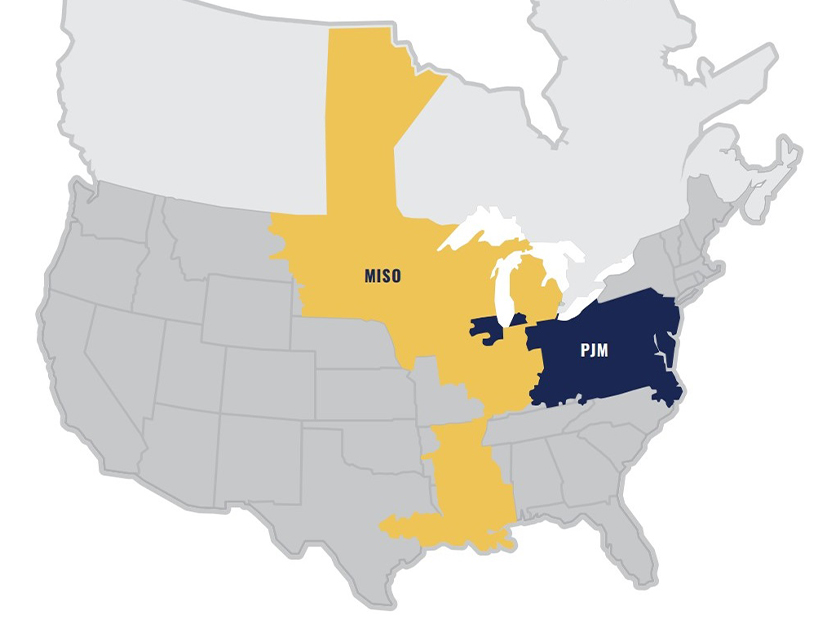

A new report from the American Council on Renewable Energy (ACORE) concludes MISO and PJM could save ratepayers $15 billion in a little more than a decade if they concentrate on building more interregional transmission.

The report, Billions in Benefits: A Path for Expanding Transmission between MISO and PJM, concludes more interregional ties between the Midwest and mid-Atlantic could reduce customer costs primarily through curbing the need for new generation capacity.

ACORE, Grid Strategies, the Solar Energy Industries Association (SEIA) and the American Clean Power Association (ACP) had a hand in producing the report.

Grid Strategies Vice President and report author Michael Goggin said greater interregional transfer capability along the seam would allow MISO and PJM to “tap into” their geographic diversity from renewable energy stretching from the Dakotas to Virginia. In turn, PJM and MISO Midwest could scale back capacity needs by about 11 GW. He said it’s unlikely extreme weather envelops both regions simultaneously and both have depleted capacity reserves.

During a Nov. 2 teleconference to discuss report findings, Goggin said if MISO-PJM lines are built, reduced capacity needs alone could save MISO and PJM ratepayers about $9 billion by 2035. The report also expects that expanded interregional transmission could provide more than $1 billion in energy market savings per year by reducing transmission congestion between the RTOs.

Goggin said more transmission capacity is valuable to maximizing existing generation during storms or heat waves “because of how weather systems move across the country,” with either MISO or PJM peaking first and then being able to export lower-cost power.

“In the likely scenario that solar penetrations are higher in PJM and wind penetrations are higher in MISO, PJM will export power to MISO during the day and during the summer, while it will import wind power from MISO at night and during the fall, winter and spring, when wind output tends to be highest,” Goggin wrote in the report.

The report didn’t analyze greater links between PJM and MISO South due to the subregion’s distance. It focused instead on the “long and tangled border across Illinois, Indiana, Michigan and Kentucky.”

Goggin said MISO-PJM interregional transmission “functions like an insurance policy, and we need to plan and pay for it accordingly.” He urged MISO and PJM to “look across the seam” and plan beyond their footprints.

Goggin said MISO and PJM’s interregional planning needs a “proactive, multivalue planning approach” that accounts for the most economic future fleet mix alongside state decarbonization goals and isn’t simply reactive to interconnection queue entrants.

“There are billions of dollars on the table. I think there’s a way PJM and MISO can come together and make this work,” Goggin said.

Goggin said congestion costs between MISO and PJM due to constraints last exceeded $1.7 billion in the 2021/22 planning year.

“This adds up to a large amount of money,” he said.

