It’s been six weeks since Hurricane Beryl, a Category 1 storm, blasted through the heavily wooded Houston area, toppling trees into distribution lines and knocking out power to nearly 3 million residents.

Electricity has been restored after weeks of recovery efforts, but lawmakers and regulators still are trying to figure out how a puny Cat 1 storm could have caused the devastation that led to long-term outages.

Houston utility CenterPoint Energy has borne the brunt of the scrutiny. Entergy lost several hundred thousand of its own customers in its Texas footprint; however, it had better communications with its customers and an outage tracker that worked.

Texas Attorney General Ken Paxton (R) became just the latest to probe the beleaguered company when he launched an investigation on Aug. 12 over allegations of CenterPoint fraud, waste and “improper use of taxpayer-provided funds” following Beryl. He said any unlawful activity his office uncovers will be met “with the full force of the law.”

Texas Gov. Greg Abbott (R), who said in 2021 just four months after the disastrous winter storm that ERCOT’s grid “is better today than it’s ever been,” has taken a hands-on approach with CenterPoint. He ordered the utility to file a plan outlining its preparation and response practices for the next storm, threatening to cut rates if the response was insufficient. After meeting with CenterPoint executives at the July 31 deadline, he called the plan “inadequate” and said “more must be done [and] faster.”

Abbott also has directed the Public Utility Commission, whose members he appoints, to conduct a “rigorous” study to determine why severe weather events lead to “repeated … power failures” in the Houston area. The PUC brought first-year CEO Jason Wells and other CenterPoint executives in for one hearing and is receiving regular updates from the utility. It plans to report its findings to the legislature by Dec. 1 (56822).

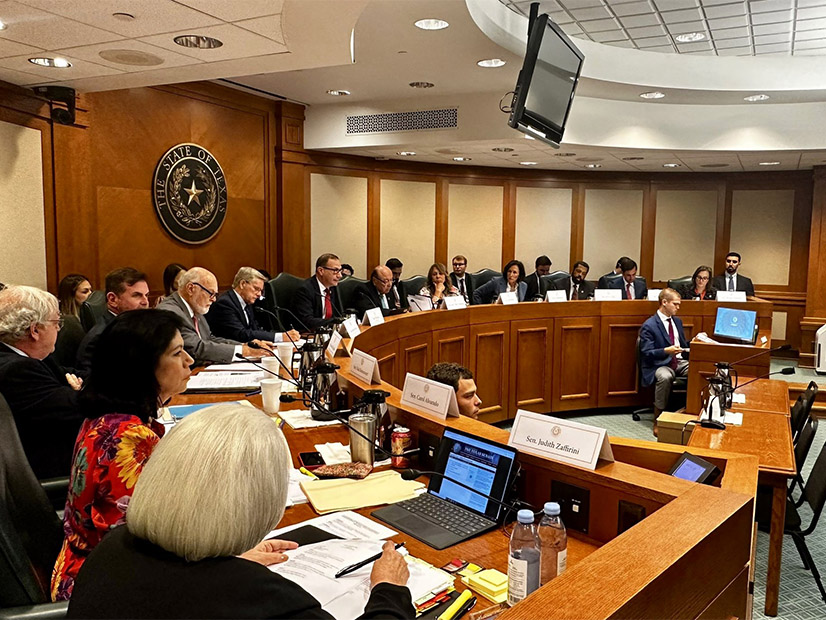

Both of Texas’ legislative houses have joined in the fun and conducted public floggings of the utility’s executives, with most of the ire coming from Houston senators. Wells was asked by Sen. Paul Bettencourt (R) whether he would heed calls for his resignation during a special Senate committee’s July 29 hearing. Noting CenterPoint has laid out 40 actions to immediately begin regaining community trust, Wells said, “I think if I resign today, we lose momentum on the things that are going to have the best possible impact for the greater Houston region.”

Some lawmakers were shocked — shocked — to learn during the hearing that CenterPoint’s regulated business model allows it to recover storm-restoration, vegetation management, line maintenance and other costs in its rate cases, while earning a 9.4% return on capital investments. They called for more accountability from the utility, threatening it with clawing back profits, trimming rates, shrinking its service territory and implementing performance-based ratemaking.

“It’s a pretty amazing business model,” Sen. Lois Kolkhorst (R) told CenterPoint execs. “Most of us that run a business, we don’t get reimbursements for our expenses.”

However, it’s CenterPoint’s $800 million lease agreement for 15 large (32 MW) mobile generators and several smaller ones in 2021 that has attracted much of the politicians’ focus. The utility said the larger generators could support restoration efforts after power outages. However, they sat unused after Beryl, as they have since being leased. The large units are so heavy they need permits to be transported and take days to set up.

