FERC’s proposed overhaul of its transmission planning and cost allocation rules received mostly supportive comments from industry stakeholders, but some criticized its requirements as overly prescriptive and said 20-year planning horizons could lead to speculative and unnecessary projects.

Stakeholders also disagreed sharply over whether the commission should reinstitute a federal right of first refusal (ROFR) for incumbent transmission owners.

More than 180 comments had been filed by utilities, public interest groups, industrial consumers, RTOs and ISOs and state officials by Wednesday’s 5 p.m. ET deadline (RM21-17). Reply comments are due Sept. 19.

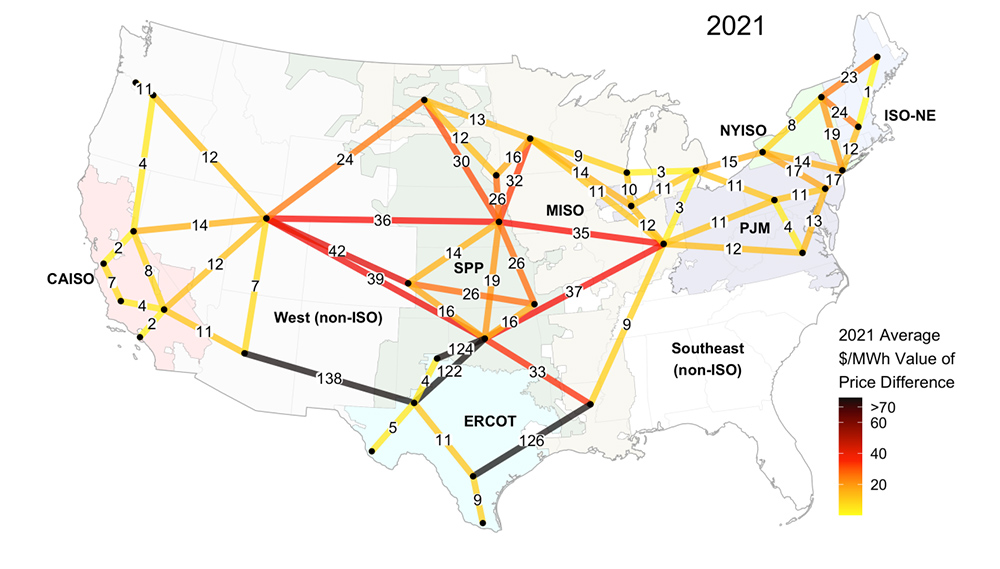

Congestion across regions is often higher than congestion within regions, suggesting interregional transmission could produce economic gains, Lawrence Berkeley National Laboratory found. | Lawrence Berkeley National Laboratory

Congestion across regions is often higher than congestion within regions, suggesting interregional transmission could produce economic gains, Lawrence Berkeley National Laboratory found. | Lawrence Berkeley National LaboratoryThe Notice of Proposed Rulemaking, approved by the commission April 21 on a 4-1 vote, would direct transmission providers to identify infrastructure needs on a long-term, forward-looking basis and propose a list of benefits on which they would base their selections of proposed projects.

The NOPR said the new rules would help planning entities prepare for the growth of renewables, new sources of demand such as electric vehicles and extreme weather events, expected to increase as climate change worsens. (See FERC Issues 1st Proposal out of Transmission Proceeding.)

As always, numerous commenters urged the commission to allow regional flexibility and not to impede innovations already being pursued.

The ISO/RTO Council (IRC), representing the six FERC-regulated grid operators, said “many” of its members already engage in “long-term planning … or have ongoing initiatives” to develop such procedures. MISO, CAISO, NYISO and SPP employ a 20-year horizon in at least some of their planning processes, while PJM uses 15 years and ISO-NE uses 10 years, the IRC said.

The IRC said the commission was “overly prescriptive” on some issues.

“The proposed rule is very focused on process but needs to provide more clarity on how these processes produce actionable results,” the IRC said. “Without discretion to adapt the scenarios, factors and benefits to regional circumstances, the final rule could end up leading to more conflict, rather than useful transmission planning for needed infrastructure. Instead of prescribing detailed procedures, the IRC believes that the final rule should state high-level, long-term planning principles that transmission planners must consider, and then authorize them to craft their own processes that are tailored to their regional needs.”

ISO-NE cautioned the commission against setting uniform implementation requirements for long-term scenario analyses or “hardwiring these details into the region’s tariff.”