He also said from 2011-2020, interregional transmission builds nationally have averaged just 70 miles per year, a “dismal” figure.

Goggin recommended MISO and PJM model their interregional planning using the success stories from SPP, ERCOT and MISO’s own regional processes. He said MISO and PJM also could model planning after MISO and SPP’s Joint Targeted Interconnection Queue (JTIQ) study, which is meant to interconnect generation at the seams.

Goggin pointed out that PJM’s 2014 Renewable Integration Study and MISO’s 2017 Regional Transmission Overlay Study yielded similar, possible high-voltage solutions in northern Indiana and Illinois and at the MISO seam at the Iowa border.

He said MISO and PJM’s current affected system studies — the RTOs’ means of studying interconnecting generation near the seam — are designed so additional transmission upgrade costs are tacked on nearly at the finish line of the RTOs’ queues, a “nasty surprise that reshuffles the entire queue.”

Goggin said MISO and PJM should allow merchant transmission developers to “propose interregional solutions and be fully compensated for the value their projects provide.” He said projects like the Grain Belt Express and SOO Green HVDC Link are poised to be valuable in increasing links between the Midwest and mid-Atlantic and they should be accounted for in MISO and PJM planning processes.

However, Goggin warned PJM lags in building proactive, large projects even regionally, focusing instead on local reliability projects to replace aging infrastructure.

SEIA Counsel and Director of Energy Markets Melissa Alfano said more powerful interregional connections would allow the country to move away from “toxic” thermal resources that often fail during extreme weather events, especially in recent winter storms. She said a stronger interregional system also would help alleviate cascading project withdrawals in the MISO and PJM generator interconnection queues.

“All of these benefits are undeniable. … Yet here we are not building interregional transmission,” Alfano said.

She added that aside from groups urging MISO and PJM to do more, FERC should issue a rule on interregional planning standards. She said it seems meaningful interregional planning between MISO and PJM won’t happen absent a FERC mandate.

Jeff Dennis, deputy director of transmission at the Department of Energy’s Grid Deployment Office, said significantly more interregional transfer capacity between the Midwest and mid-Atlantic is one of the key needs outlined in last week’s National Transmission Needs Study from the DOE.

Katharine McCormick, assistant director of policy division at the Illinois Commerce Commission, said both PJM and MISO have been consistently warning over 2023 that they’re facing reliability risks by the end of the decade. She said building interregional transmission would aid reliability.

ACP Senior Counsel Gabe Tabak said DOE’s recent funding assist for MISO and SPP’s JTIQ $2 billion portfolio of 345-kV lines is a good starting point to encourage more interregional planning. (See DOE Announces $3.46B for Grid Resilience, Improvement Projects.)

“Meaningful” federal cost sharing is a way to “unstick the process that we all know needs to be advanced,” Tabak said.

MISO, PJM Mum on Conclusions

Both MISO and PJM said they still are reviewing the study and couldn’t speak to the findings.

“MISO is committed to interregional coordination in both planning and operations,” spokesperson Brandon Morris said in an emailed statement to RTO Insider.

At the Organization of MISO States’ annual meeting at the end of October, MISO Senior Vice President of Planning and Operations Jennifer Curran said MISO will attempt to plan a JTIQ-style portfolio with PJM. However, she warned that MISO and PJM employ different planning styles that are difficult to reconcile. (See OMS Leaders Reminisce on 20 Years at Annual Meeting.)

MISO and PJM have approved one large interregional market efficiency project in 2020 and four sets of smaller transmission projects aimed at relieving congestion since 2017.

Still, the nonprofits that signed onto the report are hoping for more from MISO and PJM.

“The U.S. Department of Energy has found that the MISO-PJM seam has the greatest need for expanded interregional transmission ties,” ACP Vice President of Markets and Transmission Carrie Zalewski said in a press release. “In fact, the intertie with MISO accounts for around 80% of PJM’s total need for interregional transmission. These grid operators must collaborate on the transmission planning necessary to bridge this gap, preserve reliability and benefit millions of customers.”

“Interregional transmission lines have helped save American lives during extreme weather events, yet today’s transmission planning processes do not value the added reliability they provide our grid,” ACORE CEO Gregory Wetstone said. “Consumers should not be forced to endure outages when study after study shows additional line capacity would help keep the lights on and reduce power costs.”