Stakeholders Sound off on Market Design Framework

ERCOT’s Technical Advisory Committee held its first meeting of 2025 on Jan. 22, with the biggest chunk of the meeting devoted to discussing the grid operator’s proposed market design framework.

The framework dates back to August 2024, when ERCOT CEO Pablo Vegas presented it to the Board of Directors. It is made up of very broad guidelines to use as the grid operator develops rules and regulations, said Vice President of Commercial Operations Keith Collins.

“What we see is that while reliability is the organization’s primary objective, cost should always be considered,” Collins said. “So, I think that hopefully will set us up for some of the discussion debate that will happen about what the meaning of this balance is.”

ERCOT already had gotten comments from six sets of stakeholders on the document, and Collins invited them to reiterate what they wrote at the TAC meeting.

“Our comments are meant to be very generally supportive of the framework and the intent behind the framework, because it can be helpful to have this sort of tool to help socialize and coordinate thinking about market design changes,” said Ned Bonskowski of Vistra.

However, Vistra wanted to make sure the policy framework is not resetting all of the work the Texas legislature and Public Utility Commission have put into the markets since the February 2021 winter storm, or even further back, he added.

The PUC shelved the performance credit mechanism in December, and ERCOT is working on implementing the real-time co-optimization (RTC) of energy and ancillary services, which means stakeholders have to look for some new policies to improve the system.

“We want to choose among the best tools that we have available to us and use those tools efficiently,” Bonskowski said. “But we also don’t want to, for instance, give up on trying to just because we may not have the exact perfect tool that we would like to have for a situation. We should not let the perfect be the enemy of the good.”

The Lower Colorado River Authority’s Blake Holt saw the document as providing some clarity to those who are not in the “stakeholder trenches” regularly, but he had questions on how the document would influence policy implementation at ERCOT.

“How does ERCOT intend to resolve conflicts between competing attributes and timelines?” Holt said. “For example, [the reliability unit commitment] enhances reliability for the hours utilized. However, excessive use of the tool can lead to wear and tear on a unit and worsen reliability in the future, not to mention the out-of-market action leads to flawed and inefficient price formation.”

One basic issue the document brought up for many is the tension between affordability and reliability, which is a universal concern in the power industry.

“We recognize there are tradeoffs between the two, and we currently support the stance of conservative operations and understand that operating more reliability or more reliably comes with increased cost,” Holt said. “We believe the best way to support this increased cost is through markets in which these operational reserves are currently valued and reflected in as procurement.”

Collins agreed the framework could be useful for people who are not always in stakeholder meetings to use as a way to help wade through the information that is produced at them.

The city of Eastland’s Mark Dreyfus questioned the purpose of the document, noting that the stakeholder process implements the nitty gritty details of policy. While they are complicated, many people are involved, and ERCOT’s board has the grid operator’s entire staff to explain things to them.

“Consumers, as a market segment, have always supported competitive markets, because we know that the competitive market — as reflected in the law, interpreted through the commission rules and into the protocols — is the best way to provide reliability at lowest cost to consumers,” Dreyfus said.

The Texas Advanced Energy Business Alliance’s Doug Pietrucha said his group agrees that markets are the best way to ensure the right balance between reliability and affordability, but it wants to make sure that technology neutrality is a key part of market design.

“The participation in various services should be based on the attributes that different technologies can provide, and the goal of the service shouldn’t be to be designed around the attributes of any one particular technology,” Pietrucha said.

Mark Bruce, principal at Cratylus Advisors, questioned the value of the document, noting that policy is determined elsewhere.

“ERCOT doesn’t get to make high-level, aspirational policy determinations and documents like this,” Bruce said. “All this talk about competitiveness, that issue has been settled since Sept. 1, 1999,” referring to the law that restructured Texas’ utility industry.

Collins disagreed with that assessment, noting that he has worked around the country in other markets where they do not necessarily wait for FERC for directions.

“You can blaze a path that that can help the commission determine … a reasonable approach to implementing reliability,” Collins said. “It’s one thing to say you want a reliable market. Well, how do you want a reliable market? How do you want competitive markets? And what we’re seeing here are things that help emphasize how you can achieve that.”