“In ISO’s experience with transmission planning based on scenario analysis, these actions will limit the efficacy of the studies,” it said.

SPP added: “If the commission specifies requirements that are expansive in scope and prescriptive in detail, this could become duplicative with SPP’s current processes and initiatives and place unnecessary burden on the future state of SPP planning.”

20-Year Planning Horizon

Commenters — including Minnesota’s Public Utilities Commission and Department of Commerce, the SPP Market Monitoring Unit and the U.S. Department of Energy — endorsed FERC’s call for a minimum 20-year time horizon for transmission planning, with reassessments and revisions to the scenarios at least every three years.

“Traditional transmission solutions that benefit an entire region can take more than a decade to site, permit, and construct and require planning that is more than a decade into the future. Creating long-term scenarios that are at least 20 years into the future will capture power sector changes that occur during transmission development,” DOE said. “However, for the evaluation period, the department encourages the commission to consider requiring an evaluation of transmission costs and benefits over a minimum of 30 years after in-service dates rather than the 20 years proposed in the NOPR.”

But others, including the Nebraska Power Review Board, said any 20-year horizon should be used only for guidance and not to identify transmission upgrades.

“While there is no crystal ball when it comes to transmission planning for the future, PJM continues to believe a 15-year planning horizon allows for sufficient time to identify, plan, and obtain siting and permitting approval and to construct regional transmission facilities while reducing input assumption risks associated with a 20-year horizon,” the RTO said.

Calpine Hay Road Energy Center, Wilmington, Del. | © RTO Insider LLC

Calpine Hay Road Energy Center, Wilmington, Del. | © RTO Insider LLC

Industrial Energy Consumers of America, the American Forest & Paper Association, the PJM Industrial Customer Coalition and the Coalition of MISO Transmission Customers said “a 20-year planning horizon for new transmission has not been shown to be just and reasonable.”

NRG Energy (NYSE:NRG) said a 20-year planning horizon should be “only for purely informational purposes and not as a basis to mandatorily allocate investment costs.” It said a 10-year maximum planning horizon was more appropriate when applying involuntary cost allocation.

“While it is true that transmission development takes time and thus can be served by a longer view forward, it is also true that identifying a transmission project solution up to 20 years in the future could prove to be problematically speculative,” said the Electric Power Supply Association (EPSA). “A longer view could also lock in a specific approach to the detriment of any other solution that could be developed on a more timely basis or close the door to options for a transmission project that does not reach the final phase of development, which is all the more likely decades out. This could also prove to be short-sighted based on the pace of technological change.”

WIRES, which represents transmission providers and developers, said FERC should allow variances from the 20-year requirement “in order to account for regional differences or circumstances that would render such a timeline inappropriate.”

Non-profit GridLab said the NOPR “conflates the planning horizon with the time horizon over which benefits and costs are calculated in benefit-cost analysis (BCA).”

“FERC should clarify the distinction between the two … while maintaining requirements for a 20-year planning horizon and a 20-year period for BCA. The main benefit of a longer planning horizon will likely be capturing changes in transmission value (benefits) over a longer time horizon, which assumes that the value of regional transmission will look very different in the 2030s than it does today. There is indeed evidence that this will be the case, though some of the forces driving change in regional transmission value will increase value (e.g., growth in wind and solar generation, increased risk of extreme events), while others will decrease it (lower cost energy storage, growth in distributed energy resources). The balance can only be determined through rigorous planning and risk assessment.”

Grid-enhancing Technologies

FERC’s support for grid-enhancing technologies received wide support, but the Los Angeles Department of Water and Power (LADWP) said the commission’s singling out of technologies such as dynamic line ratings (DLRs) and advanced power flow control devices (APFC) “seems inappropriate.”

“Transmission providers should have the range of available technologies for evaluation of solutions to meet economic, reliability and security needs in their respective regions,” LADWP said. “A rule that specifically calls out certain technologies as solutions is in danger of being biased, prescriptive and incomplete.”

ISO-NE said FERC should not mandate use of DLRs in lieu of transmission. “This technology cannot substitute for transmission facilities needed to solve system needs,” it said.

