Other CAISO Committees

CAISO continues to work to revise the rules around how congestion revenues will be allocated to participants in the ISO’s Extended Day-Ahead Market, which will be launched in spring 2026.

CAISO is finalizing a set of changes to its resource adequacy program, with plans to vote on three proposals at an upcoming Board of Governors meeting,

CAISO’s Market Monitor is concerned about potential gaming practices and inefficient bidding behavior in the ISO’s bid cost recovery process for battery storage resources.

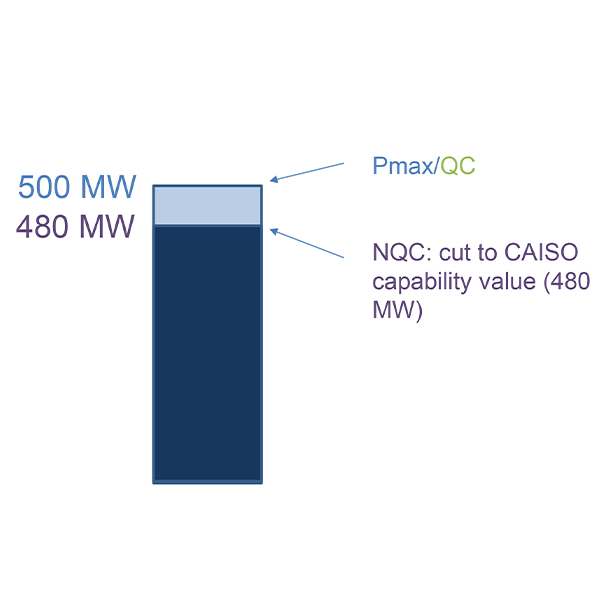

CAISO is proposing a new method for verifying how much energy thermal resources can provide during peak conditions on California’s grid for resource adequacy purposes.

CAISO sidelined a proposal to provide an additional market run for gas resources due to a lack of information on the subject and a need for operational experience with the ISO’s Extended Day-Ahead Market.

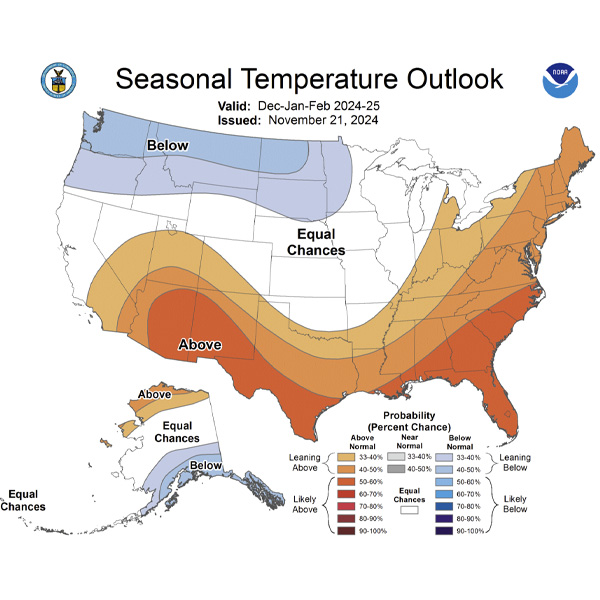

CAISO, California and other parts of the West head into 2025 with a heavy load of priorities: implementing EDAM, developing the infrastructure needed to meet ambitious climate goals, and moving forward with new and continuing initiatives to address some of the ISO’s biggest challenges.

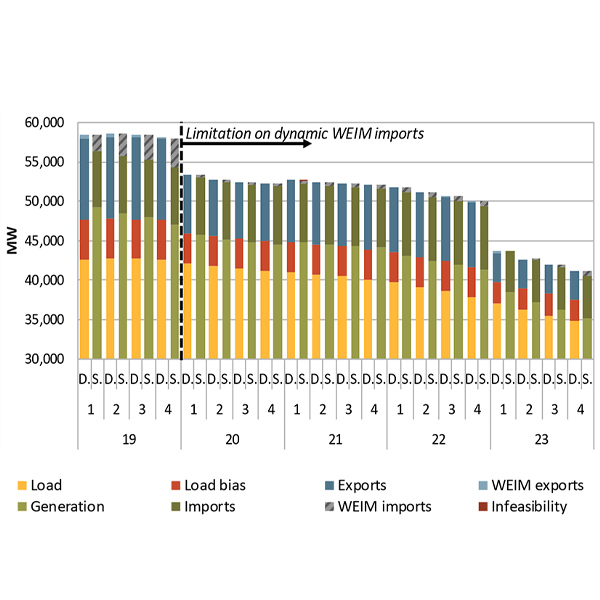

CAISO focused on CRRs when it served up the latest volley in the ongoing dispute over what played out on the Western grid during the January cold snap that forced Northwest utilities to import high volumes of energy to avoid blackouts.

CAISO’s own systems may have contributed to a set of “operational surprises” that forced it to declare a series of energy emergency alerts in July 2023, a member of the ISO’s Market Surveillance Committee said.

CAISO is proposing to raise the soft offer cap in its market from $1,000/MWh to $2,000 to accommodate the bidding needs of battery storage and hydro resources in time for operations this summer.

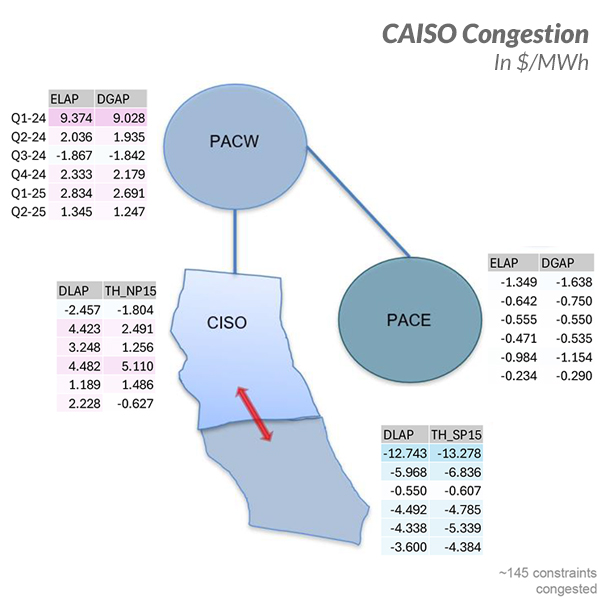

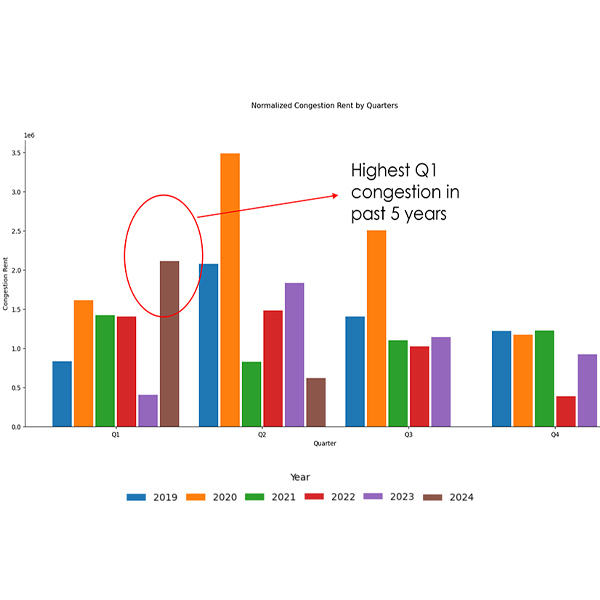

Congestion revenue rights auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring.

Want more? Advanced Search