California will need to double its public EV charging infrastructure between 2030 and 2035, according to a new report by the state's Energy Commission.

California will need to double its public EV charging infrastructure between 2030 and 2035 to serve the expected number of electric vehicles in the state, according to a new report by the California Energy Commission (CEC).

That draft Electric Vehicle Charging Infrastructure Assessment, which highlights the massive needs stemming from the state’s aggressive transportation decarbonization goals, coincided with the release of a CALSTART working paper on phasing the national EV charging infrastructure build-out.

The CEC assessment estimated that by 2035, more than 15 million light-duty electric vehicles in California would require more than two million chargers at public and “shared private” locations, more than doubling the seven million vehicles and one million chargers projected for 2030. This estimate did not include chargers installed in single-family homes but included shared private locations such as multifamily dwellings and workplaces.

The estimate of 15 million electric light-duty vehicles represents a tenfold increase from today. In the first quarter of 2023, California surpassed 1.5 million light duty electric vehicles, with nearly 85% full EVs, 15% plug-in hybrids (PHEVs) and less than 1% hydrogen fuel cell vehicles. In that quarter, full EVs and PHEVs accounted for more than 20% of new passenger vehicle sales. Light-duty vehicles were defined as vehicles with a gross vehicle weight rating below 10,000 pounds, primarily privately owned cars and trucks.

The assessment was the second biennial report required under Assembly Bill 2127. The draft report extended the 2021 analysis by five years to 2035, the target date for Gov. Gavin Newsom’s ambitious transportation electrification goals. His Executive Order N-79-20 set goals for 100% zero-emission new passenger car and truck sales and 100% zero-emission vehicle operations for drayage trucks by 2035.

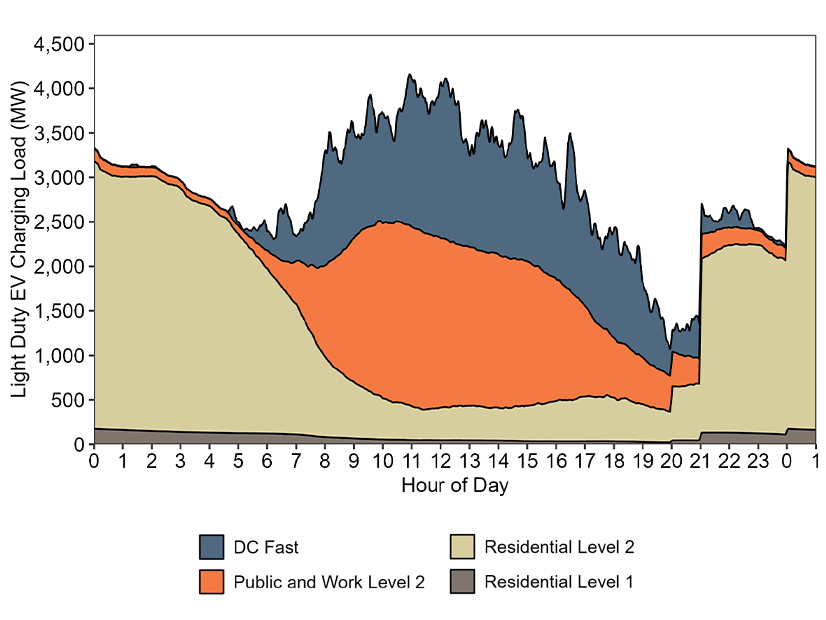

For the grid, peak weekday charging for light-duty vehicles is likely to reach 4,000 MW in the middle of the day by 2030, with more than a third of that from DC fast chargers. Residential charging, in contrast, would peak overnight, with the estimated demand showing a significant rise at 9 p.m. when time of use rates drop.

The assessment’s estimates for the mix of Level 1, Level 2 and DC fast chargers for light-duty vehicles appeared to be conservative, with only 83,000 DC fast chargers in the 2.11 million total, or less than 4%. That is a much lower percentage than today when California has 9,808 DC fast chargers to its 82,000 public Level 2 chargers.

In addition to building out EV charging infrastructure for passenger vehicles, the assessment forecast demand for fast chargers for commercial vehicles. The 377,000 medium- and heavy-duty EVs in 2035 would need an additional 256,000 20 to 150-kW DC fast chargers in depots, as well as 8,500 higher powered 350 to 1,500-kW public DC fast chargers. For medium- and heavy-duty vehicles, the load on the grid is more spread, with a peak demand in 2030 of 800 MW overnight, largely from vehicles at depots.

CALSTART, a nonprofit consortium focused on clean transportation, released a working paper on charging infrastructure for zero-emission medium- and heavy-duty vehicles throughout the United States. In Phasing in U.S. Charging Infrastructure: An Assessment of Zero-Emission Commercial Vehicle Energy Needs and Deployment Scenarios, CALSTART recommended phasing the building-out of commercial vehicle charging infrastructure, starting with “favorable launch areas.” The phased approach could support commercial EV uptake at the rates specified in the Global Memorandum of Understanding on Zero-Emission Medium- and Heavy-Duty Vehicles (Global MOU), which the United States signed in 2022.

“This phased approach can manage distribution grid upgrade timelines and maximize utilization even with the Global MOU’s attainable market penetration rates, which exceed those proposed by U.S. regulators,” the report said. “Favorable regions include where 1) industry concentrates, 2) public and private funds have high leverage, 3) policy is supportive, 4) energy will cost less or 5) distributed grid modernization will occur.”