Five lease areas off the California coast brought in a total of $757.1 million as bidding ended Wednesday, with five companies named the winners in the West Coast’s first offshore wind auction, the U.S. Bureau of Ocean Energy Management (BOEM) reported.

The winners were all subsidiaries of large multinational firms with experience in offshore wind, but no developer has yet built floating wind platforms of the immense size and number envisioned for the West Coast. The large scale, deep water, lack of port infrastructure and other risk factors kept the lease bids well below two East Coast auctions held earlier this year for areas off New York and the Carolinas, where shallower waters allow for fixed turbine platforms.

The bid prices, however, exceeded those from East Coast wind auctions held in prior years, according to a news release from the Interior Department, which oversees BOEM.

“Today’s lease sale is further proof that industry momentum — including for floating offshore wind development — is undeniable,” Interior Secretary Deb Haaland said. “A sustainable, clean energy future is within our grasp, and the Interior Department is doing everything we can to ensure that American communities nationwide benefit.”

The department called the sale a “significant milestone toward achieving President Biden’s goal of deploying 30 GW of offshore wind energy capacity by 2030 and 15 GW of floating offshore wind capacity by 2035.”

California has a mandate to provide retail customers with 100% clean energy by 2045 under 2018’s Senate Bill 100. The state’s Energy Commission has proposed offshore wind goals of 25 GW by 2045 to help fulfill that target. (See California Boosts Offshore Wind Goals.)

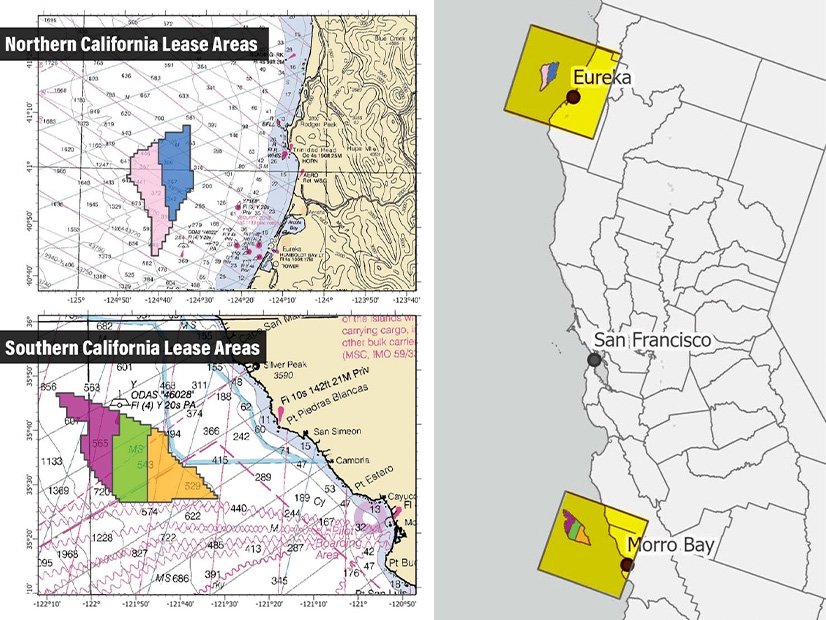

Of the five lease areas, three are in the Morro Bay Wind Energy Area (WEA) off the Central Coast and two are in the Humboldt Wind Energy Area off the coast of Northern California.

Winning bids reached as high as $173.8 million by California North Floating, a subsidiary of Copenhagen Infrastructure Partners (CIP), for a 69,000-acre Humboldt lease area with 1 GW of potential capacity. CIP is one of the firms building the Vineyard Wind project off the Massachusetts coast and is developing other East Coast offshore wind leases totaling 5 GW.

“California is expected to develop into a key market for floating offshore wind and the auction represented a strong investment opportunity for us,” CIP Senior Partner Torsten Smed said in a statement. “By adding the new lease area to our portfolio, and based on our large global portfolio of floating offshore projects in different stages of development, we are uniquely positioned to lead the commercialization of floating offshore wind in the U.S.”

Equinor Wind US submitted the lowest winning bid for an 80,000-acre Morro Bay parcel with 2 GW of potential capacity.

“Today’s announcement confirms Equinor’s floating [turbine] leadership and strong commitment to deliver renewable energy to the U.S. It adds at least another potential 2 GW to our existing 3.3 GW U.S. offshore wind portfolio,” said Pål Eitrheim, executive vice president of renewables at Equinor. “We were among the first movers into U.S. offshore wind and are now one of the first movers into California, a market we believe will become a strategic floating market globally.”

About two-thirds of offshore wind potential in the U.S. lies in deep waters; the Pacific Coast’s narrower continental shelf drops quickly to 3,000 feet or more, requiring floating platforms, the firm noted.

Other bids were $145 million by Invenergy California Offshore for an 80,000-acre Morro Bay lease area; $150.3 million by Central California Offshore Wind, an Ørsted affiliate, for a similarly sized lease in the Morro Bay WEA; and $157.7 million by RWE Offshore Wind Holdings for the second Humboldt lease of 63,338 acres.

The average price paid for all five parcels, totaling 373,268 acres, with up to 4.6 GW of capacity, was $2,028/acre.

That was far below the record bids in February for the New York Bight auction, which pulled in $8,837/acre for a total of $4.7 billion. It was about a third less than the $2,900/acre that bidders paid in May in a North Carolina auction that fetched a total $315 million. However, it was double the $1,083/acre paid for wind leases off the Massachusetts coast in 2018.

The provisional winners of the California auction now have the exclusive right to propose projects and seek federal approval.

Reasons for Caution

Analysts had warned Tuesday, as the auction began, that bidders could show more restraint than they had in New York or the Carolinas.

ClearView Energy Partners called floating offshore wind “a far more nascent and undemonstrated technology,” saying the higher risks could mean lower lease prices.

“The record number of [43] eligible companies bidding for the areas suggests a highly competitive environment that may not conclude until tomorrow or Thursday,” ClearView said in a statement previewing the auction.

“However, we are not yet convinced that final per-acre prices will exceed those reached for the WEAs leased off New Jersey and New York earlier this year,” the firm said. “While California has aggressive decarbonization targets and needs new non-solar renewable resources, it does not yet have policies specifically targeting offshore wind akin to those adopted by several East Coast states.”

The Business Network for Offshore Wind said it was “excited to see the commencement of the first West Coast and first floating offshore wind lease auction” but warned not to expect record prices.

“The Network does not believe the California leases will fetch as high of auction fees as the New York Bight,” the trade association said in a statement. “The New York Bight had several key elements, including a very visible path to offtake, strong monetary and public support from state governments, a visibly emerging port infrastructure and supply chain, and apparent willingness to tackle transmission. …

“Today, the California market is not as strong, and adding in new technology development will likely result in a lower price,” it said. “However, California is a premier market with strong political and public support and being the first to market is very attractive, as auction prices will only rise over time.”