Potomac Economics, which performs market monitoring for MISO, NYISO, ISO-NE and ERCOT, said the commission should also require transmission providers to consider transmission switching and network optimization in addition to DLR and APFC. “Like GETs, network optimization can allow a transmission operator to circumvent a limiting transmission facility and substantially mitigate the associated congestion. In this case, investing millions in upgrading such a facility could prove wasteful and inefficient,” it said.

The Working for Advanced Transmission Technologies (WATT) Coalition, a trade group supporting GETs deployment, asked the commission to be more prescriptive, saying it should “specifically require evaluation of APFC for thermal overloads that fall within 50% of the line rating” and for network upgrades for new loads.

Right of First Refusal

There was also no consensus on the commission’s proposal to allow incumbent transmission owners a federal ROFR on regional projects on the condition that they partner with an unaffiliated company with a “meaningful level of participation and investment” in the project. (See ANALYSIS: FERC Giving up on Transmission Competition?)

Among those opposing the proposal were Electricity Consumers Resource Council, which represents large industrial consumers, and EPSA.

“Rather than less independence and accountability, there must be more independence and accountability in regional transmission planning processes to ensure that all options are offered and assessed to meet expected cost and time parameters pursuant to the planning process,” EPSA said.

“Because competition serves to discipline costs, allowing the incumbent transmission utility to exercise a ROFR, even if done in partnership with another entity, could expose load to higher costs,” said the Pennsylvania Public Utility Commission. “To the extent that FERC determines that the elimination of the ROFR by Order No. 1000 resulted in transmission providers focusing on local projects rather than regional projects, the solution is not to appease incumbent transmission owners’ reluctance to engage in competition from nonincumbent transmission developers, by restoring the ROFR. … Such a mechanism clearly grants preferential treatment to the incumbent transmission providers and discriminates against competitive transmission developers, in violation of the principle of an ‘open’ transmission planning process, as articulated in Order No. 890.”

FERC approved the transmission planning NOPR in April. | © RTO Insider LLC

FERC approved the transmission planning NOPR in April. | © RTO Insider LLC

NRG said FERC should withdraw the proposal “and instead eliminate formula ratemaking and other aspects to its regulatory scheme that have caused transmission developers to avoid regional projects.”

Transmission owners and the Edison Electric Institute expressed support for a renewed ROFR.

“Although in some instances, the lack of a ROFR may have arguably increased the number of innovative and/or cost-effective transmission options for consideration, it has also caused delays and limited opportunities for dialogue between transmission developers, market participants and RTOs/ISOs, in addition to not delivering regional transmission projects under the time frames necessary to meet increasingly aggressive climate targets,” WIRES said.

NEPOOL said it does not have a formal position on the conditional ROFR but noted it has previously advocated for competitive processes for transmission development. “To the extent the final rule provides for a conditional ROFR, the commission should maximize the opportunities and requirements for competitive processes to be used within that construct,” NEPOOL said. “This objective could be achieved potentially through guidelines for the criteria to be used in establishing joint ownership and development of regional transmission facilities.”

The Minnesota agencies noted that the state’s legislature has backed a state ROFR and said FERC’s joint ownership model “would create additional complexity but is not likely to provide the anticipated innovation and cost-control benefits.” (See Courts Uphold Minn. ROFR, MISO Cost Allocation.)

“Continuing to clearly align the responsibility to construct, own and maintain the high-voltage transmission system in our state with the related decision-making authority that has been given to the responsible utilities remains the best ownership model, at least for now,” they said.

States’ Roles

State regulators and others urged FERC to let states take a central role in planning.

ISO-NE noted that the New England States Committee on Electricity’s role in determining the range of scenarios to be plugged into the grid operators’ studies. Therefore, ISO-NE said, “the states should be responsible for determining whether to move forward with transmission and the associated cost allocation method, with the ISO playing a supporting, technical role.”

FERC should “explicitly authorize or allow for … greater state involvement in all aspects of policy-based transmission planning — not just the criteria for selecting and methodology for allocating costs of long-term transmission facilities,” ISO-NE said.

“FERC should reframe long-term regional transmission planning as an informational process with no attendant project selection or construction obligations unless the affected state regulators first support such actions consistent with their regulation of the public utilities subject to their respective jurisdictions,” said the Alabama Public Service Commission.

The National Association of State Energy Officials praised FERC’s creation of the Joint Federal-State Task Force on Electric Transmission as a “welcome advancement of federal-state coordination.”

But it said “FERC’s engagement on these issues needs to include additional state agencies, such as state energy offices.”