Large Load Interconnection Report

In other business, TAC got an update on the number of large loads lined up to connect to the ERCOT grid.

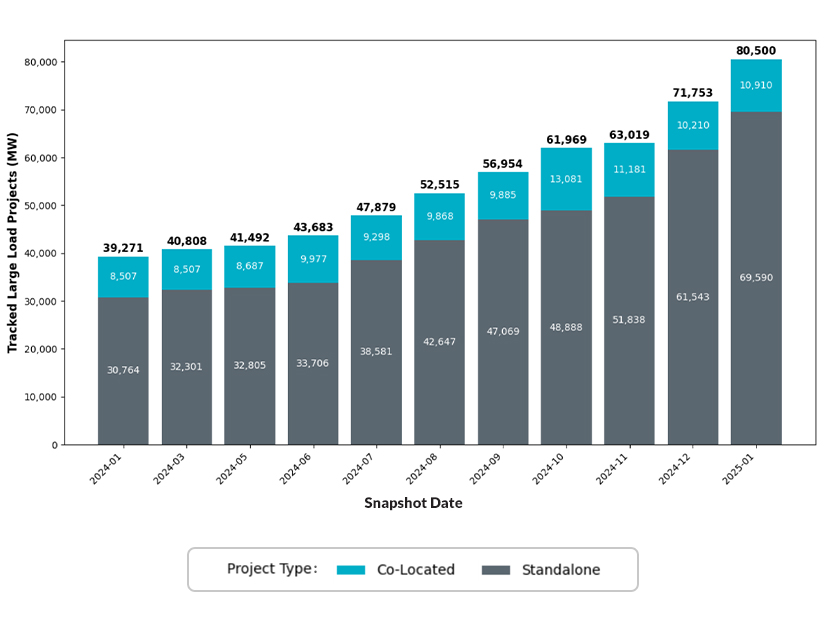

A combination of new standalone projects and those co-located with generation, net of a few cancellations, has ramped up the queue by 17,481 MW since TAC’s last meeting in November. With some rule changes anticipated, interconnect requests for loads energizing more than two years in the future have gone up significantly in the past two months, according to an ERCOT report.

ERCOT has added 5,229 MW of large loads from 2022 through 2024, and that could grow to more than 80,500 MW by 2030, the report says. Projects representing more than 14,000 MW are interested in connecting to the grid this year, though most of that — and most of the 80 GW for 2030 — is under ERCOT review or has yet to submit enough information for the grid operator to even start a review.

Votes on Leadership, Transmission, Rule Changes

The meeting opened up with TAC members voting to give Caitlin Smith of Jupiter Power another year as its chair.

The committee elected a new vice chair, with Martha Henson of Oncor taking that role over after Collin Martin, also of Oncor, stepped down at its last meeting. (See ERCOT Technical Advisory Committee Briefs: Nov. 20, 2024.)

TAC voted to recommend three transmission projects from Oncor that are big enough to require approval from the board:

-

- The Forney 345/138-kV Switch Rebuild Project, which costs $103.5 million, to address reliability issues in Kaufman County and will not require a certificate of convenience and necessity (CCN).

- The Wilmer 345/138-kV Switch Project, which costs $158.2 million, to address reliability issues in Dallas, Kaufman and Ellis counties, which will require a CCN.

- The Venus Switch to Sam Switch 345-kV Line Project, which costs $118.9 million, to address reliability issues in Ellis and Hill counties and will not require a CCN.

In addition to the three transmission projects, TAC also voted on many rule changes, but the only one that generated debate was NPRR 1250, which is needed for ERCOT to end its renewable portfolio standard implementation practices. Others were put on a combination ballot and were approved unanimously.

The legislature passed HB 1500 to end the RPS, which effectively has been moot for more than a decade, as the Texas grid has long had more renewables than was ever required by the standard. ERCOT still will run a voluntary renewable energy credit (REC) trading program but will end the mandatory REC program for RPS compliance.

Vistra’s Bonskowski abstained from voting for NPRR 1250 because it did not eliminate several compliance provisions, but he noted they’re going to be dealt with in a future rule change.