The first-ever offshore wind lease auction for the Gulf of Maine resulted in the sale of four offshore lease areas to two developers, bringing in a total of about $21.9 million.

The auction offered eight lease areas in total, with the potential to provide 13 GW of power. (See BOEM Announces Gulf of Maine Offshore Wind Lease Sale.) The four sold lease areas could host enough offshore wind generation to power 2.3 million homes, the U.S. Department of the Interior said in the Oct. 29 announcement.

Avangrid Renewables and Invenergy NE Offshore Wind each provisionally won two lease areas, which range in size from 97,854 acres to 124,897 acres.

Avangrid CEO Pedro Azagra said the company’s leases provide for the potential development of about 3 GW of floating offshore wind.

“Securing these lease areas provides a unique opportunity to advance our growing business at a significant value and reinforces our unwavering commitment to helping the New England region meet its growing need for reliable, clean energy,” Azagra said.

“With today’s lease sale building on earlier deepwater auctions on the West Coast, the United States is truly on track to become a global leader in floating offshore wind technology,” said Anne Reynolds, vice president for offshore wind at American Clean Power.

While all commercial offshore wind farms currently under construction or in operation in the U.S. feature fixed-foundation technology, farms developed in the deeper waters in the Gulf of Maine will need to rely on floating technology.

Although floating offshore wind technology is in its early stages — the world’s largest floating installation has an 88-MW nameplate capacity — its development will be key to meeting state and federal clean energy goals, due to the limited availability of viable fixed-bottom locations.

The U.S. Bureau of Ocean Energy Management (BOEM) in August approved a floating wind research lease for the state of Maine, which eventually could provide the state with 144 MW of offshore wind. (See Maine Approved for Floating Wind Research Lease.)

The $21.9-million price tag is significantly less than BOEM’s 2022 California lease sale, which also was centered around floating technology. The California leases, which cover a smaller overall footprint than the Gulf of Maine leases, brought in $757 million. (See First West Coast Offshore Wind Auction Fetches $757M.)

The offshore wind industry’s struggles to scale up over the past two years may have cooled bidder interest in new lease areas. An Oregon offshore wind lease auction scheduled for Oct. 15 was postponed due to a lack of interest from potential bidders, while BOEM canceled a Gulf of Mexico auction planned for September. (See BOEM Postpones Oregon Offshore Wind Auction and BOEM Cancels Gulf of Mexico Wind Lease Auction.)

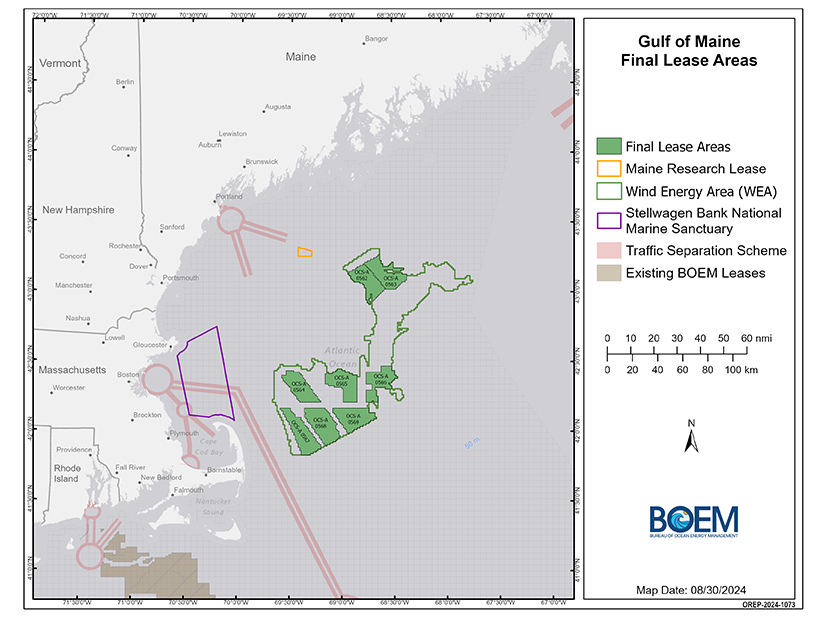

Avangrid’s lease areas (OCS-564 and OCS-568) are located about 34 miles from Massachusetts and feature “strong wind speeds” along with “relatively shallow waters within the limits of existing floating wind technology” and multiple potential interconnection points, Avangrid said.

While Avangrid’s lease areas are located adjacent to each other east of Massachusetts, Invenergy’s lease areas bookend the northeast and southeast corners of the wind energy area. Invenergy’s southern lease (OCS-567) is located about 25 miles east of Massachusetts, while its northern lease (OCS-562) is located southeast of Portland, Maine, about 53 miles offshore.

Reynolds specifically praised Maine Gov. Janet Mills (D) for the state’s “proactive approach to floating offshore wind technology.”

In 2023, Maine passed legislation (LD 1895) authorizing the procurement of at least 3,000 MW of offshore wind power “in proximate federal waters” by the end of 2040. The law directs the Governor’s Energy Office to submit its first solicitation to the Public Utilities Commission by July 2025, with the PUC set to issue a request for proposals in January 2026.

Massachusetts also is well located to purchase power from the Gulf of Maine areas, and the state has indicated it will need to procure at least 10 GW of power from offshore wind in the Gulf of Maine to meet its climate targets.

Developers recently broke ground on a new offshore wind terminal in the city of Salem, Massachusetts, which is located in relatively close proximity to the southern Gulf of Maine lease areas. (See Mass. Breaks Ground on Salem Offshore Wind Terminal.)

The availability of future leases in the area could be affected by the outcome of the presidential election in November, as Republican nominee Donald Trump has expressed hostility toward offshore wind. The Department of the Interior has another lease auction scheduled for the Gulf of Maine in 2028.