ARLINGTON, Va. — High-voltage transmission developer Grid United says its proposed North Plains Connector would provide significant reliability capacity benefits to interregional transmission, according to a study.

The study, conducted by Astrapé Consulting, modeled the North Plains Connector as two 1,500-MW HVDC lines connecting SPP and MISO to the Western Interconnection and quantified the project’s ability to increase power system reliability.

Loss-of-load analyses like those performed for new generating facilities indicated a capacity value can be credited to the line. According to the study, when the project’s bi-directional nature and the seasonal diversity among the three regions are considered, it would unlock 3,550 MW of capacity across the three systems, more than the line’s physical capacity.

“You’re probably wondering, ‘Well, how can it be more than what the line is?’” Grid United President Kris Zadlo asked his audience June 26 during an Infocast conference on transmission and interconnection issues.

“It’s due to the bi-directional nature of the lines, so they will provide about 1,750 MW of reliable capacity to pass through the Eastern grid and then it would provide 1,800 MW of capacity for the Western grid,” Zadlo explained.

The study identified the benefits from connecting meteorologically diverse regions whose demand peaks occur at different times of the day or in different seasons. Using the difference in generation and load profiles improves the grid’s reliability on both sides of the project without adding any new capacity and allows it to add an outsized amount of reliability benefit relative to its physical capacity, Grid United said.

Zadlo said the study’s findings were similar to an analysis the developer conducted for MISO of a 2-GW interconnection between MISO South and North.

“They found that a similar interregional line like that would create 3 GW of capacity, 1,500 MW each way,” he said. “When you start building these interregional lines and connect diverse loads and in diverse generation shapes, then we can start sharing energy across the grids. The two areas peak at different times, not only times of the year but during the day because there’s a two-hour time zone.”

As Zadlo told RTO Insider, “The simple way to say it is the grid has to be bigger than the weather.”

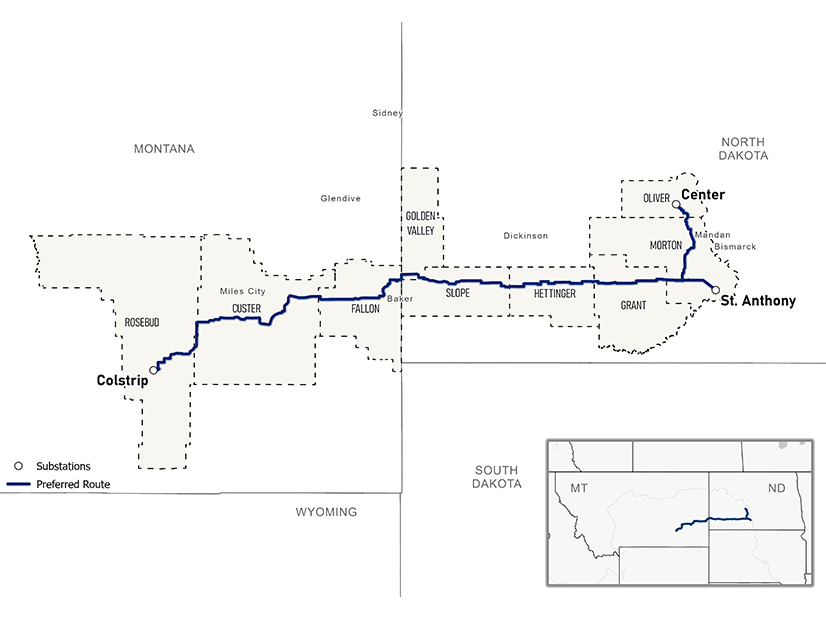

Grid United and utility ALLETE announced the project in February 2023. The 415-mile HVDC transmission line, capable of up to 525 kV, would connect the western and eastern grids in Montana and North Dakota. It would be the first HVDC connection among three regional markets: MISO, SPP and WECC. (See Transmission Project Would Span Across Interconnection Divide.)

The developer’s staff are engaging with the various regulatory bodies that will be pivotal before construction can begin. Zadlo huddled during the Infocast conference with Sheri Haugen-Hoffart, a member of the North Dakota Public Service Commission that is among those who must approve the project.

A Grid United spokesperson said North Plains will have to go through a U.S. Department of Energy environmental review related to its funding and routing process across federal lands. FERC approval also is required, as is that of MISO and SPP, for the merchant project.

SPP said NERC’s planning coordinator responsibilities define its roles related to merchant HVDC lines. The RTO must identify any reliability needs that arise from a facility interconnecting to the system under its functional control, with the developer providing a solution to address those needs before the project goes into service.

MISO said any merchant HVDC project that wants to connect to its system must follow its tariff’s procedures.

Grid United officials said the North Plains project would be paid for by subscribers to the line, which would dead-end into the 1,480-MW coal-fired Colstrip plant in Montana. Western utilities have existing transmission rights from the plant but in the East, the developer would have to rely on bilateral contracts with utilities.