The U.S. Department of Energy on Tuesday released a new “Liftoff” report laying out how virtual power plants (VPPs) can reach commercialization.

VPPs are aggregations of distributed energy resources such as rooftop solar, batteries, electric vehicles and traditional demand response programs.

“Pathways to Commercial Liftoff: Virtual Power Plants” is meant to spark a dialogue between DOE, regulators, policymakers, utilities, ISO/RTOs, corporations, research organizations, advocacy groups and others around challenges and potential solutions for commercialization. It’s the fifth Liftoff report, with others covering advanced nuclear, long-duration energy storage, carbon management and clean hydrogen.

Electricity demand is growing nationally for the first time in a decade as fossil plants retire. Deploying 80 to 160 GW of VPPs by 2030, triple the current level, could support rapid electrification compared to building more peaker plants, the report said. National peak demand is expected to grow from 743 GW to 802 GW by 2030, while 162 to 183 GW of generation will retire the rest of this decade.

“In all scenarios, the mix of weather-dependent renewable generation will be unprecedented, leading to more variable electricity supply and higher demand for transmission capacity,” the report said. “Transmission interconnection backlogs, which have stretched to an average of five years, pose potential resource adequacy challenges. Large-scale deployment of VPPs could help address demand increases and rising peaks at lower cost than conventional resources, reducing the energy costs for Americans — one in six of whom are already behind on electricity bills.”

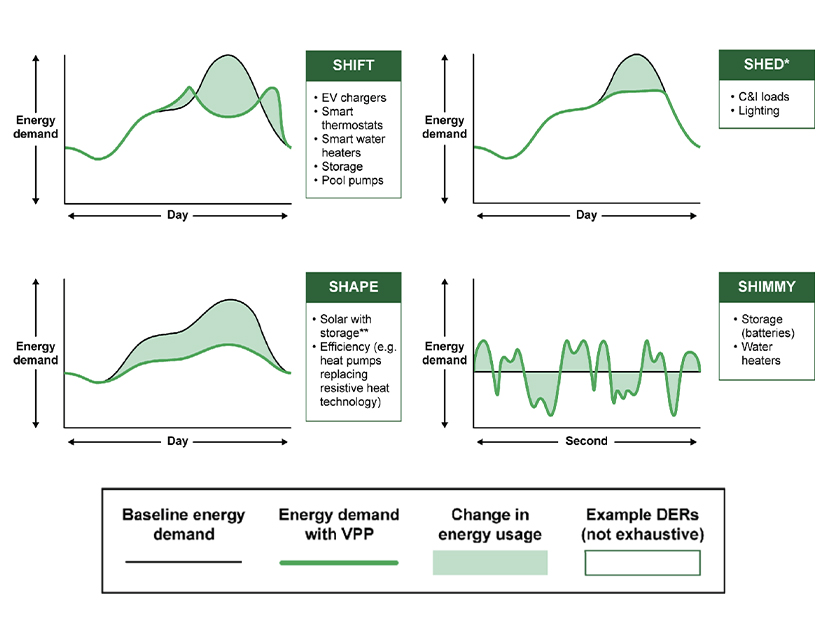

The report counts between 30 and 60 GW of VPPs today, largely made up of DR programs aimed at trimming loads when demand spikes. But VPPs can be used for many other activities that benefit the grid, it said.

“Example functions of VPPs on the market today include shifting the timing of EV charging to avoid overloading local distribution system equipment; supplying homes with energy from on-site solar-plus-storage systems during peak hours to reduce demand on the bulk power system; charging distributed batteries at opportune times to reduce utility-scale solar curtailment; dispatching energy from commercial EV batteries back to the grid; and contributing ancillary services to maintain power quality, all while minimizing impact to the DER owner,” the report said.

VPPs can be 40 to 60% cheaper than the alternatives of utility-scale batteries or natural gas peaker plants, so deploying up to 160 GW by 2030 could save customers about $10 billion annually. That would be enough to contribute 10 to 20% of peak demand, with local differences driven by DER availability and the mix of utility-scale generation.

The economic benefits are in line with a Brattle Group report from this spring, whose authors also worked with DOE staff on the Liftoff report. (See Brattle Group Finds VPPs Cheapest Alternative for Resource Adequacy.)

The resources capable of making up VPPs are expected to grow regardless, with EV charging infrastructure adding between 20 and 90 GW each year of nameplate demand capacity and 300 to 540 GWh of nameplate storage capacity from their batteries. It also will add 5 to 6 GW per year of flexible demand from smart appliances and nonresidential DR, another 20 to 35 GW of distributed generation (mostly solar) and 7 to 24 GWh from distributed batteries outside EVs.

The report includes some policy suggestions, such as expanding DER adoption by offering low-cost financing and rebates to induce customers to shift spending to products that can respond to grid needs. The enrollment process in VPP programs could be simplified by adopting opt-out enrollment when consumers buy DER devices, and the sector would benefit from increased customer education, it said.

The operations of VPPs should be standardized so the assets can be more repeatable in order to shorten the design and pilot stages of individual deployment, it said. The resources also should be integrated into standard utility planning, and utilities need the right incentives to use them.

The resources can be integrated into organized wholesale markets as FERC Order 2222 is implemented in different ISO/RTOs.

VPPs are highly configurable, the report said, meaning they can meet different grid needs at both the distribution and transmission levels. Reshaping demand curves and providing ancillary services can increase grid resilience and cut congestion.

They also are affordable, which is important: While the grid needs major investments, some one in six households already are behind on their electric bills, the report said.

“As lower-cost options for increasing grid capacity, VPPs can moderate the cost burden on ratepayers. They provide services from DERs available on the distribution grid in ways that can be more cost-effective than increasing bulk system resources,” the report said.

California is seeing rapid electrification and decarbonization, and some estimates have utilities there spending up to $50 billion to fortify their distribution systems by 2035, but the report said VPPs could cut that by 70%, down to just $15 billion. Demand has been rapidly growing in Texas, by about 9% from 2018 to 2022, and analysis suggests DERs could save customers $150 per year on average by 2030.