Congestion revenue rights (CRRs) auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring (DMM) during the ISO’s Annual Policy Initiatives Roadmap Process meeting April 22.

CAISO staff and stakeholders questioned if the consistent underfunding of CRRs should be taken up as an official initiative.

CRR auctions have been losing money for more than a decade, and CAISO has taken multiple steps to address the revenue inadequacy. In 2019, the ISO instituted rule changes meant to decrease the amount of money flowing from ratepayers to commodities traders, which reduced losses significantly, the DMM said. (See CAISO CRRs Still Losing Money, but Less.) Auction revenues for transmission ratepayers averaged 67 cents per dollar paid to CRRs since 2019, compared to about 48 cents before the changes. Almost all losses stem from rights bought by financial traders, according to the DMM.

In May 2020, CAISO released a report evaluating the rule changes and identified that an issue with the shift factor threshold — which is used to evaluate the effectiveness of energy bids to manage congestion in the clearing of the day-ahead market — was causing additional underfunding.

“Even though the CAISO did address that issue, we are still seeing quite a bit of revenue inadequacy and underfunding,” Kallie Wells, senior consultant at Gridwell Consulting, said in her presentation on the issue.

The changes implemented to address the shift factor threshold primarily impacted low-voltage lines, Wells said, with recent CRR revenue inadequacy affecting higher voltages. However, 25% of low-voltage constraints still saw recent funding levels of just 20%. Underfunding appears to be related to more than just transmission derates, Wells added, questioning the root causes of the continued revenue inadequacy.

“The ask that we have of … CAISO to include in terms of potential scope on a CRR enhancements policy is really getting at what are the root causes or drivers of the current revenue inadequacy,” Wells said. “It’s really unclear to us what those underlying factors are and whether or not they continue to align with cost causation principles.”

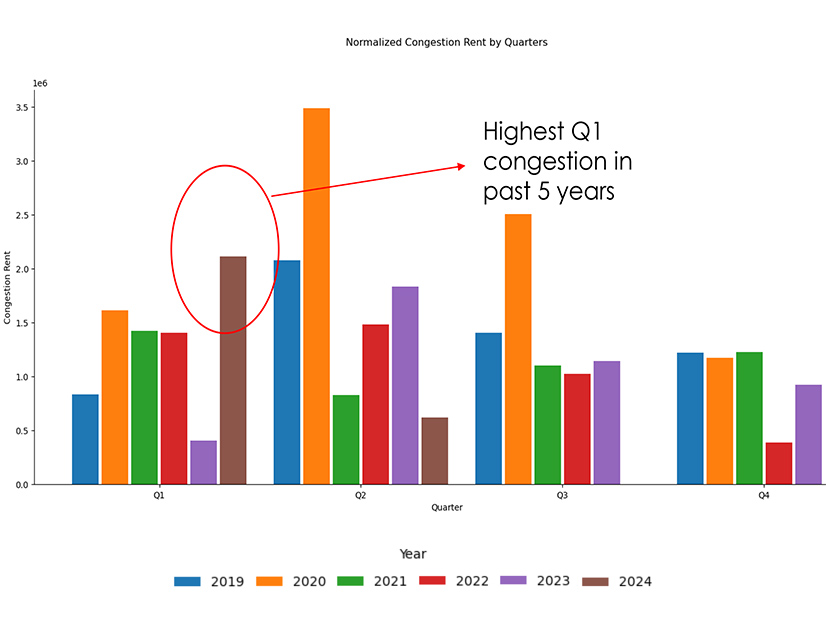

Because of how CRRs are allocated, rights are becoming a liability rather than a reliable source of revenue, Wells said. And congestion is increasing; she pointed out that the first quarter saw the most congestion in five years, further emphasizing the importance of CRRs in CAISO’s market.

“The role that CRRs play is extremely important in an organized energy market, and if we’re having this issue with how the shortfall is being allocated to the CRRs and causing the CRRs to be a risk or a liability for entities to hold and not functioning properly as a hedging tool, that’s extremely concerning,” she said.

Wells provided policy suggestions for addressing the problem, including capping underfunding and using more overfunding to offset deficits.

DMM Again Recommends Replacing CRR Auctions

The DMM continues to suggest that forgoing the CRR auction in place of a financial market based on offers from willing sellers could solve the underfunding problem.

“Ever since CRRs were implemented over 10 years ago, the auction revenues that are brought in in the auction fall way short of the congestion revenues that get paid out,” said Eric Hildebrandt, the department’s executive director. “So, from that perspective, there is a net loss to transmission ratepayers as a result of the CRR auction.

“The difference in the DMM proposal from the market that exists today is, rather than the ISO auctioning rights … there would be a financial auction in which those entities that held rights could offer them for sale to other entities.”

Under the proposal, CRR allocations could remain unchanged, or alternatively, congestion revenues could be refunded to load-serving entities instead of being allocated. A purely financial CRR market would be run with other voluntary bids to buy and sell CRRs and “would be easier and less subject to errors than [the] current CRR model based on a physical network,” Hildebrandt said.

But some stakeholders raised concern that replacing the auction with a financial market could stifle competition and liquidity.

“With auctions, the reason we have more than just load-serving entities participating in them is to inject competition into the market,” said Noha Sidhom, an Energy Trading Institute board member. “And so, my concern when I hear some of this is I just worry about lack of competition and lack of liquidity.”

Seth Cochran, head of strategic market policy at Vitol, echoed Sidhom’s concerns.

“There’s a strong assumption embedded in here that you can create a replacement market and everything will be fine,” he said. “I know you’re trying to put together a substitute here, but I can tell you from decades of experience in the market that you’re just not going to be able to foster liquidity, and it’s really going to leave the [independent power producers] out to dry. I know it might sound good on paper, but this is totally untested and unproven.”

Because of prior commitments from the ISO and the Market Surveillance Committee to address the issue, the DMM recommended the topic not be taken up as a discretionary initiative and received stakeholder support. Hildebrandt did note, however, that while CAISO and the committee began discussion of CRR losses in 2023, they’ve “been silent since.”