Another mature offshore wind project is facing financial write-downs and a potential yearslong delay in the wake of the Trump administration’s moves to shut the sector down.

The partners behind SouthCoast Wind said they would take a $278 million impairment on their planned wind farm off the Massachusetts coast and place development on hold for as many as four years because of the uncertainty created by President Donald Trump’s Day 1 executive order targeting wind power. (See Critics Slam Trump’s Freeze on New OSW Leases.)

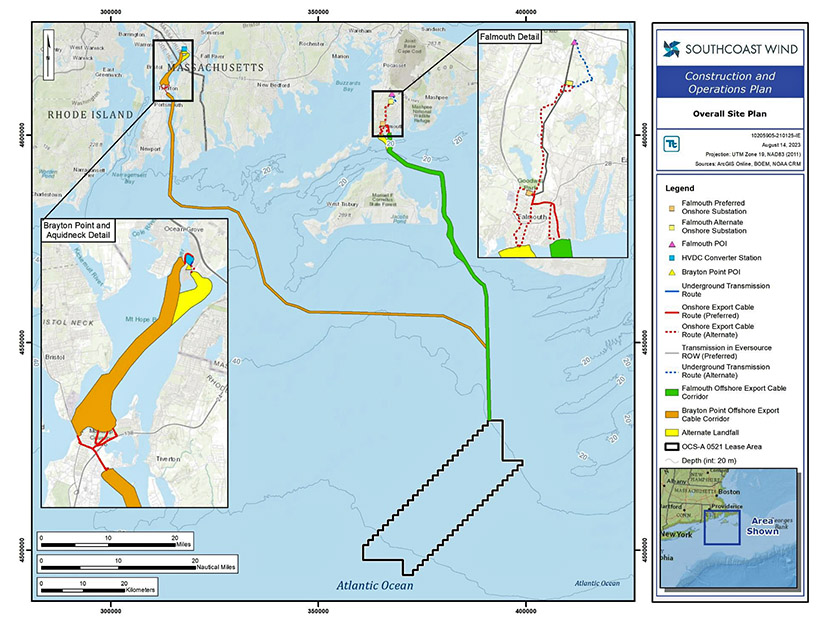

SouthCoast is at a late stage of development compared with many of the other proposals in U.S. waters. On Dec. 20, the Bureau of Ocean Energy Management issued a Record of Decision in its favor. It was the 11th offshore wind project greenlit, all of them during the Biden administration, and it seems likely to be the last for years to come.

BOEM subsequently approved SouthCoast’s construction and operations plan on Jan. 17 — the last business day before Trump was inaugurated and issued an executive order casting new uncertainty upon what once was a rapidly growing renewable energy sector.

EDP Renewables and Engie are 50/50 partners in Ocean Winds, which is developing SouthCoast. They cited the U.S. market uncertainty Feb. 26 and 27, respectively, as they discussed the possible delay and resulting impairment with financial analysts.

EDP CEO Miguel Stilwell d’Andrade said during an investor call that in the wake of the executive order, “We’ve decided to just be more prudent around the timing. … If we get a better scenario, then that would be great. We could have taken a two-year delay, but we took a four-year one.”

“We feel that there’s probably going to be delay in development. [SouthCoast] is quite advanced. It’s a great project. So if we pause it, it’s OK; you know, let’s see what happens in four years,” Engie CEO Catherine MacGregor said.

Ocean Winds North America CEO Michael Brown later said via email: “The impairment decision is a precautionary measure based on a scenario of potential delays in its projects. Ocean Winds strongly believes in the potential of offshore wind to generate significant economic activity and provide abundant, domestic energy to meet rapidly growing demand in the U.S. and remains confident in finding a path forward in coordination with all relevant authorities in the upcoming months.”

This is the narrative adopted by the U.S. renewables industry after Election Day: The country needs the electricity and the economic benefits of renewable energy development. But there is no indication so far the argument has swayed the president.

SouthCoast in September was selected in an innovative joint solicitation by the three southern New England states to provide 1,087 MW to Massachusetts and 200 MW to Rhode Island.

But nearly six months later, the parties still are negotiating power purchase agreements. The terms have not been disclosed, but they are likely to be expensive: D’Andrade hinted EDP’s bid was higher than $150/MWh.

Massachusetts officials were not able to provide an update at press time, and Rhode Island officials did not return a request for comment.

This is the second go-round for SouthCoast Wind, which was selected in an earlier Massachusetts solicitation under the name Mayflower Wind. Like most other wind projects contracted off the Northeast coast, it could not proceed to construction amid the soaring costs and supply chain constraints of 2022/23 under terms of PPAs negotiated years earlier. After negotiations, SouthCoast canceled the original PPAs and rebid its project.

The reset may prove costly, as U.S. leadership since has passed from an ardent wind power supporter to an adamant foe.

Trump’s executive order immediately halts only future wind energy leasing, but it directs a review and potential revocation of existing lessees’ permits — an implied but dire threat to an industry that already was struggling before he was elected.