Founder of Hydeal Ambition Thierry Lepercq | Green Hydrogen Coalition

Founder of Hydeal Ambition Thierry Lepercq | Green Hydrogen Coalition

Europe is in a historic energy crisis, and the impact on the U.S. is not going to be good as exports of its shale gas increase, warned a Paris-based industrialist and entrepreneur Tuesday.

Thierry Lepercq — an energy entrepreneur, author and founder of HyDeal, a pro-hydrogen industrial coalition aiming to replace gas with hydrogen — said U.S. gas prices will “skyrocket” because of European demand.

“I can tell you that $150 billion right now are being invested in LNG terminals across the coast of Texas and Louisiana to ship that very cheap” shale gas, he warned in a webinar produced by the U.S.-based Green Hydrogen Coalition.

“You’ll have that arbitrage thing where in the next few years, massive amounts of natural gas are shipped from the U.S. and to go to Europe and Asia. And the prices in Europe are likely to go down, but the price in the U.S. is going to skyrocket.

“Imagine the whole of the U.S. economy with energy prices going up by 100 to 200% because of the contamination from Europe.

“The same thing is going to happen to the U.S. with maybe [a] one- or two-year delay,” he said. “The message here for the U.S. is to think big immediately. You want to go into tens of millions of dollars to upgrade hydrogen [production] very fast.”

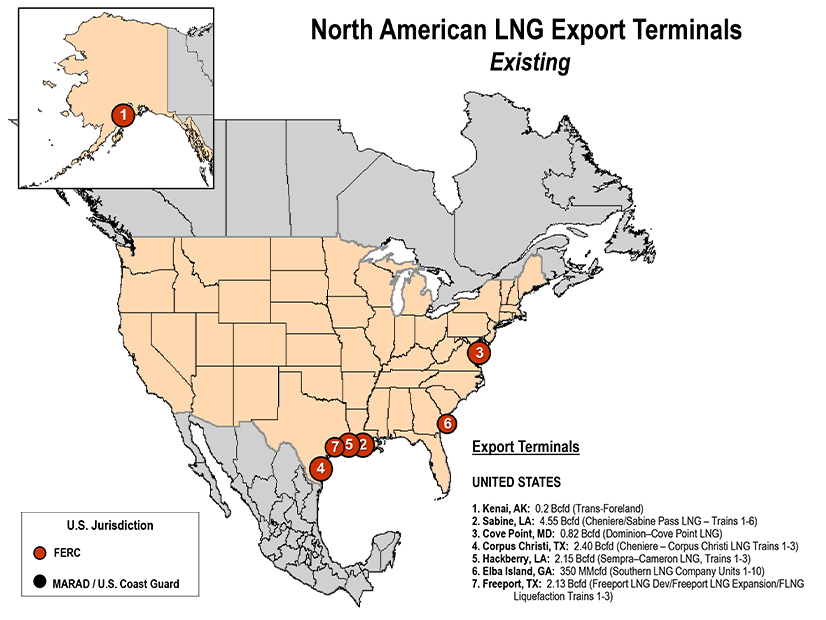

DOE and FERC have approved the construction of another 13 export terminals with a combined capacity of 25 bcfd. The first-ever exports of domestically-produced LNG from the lower-48 states occurred in February 2016. | DOE

DOE and FERC have approved the construction of another 13 export terminals with a combined capacity of 25 bcfd. The first-ever exports of domestically-produced LNG from the lower-48 states occurred in February 2016. | DOE

Lepercq, who is also on the board of directors of a newly formed U.S.-based HyDeal coalition, said hydrogen is the only real answer.

He said most of the global oil companies are reluctant to invest the billions of dollars or euros to increase production as they did following the 1970s oil crises because they fear the investments will become stranded assets.

“There needs to be a shock therapy,” he said, referring to the governments of industrialized nations. “We’re talking about hundreds of gigawatts that need to be deployed [to produce green hydrogen] very quickly, if the U.S. wants to avert that … tragic situation, which is going to strike Europe in the next couple of months.”

German economist Florian Knobloch | Green Hydrogen Coalition

German economist Florian Knobloch | Green Hydrogen Coalition

In the face of that dire outlook, fellow panelist Florian Knobloch, an economist based in Berlin and adviser to the German federal government, outlined a detailed strategy that Germany has developed to help finance the production of hydrogen globally, with contracts to buy it via pipeline or vessels.

German gas prices have skyrocketed 400% in the last year. Knobloch said the government has developed a plan to assist consumers and industry with soaring energy bills this winter. Those subsidies will cost 4% of GNP, he said.

“We have to be quite realistic [that] hydrogen won’t help us to come through the next two winters,” he said, adding that natural gas imports from the U.S. and elsewhere are crucial.

The government’s plan is to push for the use of hydrogen in the hard-to-abate sectors such as heavy industry, steelmaking and chemicals, and heavy transportation. He said the government does not see the value at this point of heating buildings with hydrogen.

But Germany will remain an energy importer indefinitely, he said.

“We will be relying on hydrogen imports at massive scales, which is why we are planning for actually creating these hydrogen production facilities around the globe already, because hydrogen is a new market and we can’t just wait for hydrogen production facilities to pop up around the globe.”