $0.07/MWh uplift charge on virtual transactions failed — not surprising given the reception on their introduction in April. (See Cool Response to Proposed 7-Cent Fee on Virtual Transactions.)

One proposal would have imposed the fee on up-to-congestion bids (UTCs), increment offers (INCs) and decrement bids (DECs); the other would have applied to UTCs only. The first proposal failed with only 26% support; the alternative motion fell short at 31%.

The proposals would have expired in six months or upon FERC approval of an alternative. Transactions placed between September 2014 and the effective date of the filing would not have been affected.

“We haven’t been able to reach consensus. We need something to protect the market in the interim,” said Noha Sidhom in making the case for the proposal.

The fee, she said, would provide transactional cost certainty as well as a new revenue stream for uplift as the system heads into volatile summer months. It also would give insight into what a permanent fee could look like.

The proposal was in response to a Section 206 proceeding ordered by FERC to determine whether PJM is improperly treating UTCs differently from INCs and DECs.

While INCs and DECs are charged uplift and subject to the financial-transmission-rights forfeiture rule, UTCs are exempt from both. UTC trading volumes crashed after Sept. 8, the refund-effective date set by FERC for any uplift assessments.

Those who supported the fee pointed to the fact that at least it would constitute something rather than nothing.

“We’re not sure FERC is going to order retroactive refunds,” said Dave Pratzon of GT Power Group. “If they don’t, you might have a period of six to nine months where you’re collecting revenue where you don’t have that now.”

Some also worried that a large refund could potentially bankrupt some financial participants.

The Independent Market Monitor, represented by Howard Haas, led the opposition to the measure.

“We think this is an end-run around the EMU process,” he said in an interview after the vote, using a shorthand reference for the Energy Market Uplift Senior Task Force (EMUSTF).

If implemented, the proposed fee would replace an allocation of uplift charges in any retroactive collection ordered by FERC, he said. By relieving such pressure, it would remove the incentive for financial participants to reach a solution at the task force, he said.

And he said, “The jury is still out on the benefits of virtuals, particularly UTCs.”

Manual Changes Unanimously Endorsed

Members endorsed the following manual changes:

- Manual 36: System Restoration — Annual review. Adds detail about when PJM assumes control and when it returns to normal operation. Also adds guidance on completion of interconnection checklist. Effective: June 15.

- Manual 03: Transmission Operations — Updates index and operating procedures for PJM RTO operation (nuclear station voltage limits, operation procedures with neighboring systems and operation procedures for AEP, ComEd, Dominion, PPL, UGI, PSEG and PECO.) A change to section 2.1.1 adding a requirement that load dump rating be at least 3% higher than emergency rating was removed due to differing ideas over what it meant. The issue will return to the committee later. Effective: June 1.

- Manual 38: Operations Planning — Makes minor changes due to system upgrades and specifies periodic review of IROL facilities. Updates the study process for transmission reliability analysis procedure. Effective: June 1.

— Suzanne Herel