Senators derided the generators as “quasi-mobile.” Wells defended the lease agreement, which may have relied on personal relationships, saying the generators are necessary when there is another load shed event as occurred during the 2021 winter storm.

“I find it troubling that you’ve been using the rate of return on something that you’re not using,” said Sen. Charles Schwertner (R), the committee’s chair. “It doesn’t smell good at all.”

“That’s fraud!” Bettencourt charged, threatening to claw back rates related to the lease agreement.

As the senators piled on Wells, Jason Ryan, CenterPoint’s executive vice president of regulatory services and government affairs, took to social media to say the large generators are a necessary tool in the toolbox to avoid a repeat of Winter Storm Uri.

“Like our own toolboxes at home, not every tool is used in every situation, and not every emergency generation asset in our fleet is likely to be used in any one event,” he wrote on X, formerly known as Twitter. Ryan’s account no longer exists.

Sen. Phil King (R), who wrote the legislation that cleared the way for regulated wires provider CenterPoint to acquire generation, apologized to the committee after Wells’ testimony.

“The intent was to simply allow there to be very mobile storm response generation,” he said. “It was never intended, at least by me, to allow it to be used for large generation of the nature we’ve talked about today. I feel like I’ve been taken advantage of, to be honest. We will fix that going forward.”

Following the hearing, Lt. Gov. Dan Patrick (R), who essentially runs the Senate, sent a letter to the PUC urging it to claw back the $800 million to ensure ratepayers do not pay for CenterPoint’s “mismanagement.” Schwertner promised lawmakers “will hold CenterPoint accountable for lining its pockets at the expense of its customers” in the coming months.

Apparently, renegotiating the generators’ contract is not an option. Ryan told the PUC during its Aug. 15 open meeting that CenterPoint can’t break the contract unless the vendor, Life Cycle Power, fails to meet its obligations. That left the commissioners incredulous.

“You entered into a contract you can’t terminate unless there’s vendor non-performance,” Commissioner Lori Cobos told Ryan. “It just seems like we’re in this circular place where you all are coming across like your hands are tied to this contract.”

Energy consultant Alison Silverstein, a former PUC and FERC adviser, said the easiest way for Texas regulators to punish CenterPoint would be to reopen the mobile generation case and assess whether CenterPoint provided “accurate or misleading” information about the generation assets and their intended purpose.

“This could be a pretty fast proceeding and could look like enough of a spanking to make customers and politicians happy,” Silverstein told RTO Insider.

She dispelled the notion that a new wires provider could be handed the franchise for the nation’s fourth-largest city.

“Outside of Florida, no utilities are doing a competent job dealing with hurricane-heavy service geographies,” Silverstein said.

Performance-based ratemaking could be one option, she said, by aligning all utility incentives (profits, cost recovery, executive compensation) with reliability, resilience and affordability. At the same time, Silverstein doubted the PUC would revise the state’s ratemaking rules on its own.

“This would be a long and boring process that won’t have the speed, bloodletting and circus elements or assured outcome that would make local and state politicians happy,” she said.

“I think we need a comprehensive look at how we fund utilities, how they prepare for storms,” PUC Chair Thomas Gleeson said during the Senate hearing.

The day after that hearing, CenterPoint held its quarterly earnings call with financial analysts and reported a 93.2% increase in earnings. It said it planned to ask the PUC to recover between $1.5 billion and $1.7 billion in Beryl storm costs.

“That dog won’t hunt,” Sen. Carol Alvarado (D) said on X.

Two days later, CenterPoint withdrew both its $2.3 billion resiliency plan filed in April (56548) and its rate-increase request to recover $6 billion of investments made since its last rate proceeding in 2019 and expand its return-on-equity (56211). The utility had been negotiating settlements in both dockets.

However, on Aug. 16, the state Office of Administrative Hearings rejected the rate case’s withdrawal. The court said the withdrawal would conflict with state law requiring investor-owned utilities in the ERCOT region to file a comprehensive rate review within 48 months of their most recent rate proceeding.

Consumer groups opposed CenterPoint’s request, saying it would prevent them from clawing back certain expenditures.

Since then, CenterPoint has continued to try to make amends. The utility rolled out its Greater Houston Resilience Initiative that tracks its progress in substituting composite poles for wood structures and its vegetation management program; unveiling a new cloud-based outage map to replace its locally hosted version that crashed during a derecho in May; fired its senior vice president of electric business; beefed up its social media presence, with more than a dozen posts on X on Aug. 17-18 alone; and held the first of 16 community open houses through September.

PUC staff is attending each of the open houses and will lead a public work session in Houston Oct. 5. The commission also created a web tool to gather feedback from Houston residents.

“What was good enough 15 years ago is not good enough anymore,” Gleeson told the Senate committee. “We have not held them to a standard that is sufficient. I think we need a comprehensive look at how we fund utilities and how they prepare for storms.”