The U.S. Department of Energy is not deterred by a slump in heat pump sales in the U.S. market.

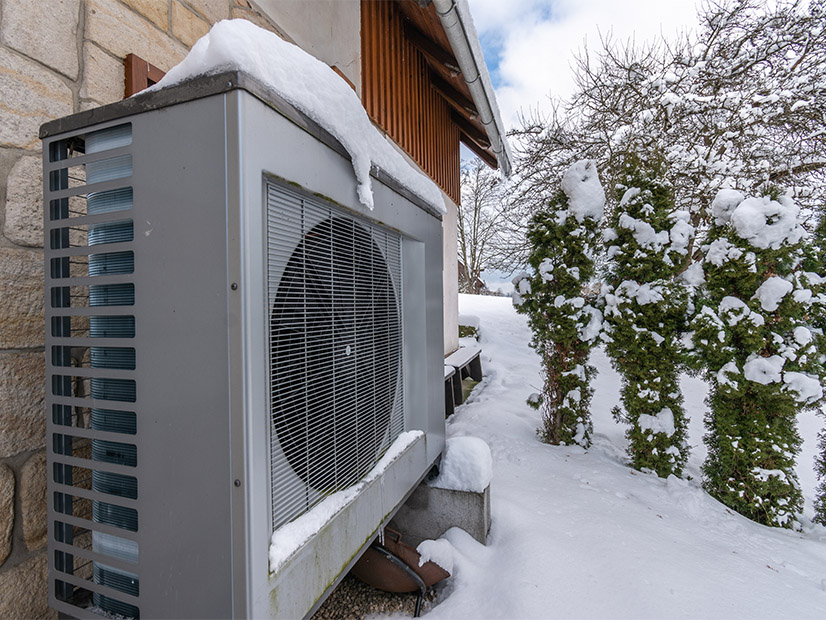

Winter is coming. While heat pumps sales are down, they still outstrip sales of gas furnaces. And DOE has a new generation of cold weather heat pumps field-tested and ready for market to keep homes warm and comfortable, even in subfreezing weather.

The eight companies taking part in DOE’s Residential Cold Climate Heat Pump (CCHP) Challenge have completed rigorous laboratory and field testing on their new models, which can keep a home warm and comfortable at 5 degrees Fahrenheit (-15 degrees Celsius) or even lower, according to an Oct. 23 press release. (See DOE Partners with HVAC Industry on Cold Climate Heat Pumps.)

One of the eight, Carrier, started manufacturing the CCHP it developed for the challenge in September and expects to start shipping to its distributors in December, said Michael Carter, associate director of outdoor product management.

The company has a full range of CCHPs on its website, but Carter said the standards required for the DOE challenge made the company stretch. While many CCHPs lose some heating capacity as temperatures fall, operating at 40% to 70% at 5 degrees F, DOE wanted 100% capacity at that temperature, he said.

To hit that target, the company fine-tuned its systems so the indoor and outdoor components of the heat pump “communicate seamlessly,” Carter said in a phone interview with NetZero Insider. Larger coils also were a key change, he said. “[The] more coil, the more heat you’re able to generate or trap from the outdoor system and then compress more [efficiently].”

Both Carrier and Lennox International, another challenge participant, stressed the role of variable speed components. “Variable speed drive technology optimizes compressor and fan speed to provide the demanded capacity at any given temperature with optimized efficiency,” Ajay Iyengar, vice president of advanced technology, said in an email.

Lennox also expects to bring its new model to market in the coming months, Iyengar said.

The other companies participating in the challenge included Bosch, Daikin, Johnson Controls, Midea, Rheem and Trane Technologies.

Heat pumps are seen as a core technology for cutting greenhouse gas emissions from the U.S. building stock, where space and water heating and cooling account for 40% of the country’s primary energy use, according to a DOE fact sheet.

Ram Narayanamurthy, deputy director of DOE’s Building Technologies Office, said when the department launched the challenge in 2021, the initial goal was to get as many of the major companies in the HVAC industry as possible onboard to improve the performance of residential cold climate heat pumps.

While the companies did not work together, “they all came out with products that they can get into the market,” Narayanamurthy said.

Next up, DOE is going to tackle cold climate heat pumps installed on the rooftops of commercial buildings, again drawing in leading companies, including AAON, Addison, Carrier, Daikin, Johnson Controls, Lennox, LG, Rheem and Trane.

Working with DOE and the National Laboratories, the companies will create prototypes to be tested in the lab for performance and durability, followed by field testing on rooftops owned by major corporations — like Amazon, General Motors and Ikea — according to the DOE press release. Dubbed the Commercial Building Heat Pump Accelerator, the initiative is slated to run through 2027.

Happy with Heat Pumps

In lab testing, all the new heat pumps were capable of full operation at 5 degrees F (-15 degrees Celsius), with some operating at temperatures as low as -15 degrees F (-26 degrees C), DOE says.

The field tests put 23 prototypes from the companies at 23 sites in northern states and Canada, according to Vrushali Mendon, a senior mechanical engineer at the Pacific Northwest National Laboratory and principal investigator for the tests.

Surveys with the homeowners participating in the test found that most were satisfied with the heat pumps, Mendon said. “They did not [have] any issues with either the heat pump not being able to provide enough heat or any kind of comfort issues, any kind of noise issues.”

For Carrier, the field tests provided critical feedback on potential problems with installing their new model in homes with older duct systems, Carter said. Older homes “may not have been built for these types of systems. … One of the lessons learned from that is that we are really targeting this product more toward the residential new construction market.”

DOE’s push on heat pumps comes as U.S. sales have hit a slump, falling about 16% in 2023, although gaining back some ground this year, with sales up about 5.4%, according to August figures from the Air Conditioning, Heating and Refrigeration Institute.

Various analysts have pointed to high electricity prices and high interest rates as two factors that have cooled the market, along with a lack of contractors who are well trained in installing and maintaining CCHPs.

But Carter says Carrier has not seen any drop in sales, and Narayanamurthy says the 2023 drop could be part of normal sales cycles.

“This is an industry where sales can go up and down,” he said. “It’s an industry that’s very driven by consumer sentiment.”

The figures to look at are heat pump sales versus gas furnaces, and heat pumps have led the market for the past three years, he said. “I think that’s really what we are looking at, and … we expect that trend to continue.”