With one notable exception, the offshore wind industry is on track for a global rebound, Rystad Energy predicts in its 2025 outlook, released March 2.

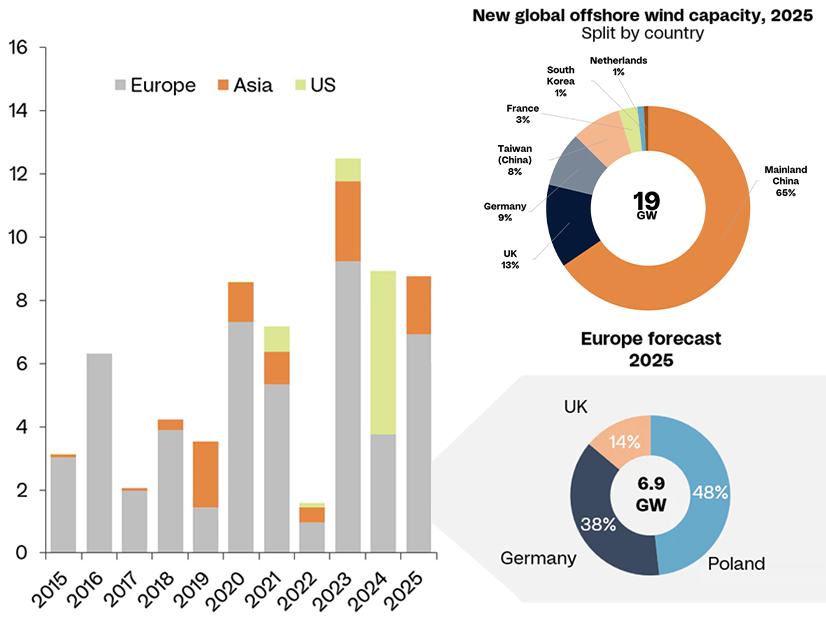

The energy research and intelligence company expects capacity additions to reach 19 GW — substantially more than the roughly 8 GW and 10 GW seen in 2024 and 2023, respectively — and expects investment to reach $80 billion.

Mainland China, the world’s largest offshore wind market, will account for more than 12 GW of the total. With South Korea and Taiwan added in, Rystad projects 74% of 2025 offshore generation capacity additions will be in Asian waters. The U.K., Germany, France and Netherlands account for the remaining 26%.

The world’s largest economy, which until very recently offered robust policy support for offshore wind development, is zeroed out in Rystad’s 2025 forecast of capacity additions.

“U.S. federal policy is creating significant global ripple effects, hindering offshore wind development, especially where a large portion of auctioned capacity lies,” Petra Manuel, Rystad’s senior offshore wind analyst, said in announcing the outlook. “President Donald Trump’s January memorandum halting new leasing and approvals on the Outer Continental Shelf, citing environmental and safety concerns, could last throughout his term, pausing new developments and creating continued uncertainty for ongoing projects.”

One U.S. offshore wind project now under construction, the 800-MW Vineyard Wind 1, could potentially have a 2025 commercial operation date, but it has experienced repeated delays.

Four other projects are in the works: Offshore and onshore construction are underway on Revolution Wind and Coastal Virginia Offshore Wind, while onshore work has begun for Sunrise Wind and Empire Wind 1.

None of the four are scheduled to be completed this year.

Trump’s Jan. 20 memorandum suspended new offshore wind leasing and directed “a comprehensive review of the ecological, economic and environmental necessity of terminating or amending any existing wind energy leases,” injecting a new degree of risk and uncertainty into an industry already struggling to build momentum in the U.S.

While China will dominate construction completion in 2025, Rystad expects that European projects will represent the bulk of final investment decisions (FIDs) made in 2025 for future construction starts — 9.5 GW in total, with Poland, Germany and the U.K. accounting for 6.9 GW. Worldwide, 2025 FIDs are expected to be about equal to those of 2024.

Another barometer of future planning is site leasing. Rystad notes that seabed areas holding a record 55 GW of potential capacity were offered at auction in 2025 outside China. But not all of that capacity found a buyer, particularly in the U.S., where two of four auctions were called off before being held and a third drew bids for only half the lease areas offered.

Rystad expects significantly less capacity to be offered at auction in 2025 — about 30 to 40 GW worldwide, which would be in line with activity seen in 2021 and 2022.