Billions of dollars in add-ons to California’s electric bills are slowing the adoption of electric vehicles, heat pumps and other clean energy technologies, says a new study by CAISO Governor Severin Borenstein and two of his colleagues at the University of California, Berkeley.

Customers of the state’s three large investor-owned utilities — Pacific Gas and Electric, Southern California Edison and San Diego Gas & Electric — shoulder the “residual costs” of wildfire prevention and victim compensation along with rooftop solar subsidies and other big-ticket items, the study found.

The add-ons amount to an “electricity tax” that hits lower-income households hardest, it says.

“Customers across the three IOU service territories contribute $678 per year on average toward the residual cost burden,” the study says. “For PG&E and SDG&E customers, residual cost burdens are more than two-thirds of their total bills, whereas SCE customers pay slightly more than half of their bills towards residual costs. As a result, how California chooses to recover these costs is the primary driver of electricity costs.”

That, in turn, “discourages efficient substitution from natural gas and gasoline … towards electricity,” it said. “As such, high electricity prices act as a deterrent to electrification of transportation and buildings.”

Released Thursday, “Paying for Electricity in California: How Residential Rate Design Impacts Equity and Electrification,” was written by Borenstein and professors Meredith Fowlie and James Sallee at the Energy Institute at UC Berkeley’s Haas School of Business. Nonprofit think tank Next 10 commissioned the report.

The study is a follow-up to last year’s publication by the same authors, “Designing Electricity Rates for An Equitable Energy Transition,” which dealt with California’s strategy of recovering fixed utility and social program costs through “increased per-kilowatt hour (‘volumetric’) prices.”

“With nearly all fixed and sunk costs recovered through such volumetric prices, the price customers pay when they turn their lights on for an extra hour is now two to three times what it actually costs to provide that extra electricity — even when including the societal cost of pollution,” it said. (See Calif. Worries High Rates Could Hurt Climate Efforts.)

Last week’s report expanded on the prior study by analyzing, for the first time, detailed billing data from 11 million households and examining the consequences of the “electricity tax.”

It found that higher-income households pay a greater share of residual costs, “but lower-income households pay much more as a fraction of their annual income on average, so much so that the effective electricity tax is more regressive than the state sales tax.”

In PG&E and SDG&E territories, for example, the lowest-earning households pay more than 3% of their annual incomes in residual costs while those in the highest income group pay less than 1%.

Net Metering

The state’s controversial net metering system for rooftop solar owners “makes the effective electricity tax substantially more regressive,” it says. “This is because wealthier households are much more likely to have rooftop solar.

“The effect is strongest in SDG&E, where rooftop solar in 2019 already provided over 20% of residential electricity under net metering, thus offsetting a majority of the cross-subsidy created by the California Alternative Rates for Energy (CARE) program” for low-income households.

The California Public Utilities Commission issued a draft decision in December to reform net metering, which credits rooftop solar owners for surplus electricity exported to the grid but backed away from the plan amid protests from the solar industry and rooftop solar owners. (See CPUC to Delay Net Metering Decision for a Year.)

In its initial proposal, the CPUC said net metering “negatively impacts nonparticipating customers, is not cost-effective and disproportionately harms low-income ratepayers.” Utilities including PG&E estimated that net metering shifts up to $4 billion a year in costs from households that can pay for rooftop solar to those that cannot.

Solar subsidies and other components of the electricity tax are hampering electrification because “customers considering electrification face much higher operating costs if they electrify,” the study says.

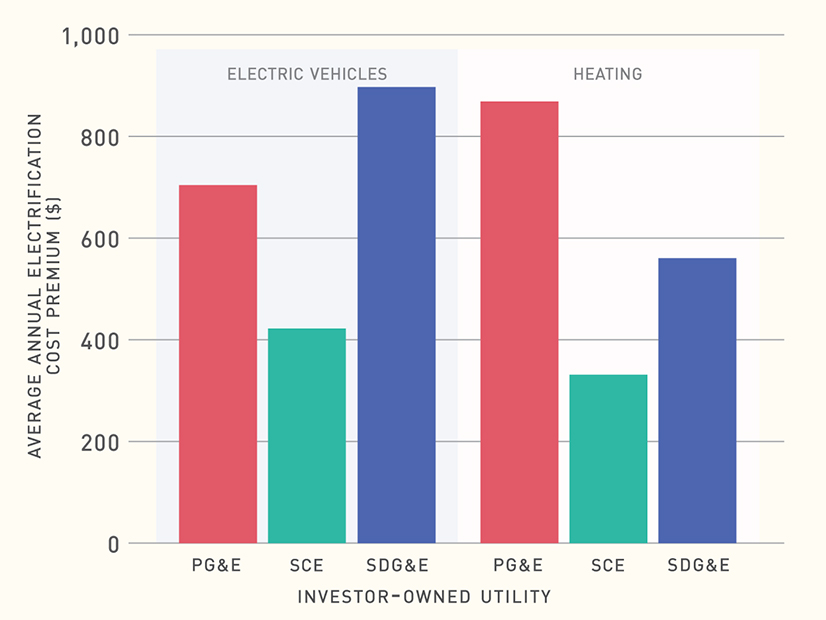

“For California households considering purchasing an electric vehicle, the effective electricity tax raises the annual operating cost of an EV by around $600 per year on average,” and by $900 for average SDG&E customers, it says. “Recent research suggests that this could be reducing EV adoption by somewhere between 13% and 33%.”

For households considering electric space and water heating, “the effective electricity tax raises the annual cost of doing so by around $600 per year,” it said. “Recent research suggests that eliminating this tax could increase the fraction of new homes that are built with electric heating by around one-third.”

The authors said they do not dispute the need for utilities to recover costs but believe it could be done in different ways to promote equity for lower- and higher-income households.

One possible solution, the report says, would be to move “some costs that contribute to the residual cost burden onto the state budget, to be funded by increases in the sales or income tax.” That “would increase equity and improve efficiency because it would reduce the effective electricity tax.” Another solution could be to introduce a “system of income-based fixed charges.”

The authors said their primary aim was to provide useful facts and potential rate-design fixes, “guided by the twin objectives of fostering decarbonization and improving equity.

“All possible reforms create some manner of trade off, and as such should be debated in the broader policy context in the state,” they said.